The White House is dropping its Digital Asset Report this week—but what exactly is inside? Will it confirm a national Bitcoin reserve? Open doors for altcoins? Or rewrite crypto policy forever? One thing’s clear: this could silently kickstart the next crypto bull run before anyone sees it coming.

The White House digital asset report Wednesday has become the hottest topic in the financial world. According to Bloomberg, the administration will release its much-anticipated crypto policy roadmap tomorrow, July 30.

What’s in the document? Well, the Digital asset report July 30, could go far deeper than before, laying out:

U.S. national strategy on Bitcoin and cryptocurrency adoption.

A clear split of responsibilities between the SEC and CFTC.

New rules for stablecoins and crypto banking access.

A roadmap for international partnerships and cross-border regulations.

Discussion on integrating Bitcoin into the U.S. Treasury Reserve strategy.

It may also include elements from the “Framework for International Engagement on Digital Assets,” aligning U.S. policy with allies like the EU, Japan, and South Korea.

Now comes the question, How will the crypto market react to this White House crypto news?

Currently, it is priced around $118,654. Despite a minor dip over the past week, its 24-hour trading activity has jumped by over 14%, signaling possible quiet moves by institutions.

Source: CoinMarketCap

While the price stays stable, the increased volume suggests that traders are expecting a strong shift after the White House crypto report Wednesday going public.

Two possible outcomes:

If it confirms or hints at Bitcoin being recognized as a national reserve asset, this could confirm a breakout above $120K to resume upward momentum.

If no information comes in favour of BTC, then expect a bearish risk toward $114–$115K

Unlike Bitcoin, Ethereum has seen solid growth this week, climbing 5% in the past 7 days, attracting both investors and developers. Currently it is sitting around $3,846 according to the Tradingview chart. This upward trend supports the narrative that decentralized finance might receive more positive attention in the upcoming U.S. cryptocurrency statement.

If the White-House to release digital asset report includes a clear difference between centralized platforms and open protocols, then this altcoin along with XRP, Solana, and Cardano could lead the next charge.

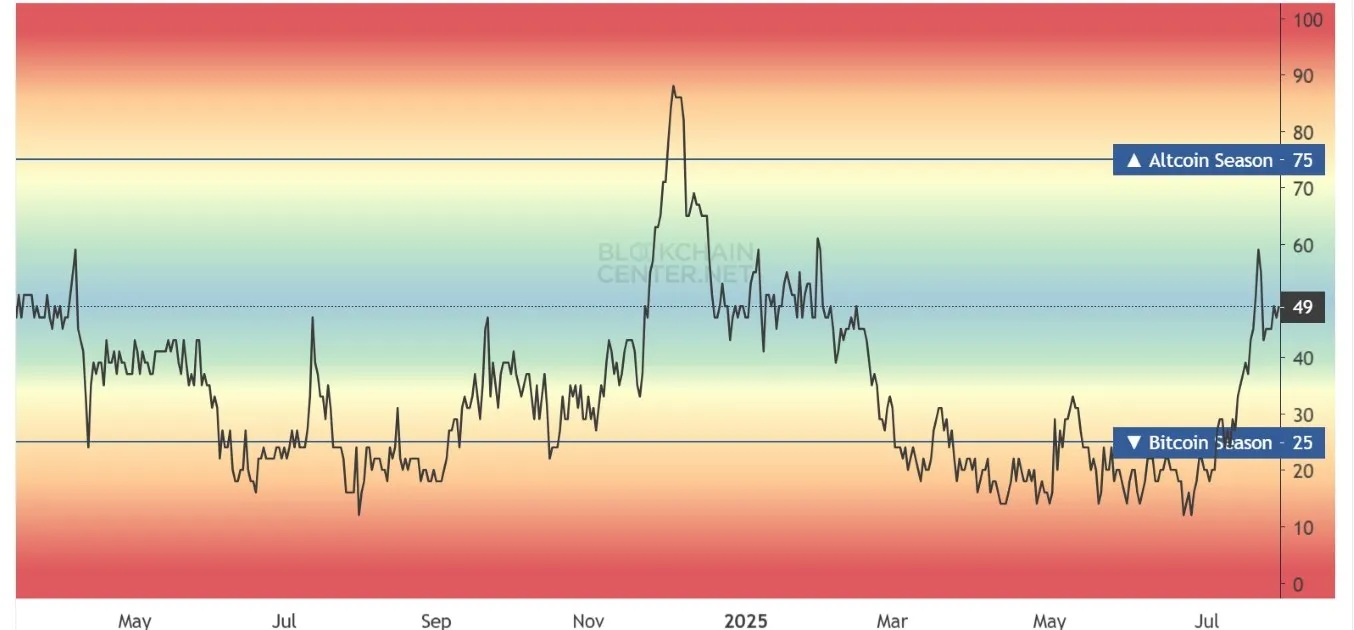

This is not all, but even the Altcoin Season Index currently reads 49—neutral—but any bullish tilt in the report could push it into the 75+ range, signaling altcoin season.

This shows the impact on the market could ripple across the board—not just BTC and ETH.

The upcoming White House digital asset report Wednesday could mark the beginning of a new phase in cryptocurrency adoption. Whether it’s the official inclusion of Bitcoin in U.S. reserves, clearer oversight frameworks, or DeFi-friendly language, the stakes are enormous.

Traders, institutions, and retail investors are aligned on one point: this brief could trigger a BTC bull run, an ethereum surge, or even a full-blown altcoin cycle.

If Washington delivers, the U.S. might finally anchor itself as the global hub for digital assets—and cryptocurrency could be entering its most bullish chapter ever.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.