In a surprising twist, Vanguard, one of the world’s biggest asset managers, is now the largest shareholder of MicroStrategy stock MSTR. This is shocking because the organisation had long been critical of Bitcoin and avoided crypto-related investments. Now, Vanguard holds MSTR shares worth over $9 billion, giving it major exposure to Bitcoin.

Source: Eric Balchunas

For years, the organisation called BTC an immature asset and warned that it didn’t belong in long-term portfolios. In January 2024, it even said BTC ETFs would not be allowed on its platform. They believed that real assets were stocks, bonds, and cash not crypto.

But despite those strong opinions, Vanguard holds MSTR stock, shares in a company that is almost completely tied to this digital asset. Strategy (previously MicroStrategy), led by Michael Saylor, owns 601,550 BTCs with the latest purchase, valued at $70.28 Billion. That makes whoever purchases this stock indirectly a holder of BTC. So now, they are exposed to this cryptocurrency more than most crypto-friendly stocks.

Vanguard holds MSTR with a huge stake, this occurred due to its index fund approach. MicroStrategy stock has performed amazingly well, appreciating over 3,400% since 2020. Due to this, it became a larger component of some indexes. Because it manages funds which replicate such indexes, it had no option but to purchase and hold greater amounts of $MSTR.

Source: Google Finance

So while the organisation didn’t go out and buy this microstrategy stock because of BTC, it still ended up with the biggest slice. Right now, Vanguard holds MSTR stock totaling 20 million shares, more than 8% of the company.

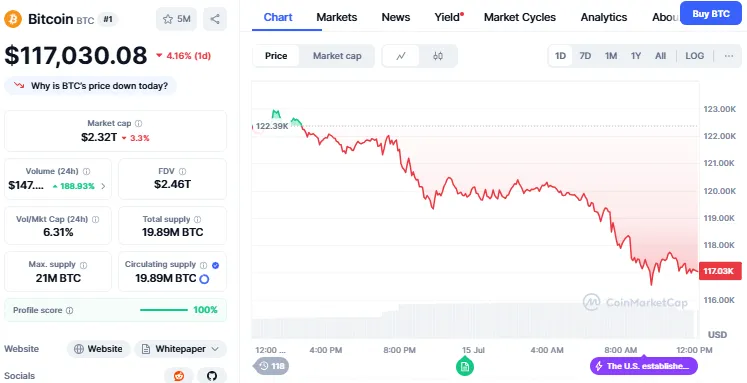

Michael Saylor, the face of MicroStrategy’s BTC strategy, sees the organisation's stake as a sign of growing trust in this digital asset. He said this move shows that even conventional finance is starting to accept this cryptocurrency as a robust long-term asset. The currency is now trading at $117,030 with a decrease of 4.16. While the trading volume has spiked up by 50%, it fell down after the massive rally of BTC hitting all time high.

Source: CoinMarketCap

What’s interesting is that both the organisations believe in holding assets long-term. Saylor is famous for saying he’ll never sell the company’s Bitcoin. While the asset management company also believe in staying invested for the long haul.

So even though they started from opposite sides of the crypto debate, they now meet at the same point, holding strong, no matter the market.

That’s why some analysts are joking that “God has a sense of humor.” Who would’ve thought Vanguard holds this stock after calling Bitcoin risky?

This occurrence can be a prelude to something bigger. If a critic like Vanguard holds MSTR, others can soon follow. It also indicates how cryptocurrency is incrementally becoming a part of mainstream finance, even for those who rejected it before.

As more institutional investors indirectly gain exposure to Bitcoin, we can expect the distinction between traditional assets and crypto to keep fading away. Whatever is certain now is that Vanguard holds MSTR stock, and that tells us a lot about where the market is going.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.