The Crypto Market has been very busy lately. The combined market cap reached $3.98 trillion, with $209 billion of trading volume in the last 24 hours. Bitcoin leads the way at 59.1%, with Ethereum at 11.1%.

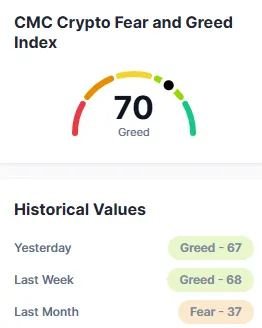

In the meantime, the Fear and Greed Index rose to 70 (Greed), up from 67 yesterday. As the things don't have to be quiet for very long. The Crypto Market showcase Bitcoin is at the forefront, but the market's mood is being shaped by significant news, such as Powell's silence on rate cuts, the drama surrounding ETFs, and the price spike of ONDO.

Here is a brief summary of today's events in cryptocurrency.

Source: CoinMarketCap

Federal Reserve Chairman Jerome Powell recently made a speech, and most anticipated that he would discuss reducing interest rates. But that wasn't the case. He was more interested in enhancing the resilience of the banking system-referencing stress tests, leverage requirements, and capital requirements. His silence made markets question what's in store next.

Donald Trump responded immediately, calling Powell a "numbskull" and stating he'll be outta there in eight months. Trump criticized the then-current rate of 4.25–4.5% and advocated for a drastic cut down to 1%. Other such voices as Peter Schiff and Senator Cynthia Lummis also expressed disappointment on social media.

Powell's uncertainty might cause the Crypto Market to move more cautiously this week.

Source: X

Bitwise ETF Gets Green Light… Then a Stop Sign

The Bitwise 10 Crypto Index Fund ETF received a rapid U.S. SEC approval, only for that approval to be suspended a few hours later. The fund would have featured leading coins such as Bitcoin, Ethereum, and XRP, being managed by Coinbase Custody and cash by BNY Mellon.

While it was a significant milestone, the unprecedented review by the SEC now puts the launch date in doubt. Investors are waiting with bated breath as this may influence faith in the digital space.

