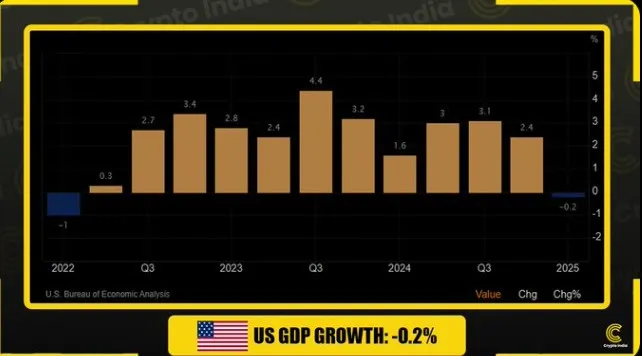

The US GDP Q1 2025 data is out—and it’s not looking good. According to the Bureau of Economic Analysis and FXEmpire, the US economy shrank by 0.2% in the first quarter.

While slightly better than the initial -0.3% figure, it still disappointed analysts who expected zero growth. The number shows a clear loss of momentum from the 2.4% growth seen in Q4 2024.

Source: Crypto India X

So, why did the US GDP shrink? The answer lies in a surge of imports and a noticeable drop in government spending. Although companies added more to their inventories, consumer spending—especially on health and entertainment—slowed. Final sales to private buyers, a good sign of real demand, dropped from 3.0% to 2.5%, showing signs of US economy recession risk.

There’s more trouble. Corporate profits fell by $118 billion—a major drop compared to the $204 billion gain in the last quarter. Sectors like wholesale trade and recreational goods saw big losses, while only a few, like chemical manufacturing, stayed stable.

These weak consumer numbers in the US GDP Q1 2025 report clearly show spending fatigue. With profits down, companies may start cutting jobs or slowing expansion, which would add more fuel to ongoing fears of a recession in the U.S.

The job market isn’t safe either. US jobless claims have now increased again, in 2025. Last week, 240,000 people filed for unemployment benefits, which was higher than the expected 230,000.

Even more troubling as per US GDP Q1 2025 report was that continuing jobless claims rose to 1.92 million, the highest level since 2021. This is serious. States like Indiana, Illinois, and Michigan are seeing more layoffs, especially in manufacturing and construction. Many are now asking—is the US in a recession already?

While the economy slows down, the US inflation rate is still not easing. The PCE index stayed at 3.6%, and even the “core” inflation number—excluding food and energy—only fell slightly to 3.4%. That’s far above the Federal Reserve’s 2% target.

So, what now? The Fed is caught between two problems: a slowing economy and high inflation. If this continues, the Fed may have to consider an interest rate cut sooner than expected—even if inflation hasn't cooled completely. This uncertainty also reflects the fragility shown in the US GDP Q1 2025 data.

This shaky economic data is also affecting crypto. As of writing, Bitcoin price dropped to around $107,000, falling 0.59% in the past 24 hours, as per CoinMarketCap. The crypto market crash isn’t limited to BTC—altcoins are crashing too.

Source: X

According to CryptoGoos on X, the "$ETH exit pump" is done and "altcoin season is cancelled." This lines up with recent market movements where Bitcoin took over dominance after altcoins peaked in December.

Many traders now fear that the altcoin season is over for good—at least for now.

Looking at all this—falling profits, rising jobless claims, and the weak US GDP Q1 2025 report—it’s clear the U.S. economy is struggling. These aren’t just small data points; they’re real signs of trouble that affect jobs, businesses, and investors.

Markets are already reacting. Meanwhile, US inflation remains sticky, leaving the Federal Reserve in a tight spot. It’s no longer just a warning—the recession risks are real.

Disclaimer: This is not financial advice. Always do your own research before making investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.