Trump Threatens India as US Signals Stricter Tariff Measures

US President Donald Trump signalled that Washington is ready to escalate trade pressure on New Delhi. The news that Trump threatens India with further tariff hikes comes as a response to India’s continued reliance on Russian crude oil.

While speaking to reporters, Trump noted that Prime Minister Narendra Modi is a "good man" but emphasized that India’s oil trade remains a major point of friction. For investors, this geopolitical tug-of-war is already stirring the crypto market trends as participants look for hedges against potential fiat currency volatility and trade barriers.

Why is Trump Threatening India amid Ongoing Trade Talks?

The main core of the dispute is that India is buying crude oil from Russia, and India is the top buyer as well. Washington argues that these trades are indirectly funding the conflict with Ukraine. Which is leading to a "risk-off" mood in global diplomacy. Trump threatens India with these measures despite having already doubled import tariffs to 50% in August 2025.

"They wanted to make me happy... He knew I was not happy," Trump remarked, suggesting that the "special relationship" between the two leaders may not be enough to stop a fresh wave of economic penalties.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

Currently, trade negotiations between the two nations are in a fragile state. As per the Economic Times, Bharat has reduced its Russian oil intake to a three-year low of 1.2 million bpd, the U.S. is pushing for a total decoupling. This tension creates a ripple effect that often spills over into alternative asset classes.

How These Trades Affect Bitcoin and Crypto

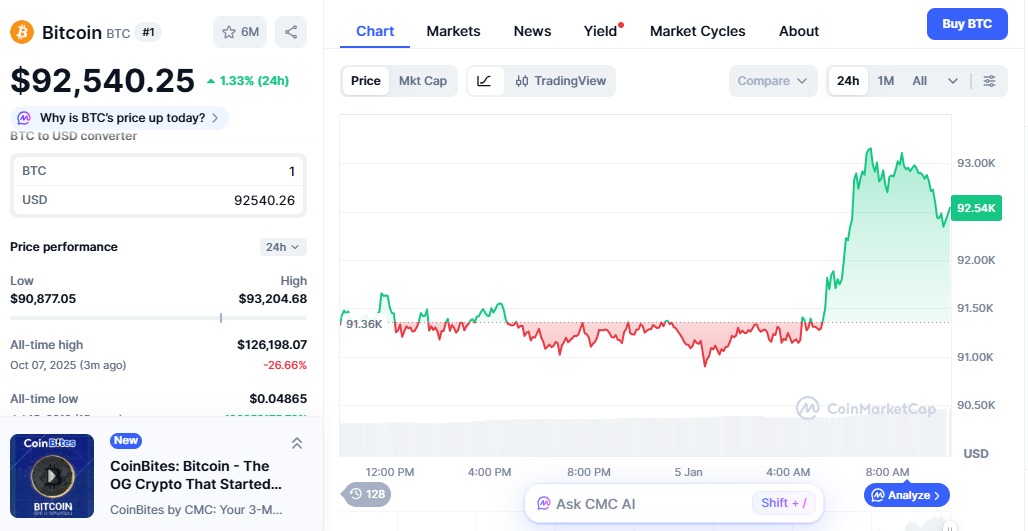

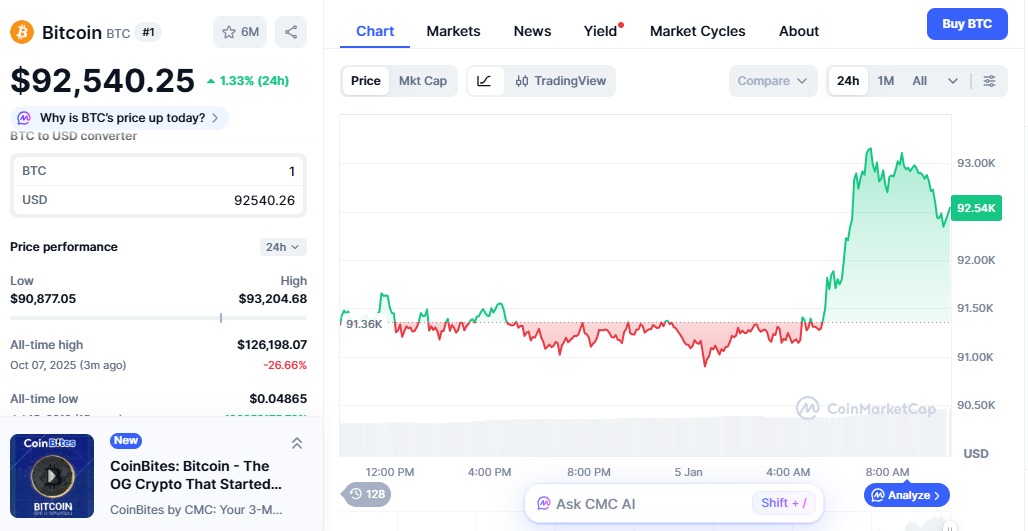

While these conflicts focus on oil and tariffs, the digital asset market also reacts to these international trade relations. Today, the total crypto market cap stands at $3.15 trillion, reflecting a 1.02% increase in the last 24 hours. Bitcoin is currently holding steady at $92,520, marking a rise of 1.34% in the last 24 hours as per CoinMarketCap. When Trump threatens India, the market is steady, and it is now also, but soon it will affect the digital asset market.  Source: CoinMarketCap

Source: CoinMarketCap

India Stands Firm on Energy Sovereignty

New Delhi hasn't wavered in its stance, consistently putting its own energy security and the needs of millions of consumers above external pressure. Despite the U.S. making it very clear they are "unhappy" with the current arrangement, Bharat continues to argue that its trade choices are simply a matter of market availability and economic necessity. But the stakes are getting higher.

If Trump moves "very quickly" to hike tariffs, the cost for South Asian companies exporting to the U.S. could skyrocket. This would likely force a massive shift in how Bharat handles both its international trade and its long-term investment plans.

The growing friction between Washington and New Delhi is more than just a political spat; it’s a sign of how global powers now use deals as a primary weapon. While President Trump’s warning of "quick" tariff hikes is clearly aimed at forcing India to ditch Russian oil, it is also shining a spotlight on why decentralized assets are becoming so popular. As traditional deals routes face disruptions and fiat currencies get caught in the crossfire of sanctions.

Conclusion

The current "watchful pause" in the crypto space suggests that big institutional players aren't hitting the panic button just yet. Instead, they are keeping a close eye on whether Bharat's stand on energy sovereignty leads to a bigger shift in how the BRICS nations handle their deals settlements.

If the U.S. actually pulls the trigger on 50% or 100% tariffs, the pressure on the Indian rupee could spark a massive, localised rush into Bitcoin. For now, the $93,500 level is the big hurdle for BTC.

Source: X(formerly Twitter)

Source: X(formerly Twitter) Source: CoinMarketCap

Source: CoinMarketCap