After many delays, the US Senate has finally released a draft of the most awaited crypto market structure bill, also known as CLARITY Act.

Source: Banking Senate

The bill introduced by Senator Tim Scott, Chairman of the Banking Committee, finally seeks to eliminate long-standing uncertainty in the US crypto market, protect investors, and offer clear rules for exchanges, brokers, and digital asset platforms.

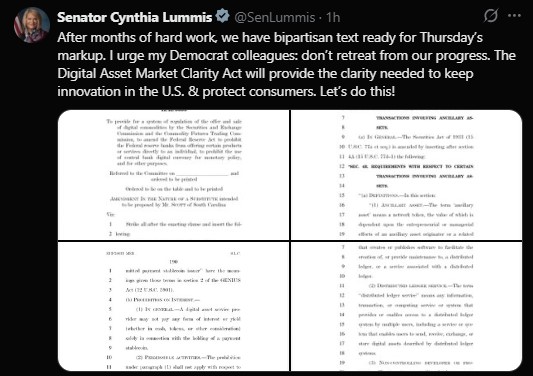

Ahead of the vote on markups, Senator Cynthia Lummis, a longstanding and vocal supporter of crypto, underlined bipartisan support of the draft as one that could finally allow innovation to remain in the U.S. while protecting the consumer.

The 278-page bipartisan draft, named Digital Asset Market Clarity Act of 2026, CLARITY Act for short, aims at defining how cryptocurrencies are regulated and splits oversight between the SEC and CFTC.

The Digital Asset Market Clarity Act of 2026 is an extension of the CLARITY ACT of 2025 that was passed in the House. This act defines and provides laws regarding digital assets, spot trading, consumer protection, and the registration of platforms. Some of the key points regarding this act include:

Roles of SEC and CFTC: The SEC will regulate securities-like virtual currencies, whereas the majority of non-securities like Bitcoins and Ethereum will be governed by CFTC as virtual commodities. This clear split ends years of regulatory ambiguity.

Stablecoin Rules: Certain stablecoin interest benefits and rewards are allowed keeping innovation intact with investor protection under certain stablecoin rules.

Anti-CBDC Provisions: The legislation blocks the Fed from using CBDCs for general monetary policy purposes but reserves them for individual services only.

DeFi & Developer Protections: Provides protection in the blockchain development field, staking programs, airdrops, and the bankruptcy treatment of digital assets.

The markup vote for the bill is scheduled for January 15, 2026, in the Senate Banking Committee, with potential input from the Agriculture Committee for CFTC-related matters.

The community saw the release as a bullish momentum for the broader marketplace. Many experts expect that this could set the US as a global crypto hub and fuel more adoption. Highlights include:

Reduced Regulatory Risk: Clear definitions and oversight reduce “regulation by enforcement” fears for major tokens.

Institutional Adoption: Banks, ETFs, and traditional funds may enter the market with confidence, increasing liquidity.

Innovation Boost: Legal pathways for exchanges, brokers, and DeFi platforms make staking, airdrops, and governance safer.

Marketplace Confidence: Clarity could stabilize volatility, attract capital, and drive sustained price growth for digital assets.

Nothing comes without challenges. Although the bill has received positive responses, there is certain amount of caution associated with it:

Compliance Costs: Smaller projects could see increased compliance costs.

Partial SEC Review: Some of these tokens may be assessed based on new maturity requirements.

Implementation Timeline: The complete implementation will take 1-2 years, with staged adoption beginning in 2027-2028.

Despite these factors, broader sentiment suggests that even the slightest momentum would be perceived as entirely positive.

If finalized, the proposed US crypto market structure regulation could be a game-changer in the US digital asset industry. With regulatory clarity, investors face less risk, and institutional and mainstream adoption move even faster.

As marketplace confidence is expected to strengthen, this will help support Bitcoin and also support altcoins alongside innovation in the DeFi space and blockchain technology.

The present motivation that one should be watching is the upcoming markup vote scheduled for January 15, with broad bipartisan support possibly paving the way for massive adoption in 2026.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.