The crypto markets continued their pace today with a $250 billion volume traded in the past 24 hours. Bitcoin continues to lead with a 60.3% market share, trailed by Ethereum at 10.7%.

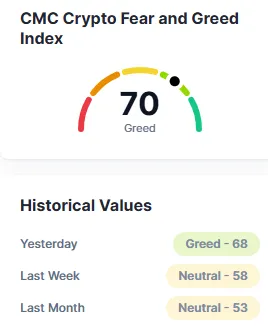

The Crypto Fear and Greed Index crept up to 70, reflecting an environment of rising optimism or greed among investors. In the light of that background, several key events have been under the spotlight, driving today's rapidly changing digital asset narrative.

Source: CoinMarketCap

In a dramatic strategic pivot, Coinbase has rolled out its highly anticipated Base App, positioning it as an “everything app” for the onchain age. It integrates payments, messaging, trading, NFTs, and social functionality- all into one platform. In essence, it's a Web3-native fusion of WhatsApp, Venmo, and Robinhood, packaged in a beautiful new interface.

Source: X

The platform's launch sent Coinbase stock to an intraday high of $405, a sign of investor optimism. The overall Base ecosystem now includes:

Base App (user-facing gateway),

BaseBuild (dev tools), and

BaseChain (the Layer-2 blockchain on Ethereum).

CEO Brian Armstrong posted that he'll personally use the app to post updates and monetize content creators, hinting at integrations ahead for creator monetization.

Source: X

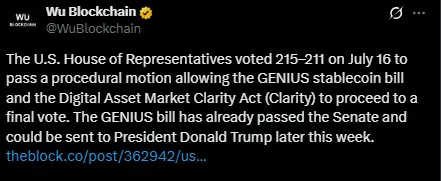

A dramatic late-night vote in the U.S. House of Representatives witnessed the long-dormant crypto regulation bill finally clear with a 215–211 vote.

The bill paves the way for the GENIUS Act and Digital Asset Market Clarity Act, which seek to regulate stablecoins and bring legal clarity to crypto companies operating in the U.S.

Reports indicate that a last-minute emergency meeting with former President Donald Trump, 11 Republican lawmakers, and Speaker Mike Johnson ensured the winning votes. It is a rare bipartisan move toward mainstreaming crypto adoption in the United States.

The 1inch CCO hailed the move, which will “legitimize stablecoins and bring structure to a chaotic regulatory environment.”

Source: X

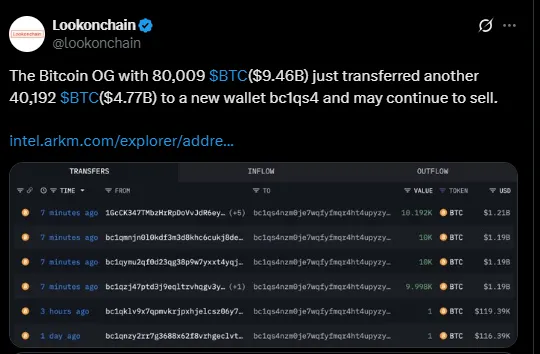

Crypto communities were in a buzz today after a 14 year old dormant Bitcoin wallet transferred 80,000 BTC, valued at approximately $9.5 billion. The latest tranche- 40,192 BTC valued at $4.77 billion was sent to a new address, leaving eyebrows raised across the market.

Some of the previous transfer found its way to Galaxy Digital, which subsequently transferred $706 million worth of BTC to Binance and Bybit, indicating a potential liquidation plan. The actions of the whale have raised concerns of short-term volatility, particularly given that Bitcoin is trading close to its high.

Source: X

The SEC has approved the XRP ProShares ETF , which will be listed under UXRP on July 18. The fund provides 2x leveraged exposure to XRP through futures and options contracts, although it won't actually hold tokens.

After the announcement, XRP increased 9.1% to an all-time high of $3.23. Volume increased by 79% to $12.58 billion in a mere 24 hours. Some analysts say this might be the trigger that ultimately takes XRP's market cap to $1 trillion, which would suggest a future price of $17.80.

Source: X

Whether it's Coinbase revamping its ecosystem, legislators enacting landmark legislation, or protracted slumbering whales disrupting charts, today's news demonstrates that crypto is not merely holding on- it's transforming. With investors motivated by hope and only a dash of greed, the sector is priming for potentially an explosive second half of 2025.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.