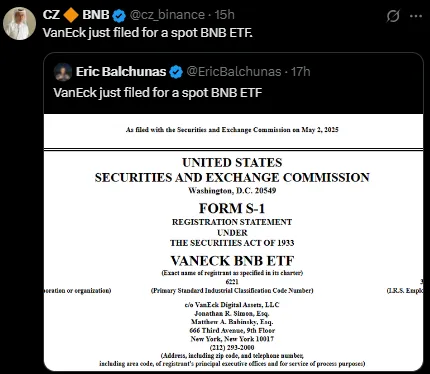

VanEck, a behemoth asset manager, has formally submitted S-1 form to US regulators to list the nation's first-ever BNB ETF. The step is intended to provide investors with simple access to BNB, the native token of Binance, via an exchange-traded fund. Changpeng Zhao took to X (formerly Twitter) to share the details.

Source: X

The fund will, in turn, maintain spot tokens and could stake a portion of those assets via reliable providers, the ETF prospectus, filed with the Securities and Exchange Commission (SEC), revealed. This is a first because no other asset manager has attempted to list a BNB exchange-traded fund in the US before.

The Chain, created by Binance, is one of the world’s most popular smart contract platforms, holding almost $6 billion in total value locked (TVL), as per DefiLlama data.

Interestingly, the filing comes just days after Binance co-founder Changpeng “CZ” Zhao mentioned that the excitement over Bitcoin exchange-traded funds could soon extend to altcoins.

Immediately after the news, the coin experienced a price increase of 1.83% in a single day. According to CoinMarketCap, currently, the coin trades at $599.25 with a market cap of $84.42 billion and a trading volume of $1.47 billion on a daily basis. Nonetheless, during the last seven days, the token has also fallen by 1.32%.

Source: CoinMarketCap

As per my analysis and experience, if it is approved, it will be a catalyst that can push up the price of the token and improve its performance in the crypto space.

Also, the VanEck is not a stranger to crypto ETFs. The firm has also applied for other ETFs on Avalanche and Solana, demonstrating its extensive interest in investment products based on altcoins.

While VanEck moves ahead, other altcoin exchange-traded fund are still waiting for approval. For example:

Canary Capital filed last year for a Litecoin ETF, but the SEC recently delayed its decision.

This delay is not unusual, as the SEC often takes more time to review such filings.

Litecoin’s price dropped 3.88% in a day after the news, now trading at around $82.71, with a market cap of $6.27 billion and a 24-hour trading volume of $574.35 million.

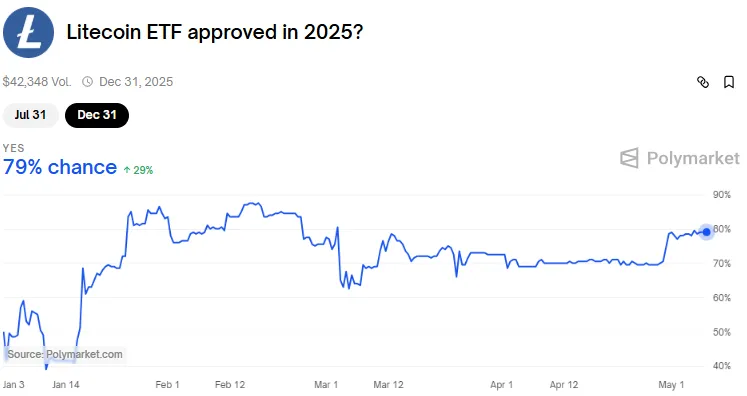

Interestingly, according to Polymarket data, the Litecoin exchange-traded fund remains the top choice among the crypto community, with a 79% chance of approval by the end of 2025.

Source: Polymarket

It has even outperformed popular coins like Doge, Pepe, XRP, and Cardano in investor interest.

VanEck filing for the first BNB ETF in the US could mark a new chapter in the crypto investment world. While BNB’s price reacted positively, the market will watch closely to see if the SEC gives its approval. Meanwhile, other altcoin ETFs, like the Litecoin ETF, remain stuck in the waiting line, though community optimism stays high.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.