Source: X Wu Blockchain

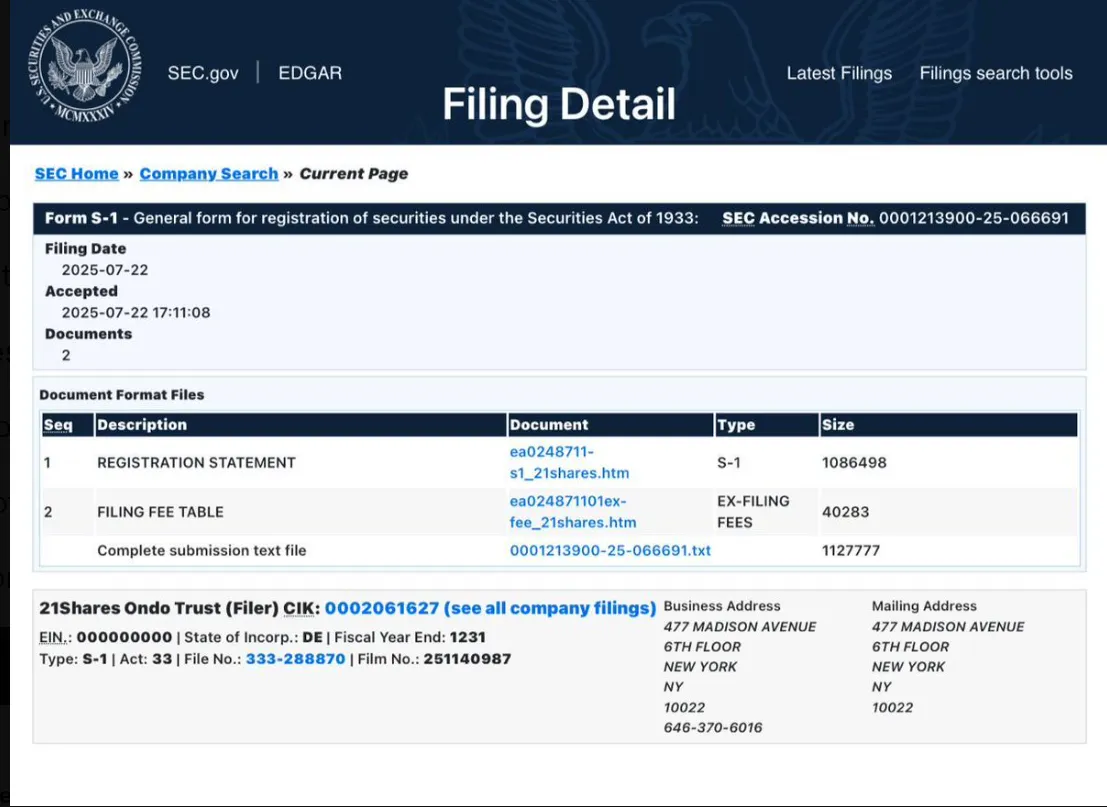

In a second ETF narrative, 21Shares submitted to list an ONDO ETF that hopes to introduce real-world assets such as the U.S. Treasuries into DeFi. Supported by Coinbase Custody, the ETF hopes to draw institutional funds by bridging traditional finance with blockchain.

After the news, ONDO token rose from $1.08 to $1.16, and trading volume increased by 21%. Although it currently stands at $1.11, the token has risen more than 64% in the past month-demonstrating genuine enthusiasm in the crypto market.

Source: Sec.gov

In a dramatic change, PNC Bank is teaming up with Coinbase to enable its customers to buy and sell digital currency directly from their accounts. The rollout will begin with wealthy clients first, with further expansion. It's part of Coinbase's Crypto-as-a-Service model, making it easy for traditional banks to dip into digital assets.

This is made possible due to recent regulatory changes from U.S. authorities. Banks do not require special licenses to provide services anymore, paving the way for increased collaborations like this one in the crypto market.

Source: Coinbase

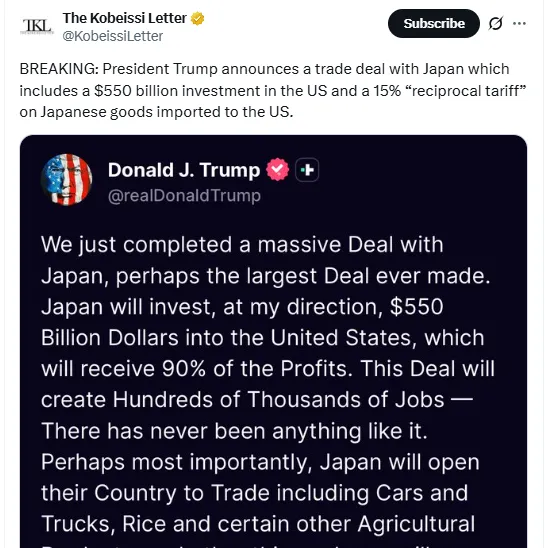

President Donald Trump recently signed what he refers to as the "largest trade deal in history" with Japan, in addition to new agreements for Indonesia and the Philippines. Japan will reduce tariffs and invest $550 billion in American factories.

While some, such as Peter Schiff, claim these transactions are harmful to U.S. consumers, the enormous investment could increase market liquidity. That could drive more money into the crypto market, particularly as the U.S. increases domestic production possibly boosting the digital economy.

Source: The Kobeissi Letter

These updates demonstrate how closely the crypto market is now linked to international politics and finance. Trump's huge trade deals, the drama surrounding ETFs, and Powell's silence on interest rates are all related to how and where money moves. Crypto is no longer on the periphery; it is now influencing the financial future as a fundamental component of both traditional banks and cutting-edge tokens.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

4 months ago

🙃🙃🙃🙃🙃🙃