The global cryptocurrency market saw a 1.29% increase, bringing its total market cap to $2.68 trillion. However, the total crypto market volume dropped 25.46% in the last 24 hours, currently standing at $119.6 billion. DeFi volume accounts for 6.19% of the market’s daily trading volume, with stablecoins contributing 93.29% of total volume.

Bitcoin’s dominance also saw a slight uptick, reaching 61.08%. Investors are closely watching price movements and regulatory updates to assess future market trends.

The long-awaited XRP ETF date announcement has been delayed by the SEC, but this hasn’t stopped XRP from gaining 2.51%, pushing its price to $2.18. Franklin Templeton has joined major players like Grayscale and Bitwise in applying for an XRP ETF, further strengthening market optimism.

Source: CoinMarketCap

The SEC also postponed decisions on ETFs for Dogecoin, Litecoin, and Solana.

Analysts predict a 65% chance of an XRP ETF approval in 2025.

Investors remain hopeful due to recent crypto-friendly regulatory shifts, with a final SEC decision expected in October.

The long-running Mt. Gox bitcoin recovery process continues, with the defunct exchange moving 11,501 BTC ($905 million) to an unknown wallet. This follows another $1.07 billion BTC transfer last week, intensifying Mt. Gox news surrounding market fears.

332 BTC was moved to a warm wallet for potential creditor repayments.

Total Bitcoin holdings by Mt. Gox stand at 35,915 BTC ($2.8B).

Repayments to creditors are due by October 2025, sparking fears of further Bitcoin price declines.

Analysts warn Bitcoin could drop to $75,000 if more large-scale sell-offs occur.

With Pi Network Migration Issues intensifying before the March 14 deadline, many users are struggling with KYC verification and account transfers. Binance’s poll on whether to list Pi Coin saw 87.1% support, but no official confirmation has been made.

Pi Coin price surged 21.37% intraday to $1.67, but it’s still down 12.50% weekly.

If Binance lists Pi, the price may rise to $3-$5.

If Binance listing announcement doesn’t happen, Pi Coin could drop to $1.20.

The crypto community awaits Pi Day updates on migration, KYC, and Binance’s decision.

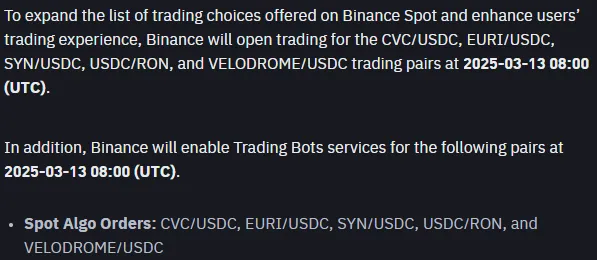

In a major update, Binance lists five new trading pairs on March 13 at 08:00 UTC. These include CVC/USDC, EURI/USDC, SYN/USDC, USDC/RON, and VELODROME/USDC.

Source: Binance

Spot Algo Orders and trading bots will be enabled for these pairs.

Users in restricted regions (e.g., the U.S. and Canada) cannot access these new pairs.

The Binance listing announcement aims to expand trading options.

Despite market uncertainty due to global economic concerns, this move is expected to increase trading volumes.

U.S. Representative Tom Emmer has reintroduced the Anti-Surveillance State Act to prevent the launch of a U.S. CBDC, arguing that it threatens financial privacy and American values.

Paxos CEO Charles Cascarilla is pushing for stablecoin regulations to prevent regulatory arbitrage.

A CPA report revealed that crypto firms spent $134 million on political lobbying in the 2024 U.S. elections.

Analysts predict greater regulatory clarity for stablecoins in 2025, while the debate on CBDCs continues.

The crypto market remains volatile, with Mt. Gox news raising concerns, XRP SEC news influencing ETF optimism, and Pi Coin Binance listing concerns dominating discussions. Meanwhile, Binance’s new listings and regulatory battles over stablecoins and CBDCs shape the market's future. As investor sentiment fluctuates, staying updated on why is crypto up today and regulatory trends is crucial for navigating the evolving landscape.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.

3 months ago

If you have experienced substantial financial loss as a result of fraudulent binary option investments, it is important to file a complain about the scam broker to Barry white and obtain a chargeback service in getting back your asset, I recommend barrywhite4390@gmail.com a reliable recovery specialist proceeding with his assistance in recovering your asset. I have come across positive feedback about him, I have use his service and gain positive outcome in securing a legal chargeback service in regaining my funds

3 months ago

This headline is concise but could be clearer. Consider specifying who is delaying the XRP ETF and adding more context about Mt. Gox's BTC movement to improve clarity and engagement.