Michael Saylor’s firm Strategy (formerly MicroStrategy) has once again grabbed attention in the world of crypto with its latest Bitcoin investment.

Strategy Bitcoin acquisition had added 4,225 BTC worth about $472.5 million buying at an average price of $111,827 per coin. Which the firm recently announced on its social media platform X(formerly twitter).

Source: X

With this Strategy Bitcoin acquisition now holds a huge 601,550 BTC that is the world largest holding by any company globally.

Strategy Bitcoin acquisition began its journey of the asset back on August 11, 2020 when it made its first investment. At that time, many people thought that it was a risky move. But fast forward to July 2025 the firm has invested over $42.87 billion into leading asset which denotes that the decision was a game changer.

And still the company CEO, Michael Saylor is still targeting that he will buy more and more coins and is targeting to buy 21 million coins at $21 million price in 21 years i.e 2046.

Source: X.

And also suggesting the investors that if you want to spend your money then spend it on leading asset as the future is Orange.

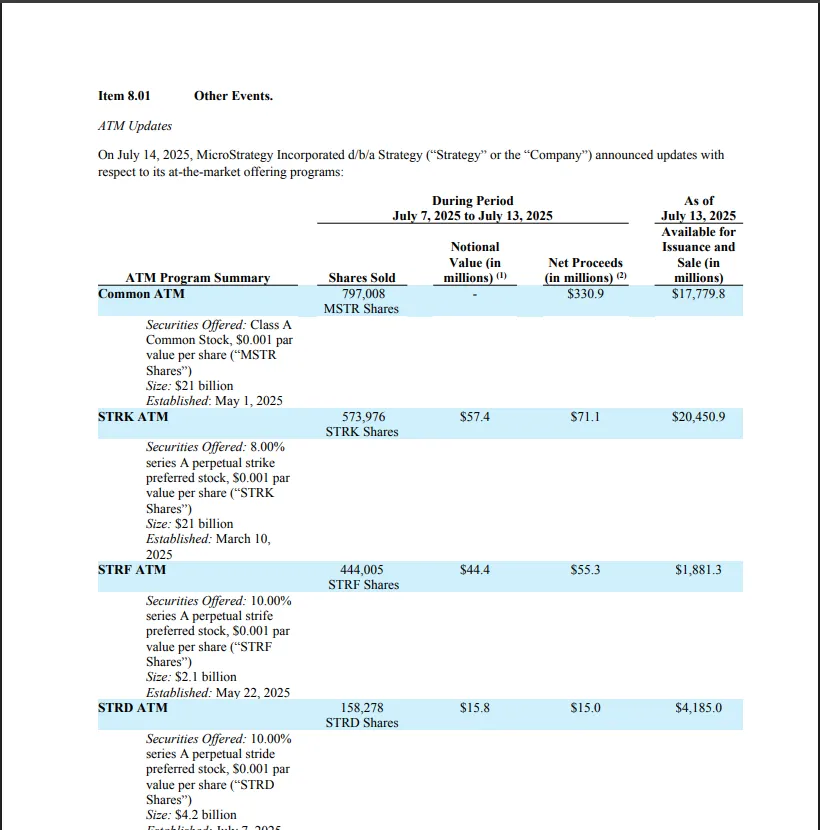

The recent investment was not just from the company’s reserve. Strategy Bitcoin acquisition funded this move by selling different types of company shares.

The major chunk came from selling MSTR stock which has raised around $330.9 million. Along with the sales of STRK, STRF and STRD they had enough funds to make the big BTC move.

Source: SEC filing

Interestingly, this came just after firm's VVP Wei-Ming Shao sold 62,500 MSTR shares that were worth around $25.7 million right before the purchase.

Earlier, such huge purchases have created shockwaves in the market. But now, with the rise of spot ETFs, the corporate coins buying has become more common and acceptable.

Strategy Bitcoin acquisition actions are now seen as a positive sign that it is a move that reassures investors instead of scaring them. Saylor’s and Robert Kiyosaki’s(author) strong predictions, bold statements and their confidence over it.

Japan’s Metaplanet which started as a hotel management company is now also going with the flow that is investing in golden assets.

The firm recently bought 797BTC worth around $93.6 million by taking its total to 16,352 coins. The firm is aiming to hold 210,000 coins by 2027 that makes it one of the top global corporate holders.

Source: BTN

Strategy Bitcoin acquisition is not alone anymore in buying the golden assets. But firms like DigitalX, KULR Tech, Blockchain Group and TAO Alpha have also added BTC to their treasuries.

From small weekly buys to major acquisitions, companies are clearly treading it as a serious asset for the future.

Micahel Saylor’s Strategy Bitcoin acquisition might have started the trend but now it is a global movement. Many companies from US to Japan are jumping in it as the asset is slowly turning into a new kind of corporate reserve asset. BTC began as a bold bet and now is becoming a common business plannings.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.