Peter Schiff recently noted that traders seem confident the US President will not follow through with his proposed tariff rates. In his post, Schiff said the markets are “playing a game of chicken with Trump,” suggesting that investors believe he will delay the tariff decision again, as he has in the past. He ended with “TACO no más,” hinting that his ego could change the outcome this time. Rather than warning of a crash, Schiff was pointing out how relaxed markets have become around the recurring Trump tariffs strategy.

Source: Peter Schiff Twitter

But one crypto project associated with the US President seems to be setting itself up in such a manner that indicates further cards are being played behind the announcements.

Since February 2025, the Trump administration has announced multiple tariffs, each triggering temporary market declines.

In April, the president announced a combined 104% duty on Chinese imports.

China responded with 34% tariffs on US goods and restricted exports of some rare earth materials.

The Crypto Market reacted quickly, Bitcoin and Ethereum saw double-digit crashes.

The S&P 500 and Nasdaq posted sharp losses.

In May, the President expanded tariffs to include the European Union, targeting both EU goods and foreign-manufactured Apple products.

The resulting panic erased $1.5 trillion from U.S. markets in days. Still, he pushed back the deadline to July 9 following talks with EU leadership, and the increase is now delayed until August 1.

Source: TradingView

During the Trump China trade war the market crashed, Bitcoin decline 4% went to $74,647, while Ethereum declined 10% to $1,396.

During this period of market stress, World Liberty Financial (WLFI), a crypto project tied to the president's network, made a series of notable buyings.

On April 12, WLFI acquired 4.89 million SEI tokens with $775,000 USD. According to the data by Lookonchain, altogether, WLFI has invested about $346.8 million across 11 different altcoins. WLFI’s activity often aligns with periods of tariff-related volatility.

Source: Lookonchain Twitter

On July 4, the organisation also proposed enabling public trading of its native token, $WLFI, just a few days before Trump tariffs deadline. Some market experts consider the project may be capitalizing on uncertainty.

Bitcoin Hits new All Time High as Crypto Reacts Differently to Tariffs

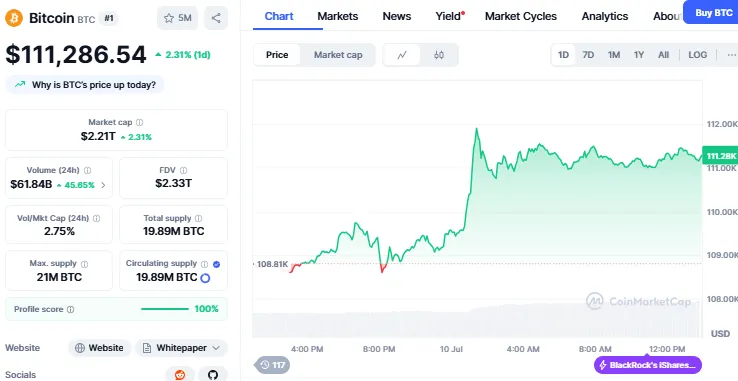

Unlike past events, the market reaction has shifted. Despite Trump tariffs announcements, Bitcoin reached a record high of $111,907 today. It is currently trading at $111,286 with an increase of 2.31%, while trading volume spiked by 45% within 24 hours.

Source: CoinMarketCap

Source: CoinMarketCap

Whereas earlier notifications sent people running to the exit, investors this time seem to be viewing crypto as a store of value and not as a risk asset.

This split has caused people to wonder how much the market still worries about the effect of Trump tariffs in the future.

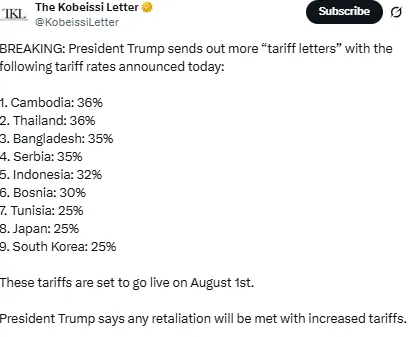

The new tariff rate, if implemented, will affect almost 100 nations, with rates between 10% and 50%. Brazil has already fought with the president over the increased rates. The president Lula said he will answer if the US President levies 50% tariff rate on Brazil.

Source: The Kobeissie Letter

As the deadline nears, focus will not only be on whether the Trump tariffs are realized, but on how crypto-related participants such as WLFI keep adapting to the evolving reality.

Traders are playing chicken with the president, thinking he’ll back off like before. But if he doesn’t flinch this time, the impact could be real. Peter Schiff sees the risk, even if markets don’t. With Bitcoin hitting new highs, some are clearly bracing for a crash, or a shake-up. We’ll know by August 1 who serves first.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.