In a surprising turn of events, the U.S. SEC gave the green light to the Bitwise ETF only to hit the brakes immediately after. On July 22, the SEC’s Division of Trading and Markets approved a rule change that would allow the Organisation's 10 Crypto Index Fund to trade on NYSE Arca as an Exchange Traded Fund. But within hours, that decision was paused.

This has left investors confused and wondering when or if it will actually launch.

Source: Wu Blockchain

The commission initially granted “accelerated approval” for the Bitwise ETF, which seemed like a major win for the crypto investment world.

However, Assistant Secretary Sherry R. Haywood granted a stay under Rule 431(e). He stated that the previous approval would be reviewed by the SEC.

"This letter is to inform you of that. The July 22 order is stayed until the Commission directs otherwise," Haywood stated in a formal announcement. That is to say although the fund received approval, it can't trade yet.

It is based on the Bitwise 10 Crypto Index, which tracks the top 10 cryptocurrencies by market cap. As of now, the fund includes Bitcoin (78.72%), Ethereum (11.10%), and XRP (4.97%), along with Solana, Cardano, Chainlink, SUI, Avalanche, Polkadot, and Litecoin.

The crypto fund is designed to rebalance every month to reflect market changes. At least 85% of the fund will include digital assets like Bitcoin and Ethereum that are already approved for ETFs. The remaining 15% which includes coins like XRP and Solana is not yet fully approved but still part of the index.

Crypto assets in the Bitwise ETF will be held by Coinbase Custody, while BNY Mellon will manage cash and serve as administrator.

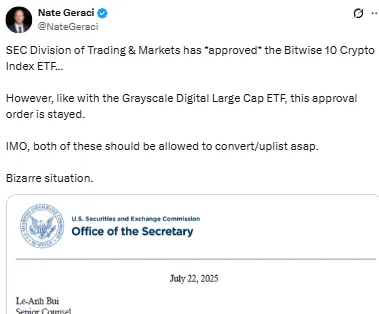

The sudden pause has sparked criticism. Nate Geraci, president of The ETF Store, called the situation “bizarre,” especially after the SEC had already approved the fund.

“Both of these should be allowed to convert/uplist ASAP,” he wrote on X (formerly Twitter), referring to both Bitwise and Grayscale’s crypto ETFs.

Source: Nate Geraci

Other analysts like Scott Johnsson and James Seyffart suggested that the SEC might be stalling to build a new framework for Exchange Traded Funds. Until that happens, even approved funds like the Bitwise ETF may remain stuck in limbo.

Right now, shares of the 10 Crypto Index Fund are only available over-the-counter. If the stay is lifted, it would start trading on a national exchange, making it much easier for both everyday and institutional investors to gain exposure to digital assets through a regulated product.

However, until the SEC completes its review, this is on hold. This move is similar to the situation with Grayscale’s Digital Large Cap ETF. It has also faced delays despite prior approval.

The Bitwise ETF approval indicates that there is an improvement towards acceptance of even more crypto ETFs in the U.S. more so in the new administration.

However the abrupt stop is to recall that the road is not smooth yet. Once again, regulators are making investors wait in anticipation until they finally approve this cryptocurrency investment product.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.

6 months ago

🙃🙃🙃🙃🙃

2 months ago

A good article to read. The writer has effectively managed the data to make the article engaging. In my opinion, this is an excellent article.