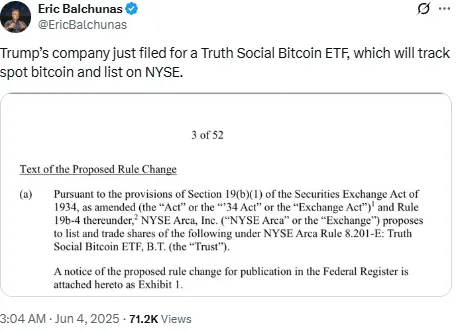

Trump Media and Technology Group, the parent company of Truth Social, has officially filed to launch a spot Bitcoin exchange-traded fund. The filing was submitted to the U.S. Securities and Exchange Commission (SEC) on June 4 by NYSE Arca. This step is part of a bigger plan by Trump’s media company to dive deep into the crypto industry.

The proposed crypto product is named as the Truth Social Bitcoin ETF and will track the price of Bitcoin. Although the President’s name is not directly written in the official documents, the connection is evident. Truth Social is owned by Trump Media, and the President still holds a majority stake, although that stake has been placed under a trust managed by his son, Donald Trump Jr.

Source: Eric Balchunas X Handle

This exchange traded fund is being launched in partnership with Yorkville America Digital, a company known for promoting "America-first" investment strategies. Yorkville will manage the fund, handle regulatory needs, and ensure it stays compliant with U.S. laws. Meanwhile, the Bitcoin used in the ETF will be stored by Foris DAX Trust Company, the same custodian that holds crypto for Crypto.com. After this announcement the stock price of Trump media has increased by 0.45% as per Google Finance.

This isn’t the first time these companies have teamed up. In April 2025, Trump Media made a contract with Yorkville and Crypto.com to develop “Made in America” crypto ETFs. These collaborations are now beginning to show actual outcomes.

The application was submitted through Form 19b-4, a required document for listing any ETF in the U.S. This form allows the SEC to review the product, collect public feedback, and make a decision within 240 days. The earliest the SEC could approve or reject the filing is within 45 days, but it often extends the review.

As of now, the fund doesn’t have a trading ticker or a disclosed fee structure. However, its goal is clear: to mirror the real-time price of Bitcoin before costs.

Trump Media has been hard at work trying to leave its imprint in digital assets space. This year, the organization rolled out Truth.Fi, a financial technology platform with the potential to invest more than $250 million in ETFs, BTC, and the like. They’ve also hinted at building a digital wallet and introducing a new token that could be used across their streaming site, Truth+, for subscriptions and other services.

In February, This company also filed for another similar proposal called Truth.Fi Bitcoin Plus ETF, which may use funds from the Truth.Fi platform.

If this proposal gets approved, this Bitcoin ETF will get along the increasing list of spot BTC ETFs which are already there in the market. This area is led by IBIT, which is BlackRock’s iShares Bitcoin Trust; it owns about $69 billion in assets.

Still this ETF would make its position in the market with the strong political ties and the President’s influence. Some people in the industry are concerned that this move can create conflicts of interest, given that Trump is currently serving as the U.S. president. While others look at it as a bold step towards making the cryptocurrencies more included in the economy. The SEC has a timeline till 29 January 2025, for giving the final verdict. If the ETF gets approval, Trump will have more influence over the digital assets industry.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.