The crypto world doesn’t slow down—not even for a second. And today, the headlines were packed with developments that matter. From token crashes to billion-dollar IPOs and game-changing blockchain use cases, here's your complete update on what happened in cryptocurrency today, featuring the top 5 biggest stories making waves across markets.

In a headline-making appearance at a Blockware Solutions event, Michael Saylor—Executive Chair of Strategy (formerly MicroStrategy)—voiced concerns about on-chain proof-of-reserves.

He argued that publishing wallet addresses could open up major security risks for crypto holders and institutions. Although transparency is critical, especially after the FTX fallout, Saylor didn’t commit to releasing MicroStrategy’s own reserves. Meanwhile, the firm just added 4,020 BTC, a move that once again puts Michael Saylor bitcoin news front and center in today’s market.

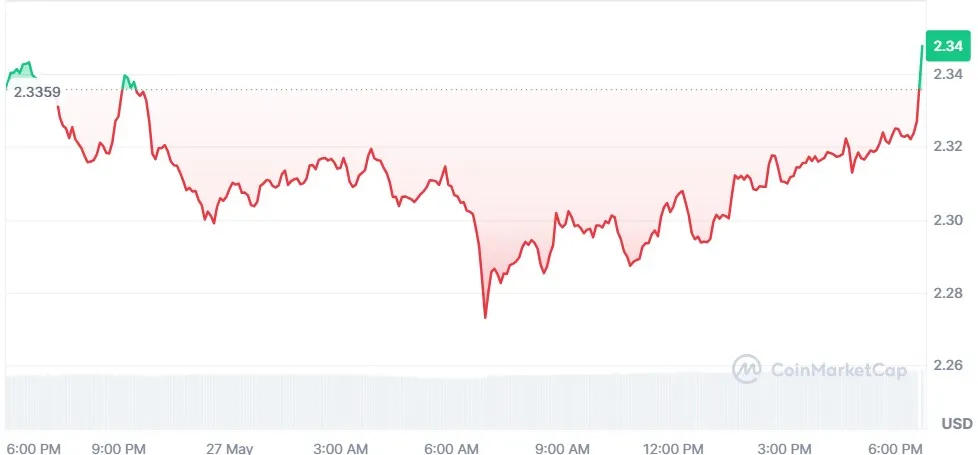

XRP Dubai real estate tokenization just became real. With XRP trading at $2.33 today, according to the CoinmarketCap data, the bigger spotlight is on the UAE, where the Dubai Land Department has partnered with blockchain firms to tokenize property via the XRP Ledger.

Source: CoinMarketCap

This move lets locals buy real estate fractions starting from AED 2,000. With XRPL’s speed and low fees, this could evolve into a AED 60 billion market by 2033. Meanwhile, investor attention is growing with rising hopes for XRP ETF approval 2025, now pegged at 83% by Polymarket.

It’s been a rough day for Binance Launchpool HUMA participants. The token plunged 45% after peaking at $0.12 during its Token Generation Event on May 26 and now trades at $0.062.

The HUMA token price crash didn’t stop a $600M+ trading volume across exchanges like Bybit, OKX, and MEXC. As someone who’s tracked many Launchpool tokens, this dip felt familiar—hype followed by correction. Still, with the airdrop claim window open and a second round coming, community activity remains strong. No doubt, the huma price crash is among the top 5 crypto news today.

One of the most awaited events in the stablecoin space is finally happening. Circle, the issuer of USDC, filed for its IPO on the New York Stock Exchange. The listing—under ticker CRCL—will offer 24 million shares priced between $24 and $26.

With backing from J.P. Morgan, Goldman Sachs, and Citigroup, Circle aims to strengthen its position against rivals like Tether. This Circle IPO CRCL stock news is a major highlight today.

Crypto investment firm Strive, co-founded by Vivek Ramaswamy, raised $750 million in private equity, with an option to double that if warrants are exercised. The capital will be used to build a BTC-heavy treasury and pursue alpha-generating strategies. Their plan includes acquiring Mt. Gox distressed claims and undervalued biotech assets.

From real estate tokenization to IPO filings and launchpool crashes, today’s cryptocurrency updates were anything but dull. As a crypto writer, I find days like this fascinating—because they show just how many verticals the blockchain world is touching.

Whether you’re watching price charts or industry moves, these updates from the top 5 crypto news today are proof that crypto is more alive than ever.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.