The US job data for May 2025 is now out, and it shows both good and bad signs. According to the US Bureau of Labor Statistics jobs report, the country added 139,000 new positions, which is more than what experts had expected. They thought only around 126,000 positions would be added.

According to The Kobeissi Letter X post, the US unemployment rate stayed the same at 4.2%, just like the predictions. Most of the new positions came from industries like healthcare, hospitality, and social assistance.

Source: X

But on the other hand, government emplyemment kept going down, which is not a good sign. Also, April's work numbers were revised down from 177,000 to 147,000.

This report was part of the latest job report released, and it added fuel to market discussions.

After the Non-Farm Payrolls data today was released, financial and crypto markets reacted negatively.

Here’s how the market responded:

Source: CoinMarketCap

As seen in the above chart, Bitcoin fell 1.37% to $104,277.20

Ethereum dropped 4.57% to $2,495.47

Dogecoin, Shiba Inu, and PEPE also saw price crashes

The broader stock market fell by around 1.65%

This confused many people because they thought a strong project report would help the market. But that’s not how it played out.

The reason is simple. Strong job data means the economy is still strong. That makes it harder for the Federal Reserve to cut interest rates. Investors were hopeful that reduced interest rates would bolster the market. However, the likelihood of a rate cut has decreased.

This is why the Bitcoin crash after this data happened. When interest rates are expected to stay high, risky assets like crypto usually fall. The same idea applies to the sharp drop in Ethereum and meme coins.

This situation has become a hot topic in today’s crypto market crash news.

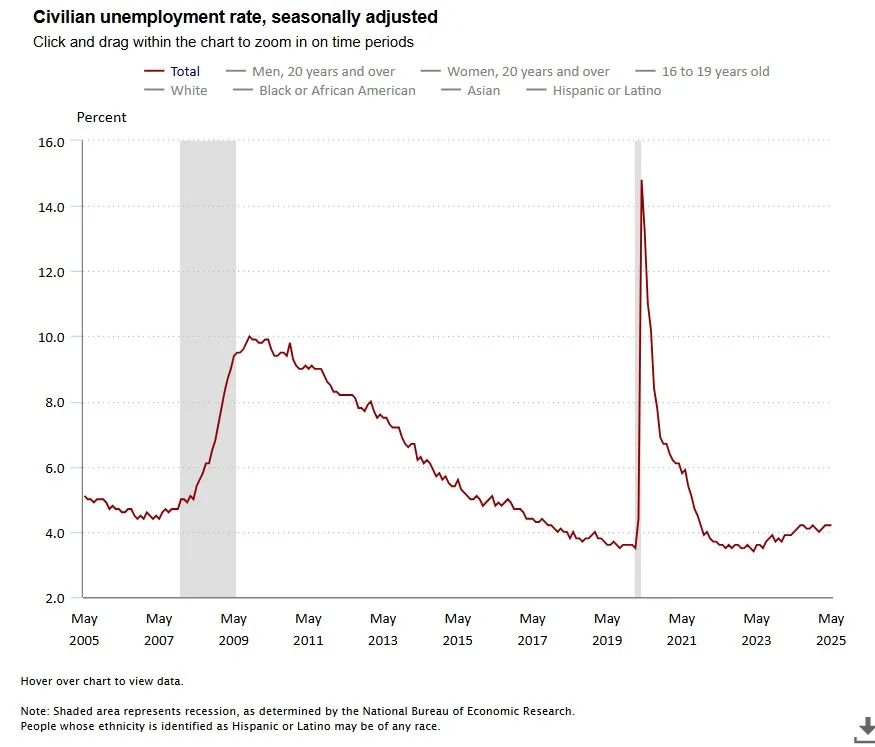

Now that the unemployment rate and career information is out, the focus will shift to the next inflation report and the Federal Reserve’s meeting.

Source: US Bureau Of Labor Statistics

If inflation remains high and positions keep growing, FED rate cuts might not happen at all this year. This will keep industry—especially cryptocurrency—on edge in the coming weeks.

The US job data appeared healthy, with more people being hired and unemployment remaining constant. But the industry did not applaud. Instead, it fell because strong figures suggests that the Fed will not decrease interest rates.

Even good news might have a negative impact on the industry these days. That's exactly what occurred to Bitcoin, Ethereum, and stocks following the latest job news.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.