On April 2, U.S. President Donald Trump stood at the White House Rose Garden and made what he called a “Liberation Day” announcement: the U.S. is imposing reciprocal tariffs on over 180 countries, with no country-specific exceptions leading to crypto crash.

“The U.S. is charging countries approximately half of what they are and have been charging us,” Trump said.

In addition to specific tariffs for top trading nations, Trump imposed a 10% baseline tariff on all others not listed. This marks one of the biggest shifts in U.S. trade policy and in decades.

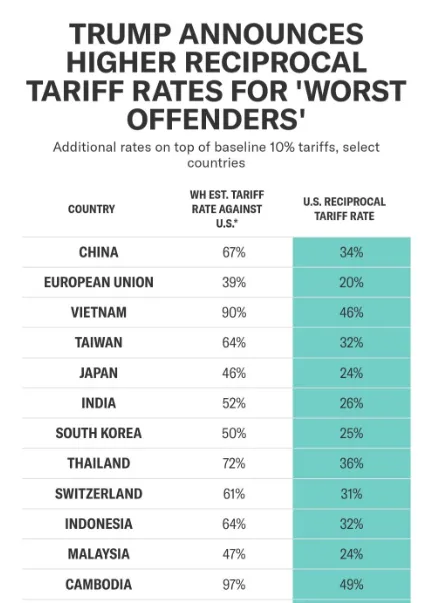

As per the Official White House Twitter handle on April 2, these are the countries and the respective tariff percentages announced:

Vietnam – 46%

Cambodia – 49%

India – 26%

Japan – 24%

South Korea – 25%

Taiwan – 32%

Thailand – 36%

Bangladesh – 37%

Sri Lanka – 44%

China – 34%

EU – 20%

UK, Brazil, Chile, Singapore – 10% baseline

Even close allies like the United Kingdom and Israel were not exempt, with 10% and 17% tariffs, respectively.

As expected, the global response came quickly.

Mexico said it will hit back with its own tariffs.

Canada hinted that it may remove U.S. trade benefits if things don’t change.

This could be the start of a new trade war, where countries keep adding tariffs on each other’s goods. That kind of back-and-forth usually hurts businesses, raises prices, and creates crypto market instability.

Right after Trump’s announcement, the cryptocurrency market dropped. According to CoinMarketCap:

Bitcoin fell to $82,143 before slightly recovering to $83,499.45, down 1.28% in 24 hours.

Ethereum dropped to $1,824.63, a 2.8% fall.

Solana was hit hard, dropping over 3.45% to $120.15.

Despite a market cap of $2.67 trillion, the overall crypto space lost value, showing a 1.61% decrease in a single day and this tariff announcement is the major reason behind the crypto market crash. Trading volume, however, spiked 64.77%, as traders moved their assets rapidly in response to the news.

As crypto struggled, gold soared to record levels, becoming the top safe-haven asset during the market panic:

Spot gold traded at $3,128 per ounce.

U.S. gold futures closed at $3,152, an all-time high.

Bitcoin fell to $82,143 before slightly recovering to $83,499.45, down 1.28% in 24 hours.

This rise reflects global investor fear and uncertainty. When markets panic, this shiny asset typically becomes the go-to investment — and that’s exactly what happened here.

Source: Robert Kiyosaki's official Twitter statement, April 2

Financial educator and author Robert Kiyosaki weighed in, saying the rise in gold, silver, and Bitcoin isn't because they’re gaining value — but because paper money is losing value.

“Gold, silver, and Bitcoin appear to be going up in price… only because the purchasing power of fake paper money is going down… Don’t be a loser. Save gold, silver, and Bitcoin.”

His statement highlights a growing belief that traditional money is weakening — and real value lies in hard assets.

Experts are split. Some believe this bold move by Trump could lead to fairer trade practices. Others warn it could backfire, triggering:

Rising consumer prices

Broken global supply chains

Long-term economic instability

Businesses are already reacting. Some U.S. companies are considering reshoring manufacturing, while others scramble to restructure global supply routes. Even this could lead to a major sell-off in bitcoin crypto as investors may now shift to gold because of its stability and reliability.

Trump’s new tariffs have shaken up the global crypto market. We’ve seen Bitcoin drop, gold hit a record high, and countries start to fight back. Whether this will lead to fairer trade or a full-on trade war—only time will tell.

But one thing’s clear: April 2 marked the start of a new chapter in global economics. And the whole world is now watching what comes next.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.