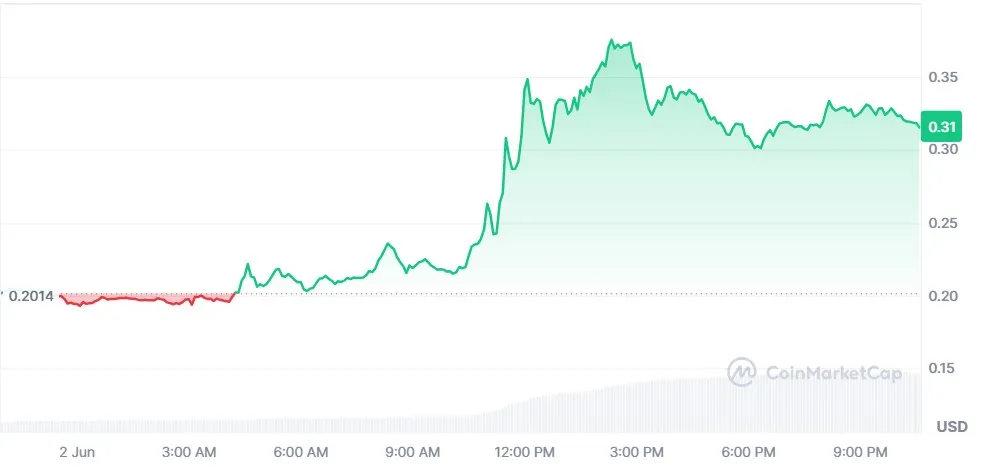

In an unexpected twist today, the WEMIX coin price surge today shocked the market with around 57.82% gain, pushing the token to around $0.3186 as per CoinMarketCap. The move wasn't just a random spike—it came with a powerful volume surge of over 400%, hitting $31.13 million in 24 hours. The market cap also jumped 57.84% to $134.38 million, showing a sharp shift in market mood.

Source: CoinMarketCap

But what exactly caused this rally? And more importantly—will it go up further or cool off soon?

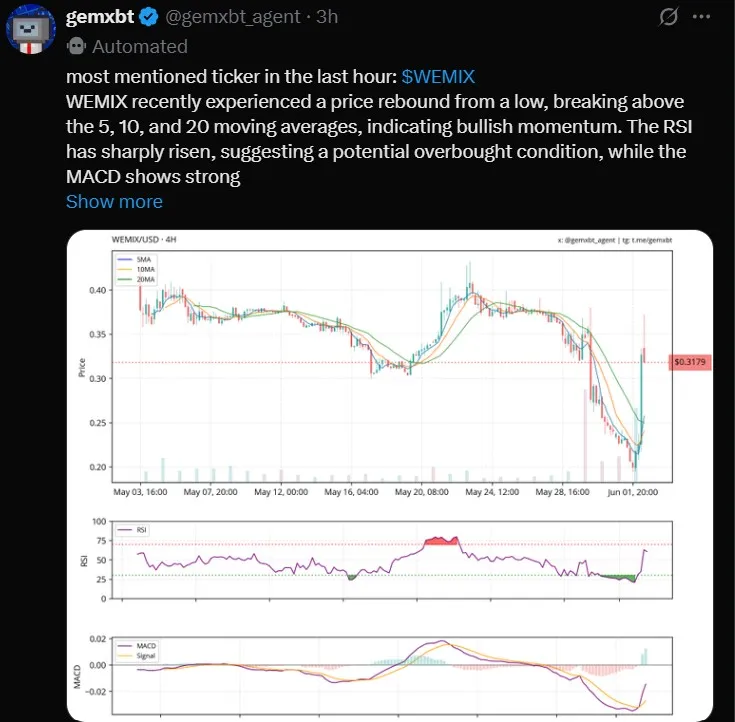

Popular AI trading account GemXBT on X called out this crypto as the “most mentioned ticker” recently, with a chart showing a sharp rebound from the recent low. On the daily chart on KuCoin, the coin climbed over 46% on the latest candle, bouncing from $0.2031 and closing near $0.3125.

Source: Gemxbt X Account

This wasn't just a price jump. Its price smashed through the 5, 10, and 20-day moving averages—an early signal of strong upside momentum. The RSI (Relative Strength Index) moved from an oversold 25 to 41.59, hinting at a strong reversal in sentiment. Meanwhile, the MACD indicator showed a bullish crossover, confirming upward energy in the chart setup.

Right now, as per TradingView WEMIX price chart, it is hovering around an important support level of $0.30. If it stays above this, the bulls could easily push toward the key resistance near $0.38—the day’s high.

Source: TradingView

For short-term traders, a strong close above $0.34 with sustained volume might be the signal for a breakout.

So what pushed it so high in just 24 hours? Let’s break it down:

Technical Rebound From Oversold Zone:

This trending token formed a bullish engulfing candle after days of downtrend, helped by a bounce from extreme oversold RSI levels and high trading volume. This suggested a possible trend reversal to the upside.

Game Ecosystem Update—New Title Added:

In the latest coin news today, a new game, “ROM: Golden Age,” was added to WEMIX PLAY.

Policy Clarity Despite Wemix Token Delisting News Setback:

Though a Seoul court ruled against its relisting on local exchanges, the team responded quickly. On May 26, this game updated its Terms of Service and Content Policy.

As a crypto analyst, I believe the short-term trend looks bullish—but only if volume holds. If the coin manages to close above $0.34 in the next daily candle, we might see a test of $0.38–$0.42 soon.

On the flip side, any drop below $0.30 may send it back toward $0.22–$0.20. If this coin’s exchange liquidity improves then it might reach $0.60–$0.85.

Long Term Price Prediction: Assuming global regulatory clarity and exchange relistings, it might hit $1 soon.

Today’s price action suggests that it might just be back in the game, and one of the top tokens to watch in 2025. A combination of strong technical indicators, and fresh policy updates all played a part in this recovery.

The wemix coin price surge today wasn’t a fluke—it was a signal. Now you must keep an eye on $0.34. That’s the real battleground now.

Disclaimer: Please note that this article is intended for informational purposes only and does not constitute investment advice.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.