Highlights

USX Solana Stablecoin briefly depegged to $0.10 due to liquidity drain on secondary markets.

Solstice Finance injected liquidity, helping the token recover to around $0.94.

The issuer confirmed over 100% collateralization and uninterrupted 1:1 redemptions.

Solana-native stablecoin USX faced a sudden depeg after capital dried up on decentralized exchanges, raising concerns before its issuer swiftly acted to stabilize the market.

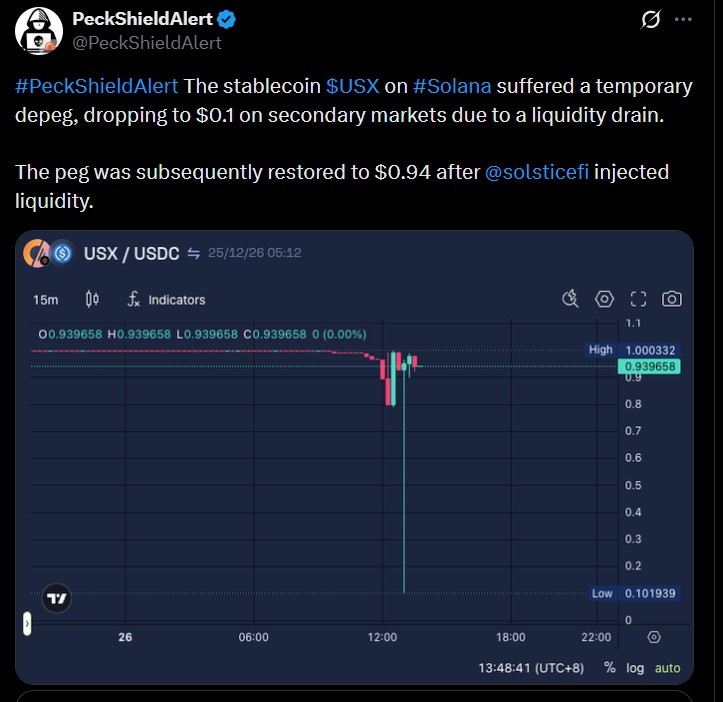

On December 26, 2025, blockchain security firm PeckShieldAlert reported that USX, a stablecoin issued by Solstice Finance on the Solana network, experienced a sharp depeg in secondary markets.

The token’s price fell as low as $0.10 on decentralized exchanges such as Orca and Raydium. The decline was caused by a sudden withdrawal of liquidity, which made the market extremely thin and volatile.

Soon after, Solstice Finance stepped in by injecting capital flow, allowing the token to recover close to its intended peg, trading around $0.94. The event sparked brief panic but was quickly addressed.

Source: PeckShield X

The depeg was not caused by a hack or loss of funds. Instead, it resulted from draining secondary markets. With fewer liquidity providers available, even modest sell pressure caused USX’s price to drop sharply. Holiday trading conditions and USX’s relatively recent launch contributed to thin liquid assets, making the token more vulnerable to sudden price swings.

No. Solstice Finance clearly stated that USX remained fully solvent throughout the incident. According to the team, the stablecoin’s underlying assets and net asset value (NAV) were unaffected. The token is backed by over-collateralized positions, with a collateralization ratio exceeding 100%, meaning the protocol had more assets than liabilities at all times.

Solstice Finance responded quickly by injecting additional liquidity into the secondary markets. The team also coordinated with market makers to stabilize trading conditions. Additionally, it announced plans to release an independent third-party attestation report to further reassure users about the protocol’s financial health and transparency.

Yes. Solstice confirmed that there was no point during the episode at which 1:1 redemptions in the primary market were stopped. This allowed users to redeem tokens at full value with the issuer, despite the prices of the secondary market being volatile.

The incident highlights a key risk in decentralized finance: price instability can occur even when assets are fully backed. It shows that even in the case of sound fundamentals, thin liquidity can cripple prices and lead to panic.

The token has grown at a rapid pace, and the value locked is about 325 million when it was launched. Though it is a sign that the Solana-based stablecoins in high demand, it also shows problems with the rapid adoption, liquidity control, and trust in the market, especially when it comes to newer protocols.

USX’s brief depeg was a liquid drain issue, not a solvency crisis. The response restored confidence, offering an important lesson on the role of transparency in maintaining stablecoin stability.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency markets are highly volatile, and readers should conduct their own research and consult a qualified financial advisor before making any investment decisions. CoinGabbar is not responsible for any losses arising from reliance on this information.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.