Tokyo, Japan August 12, 2025 Japanese-listed Metaplanet took another significant step in its Bitcoin strategy, buying 518 BTC for reserves at a cost of approximately $61.4 million.

Source: Simon Gerovich

The purchase at an average price of $118,519 per BTC raised the total holdings of the company to 18,113 BTC valued at approximately $1.85 billion at an average cost per coin of $101,911.

This latest action signals that the Metaplanet Bitcoin strategy is not slowing down. Rather, it is solidifying the company as one of Asia's most aggressive corporate buyers of this digital asset.

Metaplanet's continuous buying has drawn comparisons to MicroStrategy, the American business intelligence company that began popularizing the massive-scale BTC treasury strategy.

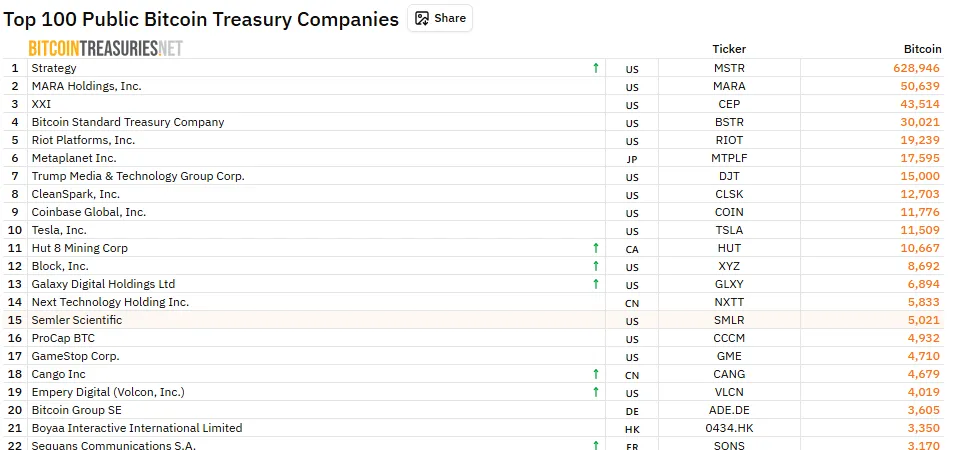

The Japanese firm now stands among the world's leading corporate holders, behind just industry giants such as MicroStrategy, Marathon Digital (MARA), and Riot Platforms. The company now stands at 6th largest holder globally.

Source: BitcoinTreasuries Net

Its path has been nothing short of meteoric. In the last purchase, Metaplanet Bitcoin Holdings hit the headlines for the purchase of 463 BTC at $115,895 per unit.

Today, not only has it increased its stack but also optimized the manner in which it finances these purchases.

One aspect that stands out about the Metaplanet Bitcoin strategy is the way that it raises capital. Rather than using share dilution typical of traditional means, the company has relied on perpetual preferred shares.

This approach offers long-term capital without substantially affecting current shareholder value.

CEO Simon Gerovich has publicly espoused the strategy. In a recent blog post, he described how the objective is to increase BTC holdings per share on a continuous basis while maintaining shareholder equity.

"Selling perpetual preferreds is a very accretive instrument that is meant to return maximum long-term shareholder value," Gerovich said.

Metaplanet Bitcoin purchases have been sparking debate among trading and social communities.

Most consider its disciplined building as an indication of strong institutional belief in this digital asset's long-term worth.

Analysts think that the consistent flow of corporate capital from companies such as Metaplanet may stabilize the prices in market selloffs, serving as a "soft price floor."

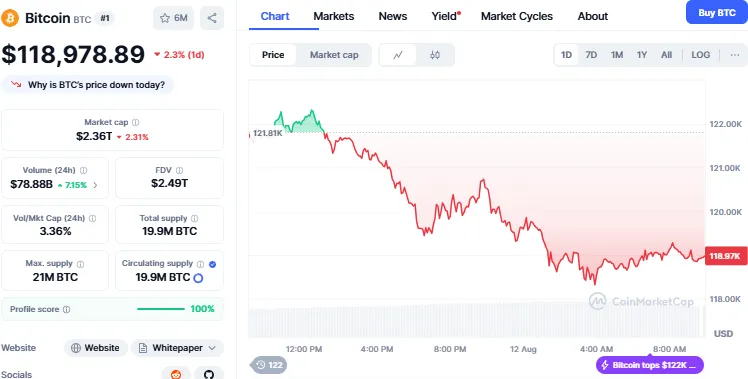

Source: CoinMarketCap

Currently the coin is trading at $118,978 with a decrease of 2.3% while the volume has increased by 7.33% within the last 24 hours as per the CoinMarketCap.

If the Metaplanet Bitcoin strategy keeps up this quality of execution and precision. It could become the default example for Asian companies looking to add this cryptocurrency to their reserves in the near future.

Such corporate treasury action is still relatively uncommon in Asia, so Metaplanet's move is even more impactful.

Market observers say it may make other Asian companies follow suit with a similar cryptocurrency standard for managing treasuries.

Its blend of intense buying, creative financing, and long-term perspective makes it a standout among other corporate participants.

For the time being through this Metaplanet Bitcoin purchase, the message is unmistakable: it is dedicated to accumulating digital currency, accumulating shareholder value, and redefining how Asian businesses view their balance sheets in the future.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.