UK Bitcoin Sale Planned to Address Fiscal Deficit

The government of the nation is set to sell more than £5 billion, almost $6.7 billion, valued seized BTC. This is going to be the largest crypto liquidations by a state to date. The urgent financial pressure led the selling movement under its treasury and Home Office which aims to reduce the country’s £20 billion budget deficit without increasing tax or cuts in spending. However the decision is facing legal and diplomatic hurdles since its announcement.

In 2018, the country seized a large sum of crypto in the form B-coins, around 61,000 BTC, during a Chinese scam operation which involved a money laundering case. At that time Virtual asset was worth approx. £300 million (~$390 million), but now it has surged into a big chunk as the golden asset is setting new all time highs (adding on UK Bitcoin Sale).

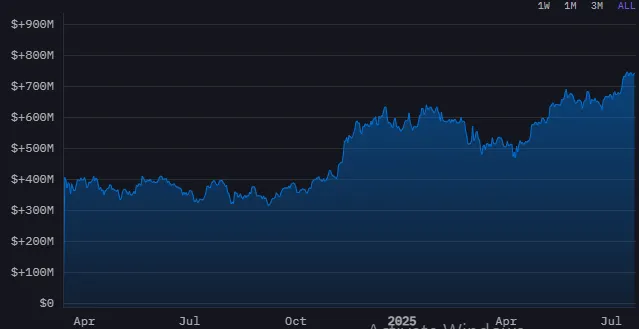

Its value per coin is currently labelled at ~119k with a total market cap of around $2.35 trillion.

Source: CoinMarketCap

UK Bitcoin Sale is not going to be an easy task as the country does not acquire the sum directly but it was originally stolen from people in China. So, for selling it has to come across international laws as China is already demanding for the return and victims are also pushing for their rights over shares.

To handle these demands and make things faster, the UK needs to use country treaties, legal processes and international court cases. Any setback in this procedure can lead to harmed relations and delays.

The UK Bitcoin Sale strategy highlights the past act of Gordon Brown's early 2000s gold sales, when the state threw away gold reserves cheaply, only to later watch it gain in value. Likewise, the U.S. Marshals Service sold 185,000 BTC between 2014 and 2021, losing close to $21 billion through premature selling.

Fearing from another lost opportunity some experts argue that the state might lose future value, pointing to EI Salvador's strategic earn of $440 million in B-Coin profits through its 6,244 BTC reserve worth around $743M.

Source: Arkham

An offload of 61,000 coin is a giant amount of its trading volume on any given day. Released into the market in one shot, it would cause short-term downward pressure on prices and panic among investors. But governments tend to resort to over-the-counter (OTC) desks or institutional sales to prevent shocks.

However, even the little news of such a significant the UK Bitcoin Sale can impact the sentiment in the crypto space.

No matter if trade is executed or not, but as the state steps into digital finance through the UK Bitcoin Sale terms, the world watches closely. This action also shows how crypto has evolved as a whole new exchange of economy or a financial tool. This sale could reshape the upcoming future of crypto regulations.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.

4 months ago

😀😂🤩😝🤪😜🤑🤣🤣🤣

1 month ago

A good article to read. The writer has effectively managed the data to make the article engaging. In my opinion, this is an excellent article.