The US Treasury buy back is back in focus after the government carried out a $6 billion debt repurchase in January 2026.

This move may sound technical, but it connects to market liquidity, investor sentiment, and even how digital assets react to policy signals. So why is this routine action getting so much attention right now?

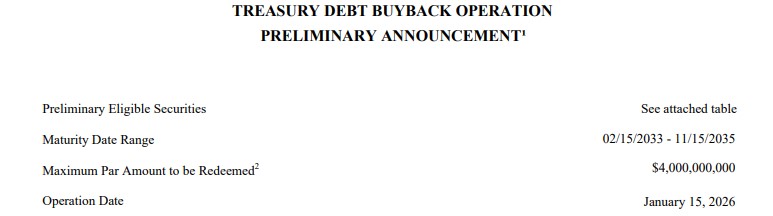

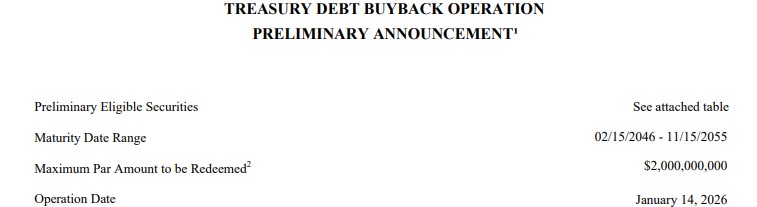

The latest US Treasury $4 billion buy back took place on January 15, 2026, following $2 billion a day earlier. In these two separate operations, the Finance Department repurchased a total of $6 billion of its own bonds mainly with long term-term maturities between 20 and 30 years.

Source: Official Fiscal Data

The recent purchases are part of a broader plan unveiled in 2025-end, where the organization schedules several small buybacks each quarter. The strategy aims to enhance liquidity in less active and old bonds while managing the government's debt profile efficiently.

Importantly, the existing cash is used for purchases, which means no new money was printed for operation, keeping Federal Reserve policies unlinked. Settlements, one day after, will give primary dealers cash in exchange for the bonds they sold.

The US Treasury buyback comes as the country's economic conditions are showing mixed reactions. Growth indicators hold positive with GDP for 2026 forecasts at the range of 1.8%-2.2%, supported by consumer spending along with investment in AI sectors and fiscal programs.

On the other side, the labor market is cooling with a mid-4% unemployment range and slower hiring. Inflation also hovering around 2.7%, slightly but higher than target, pressured by tariffs.

In this scenario the buy-back operations work as a tool to stabilize and improve the market with smoother liquidity flows, to avoid overstimulating the economy.

For cryptocurrency investors, the action matters because liquidity supply affects risk assets like Bitcoin. When traders receive cash, they slightly improve pressures in financial markets, even if it’s in small amounts.

However, size is important. A $6 billion buyback is small compared to Federal Reserve quantitative tightening, which often removes tens of billions of dollars from the system each month. In crypto terms, this move alone cannot drive prices higher.

Still, perception plays a role. Some market analysts noted the buybacks as a mild positive signal, specially when bitcoin is again surging, holding near $96K and overall market is 0.49% up today, following yesterday's same scenario.

Source: Coin Market Cap

Beyond this, the crypto regulations in the US entering 2026, influencing the markets significantly. But delays and uncertainties keep traders hesitant as they hope for clarity over short-term liquidity moves.

The US Treasury buy back is generally seen as routine maintenance of the marketplace, not any hyped move. It surely boosts capitalization and mild confidence, but does not directly affect the traditional markets.

For virtual assets, bigger actions, interest rates, demand from institutions, regulated laws, and worldwide liquidity, matters far more than this. These operations add a small contribution, while broader ones decide where the market will go next.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.