If you are watching crypto trends very closely, all the signs show that we are in for a big turn around: altcoin season 2025 may be just around the corner. Bitcoin dominance is slowing down, and several coins signals are flipping green.

Analysts believe that we are coming into the most explosive part of the cycle. How do we know and what evidence do the experts and the charts show to indicate that the crypto market will be transitioning into another rally soon?

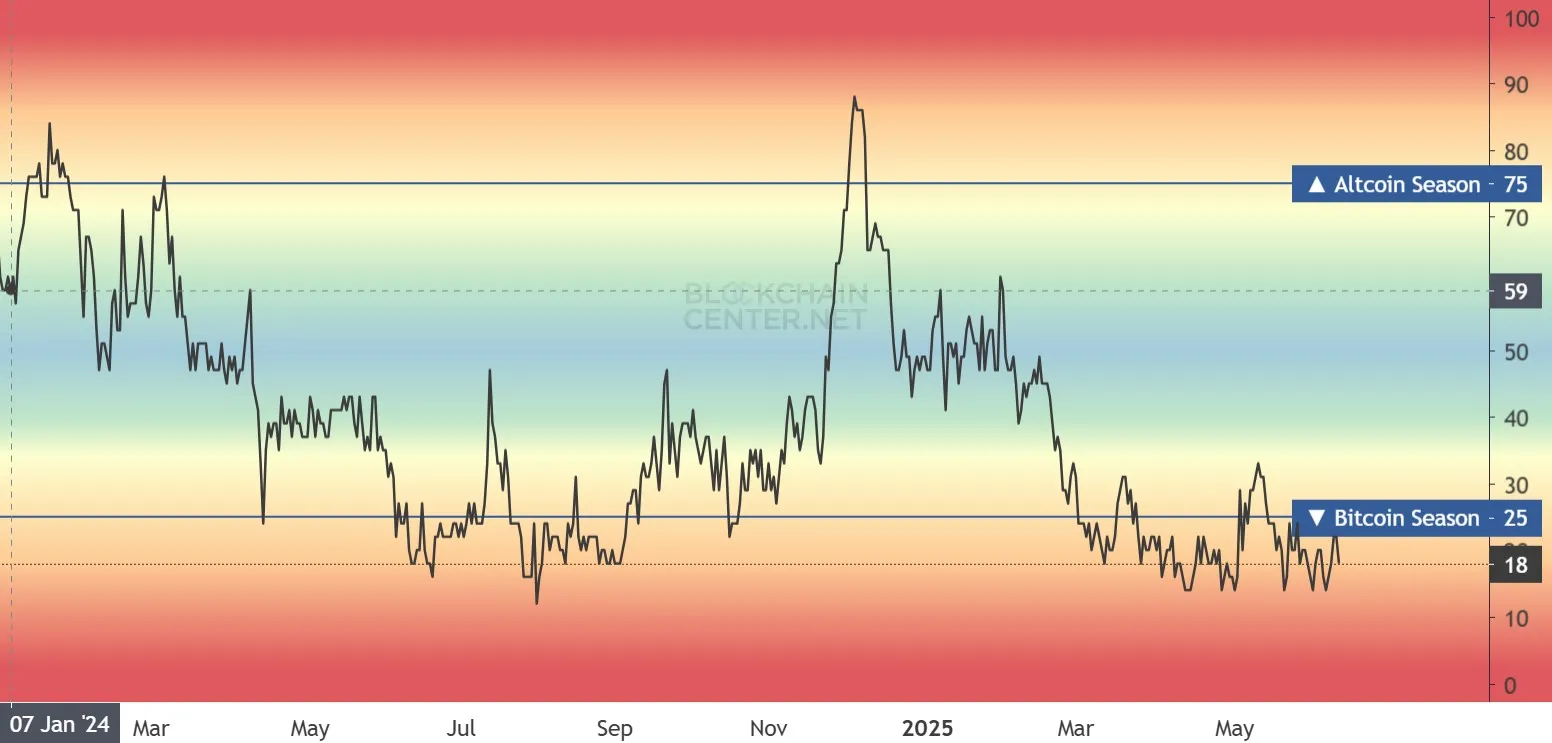

This Season Index by BlockchainCenternet is a widely used tool to measure whether the market favors BTC or other cryptocurrency. The current score is 25, sitting right at the boundary of what’s considered BTC preiod. Historically, when the index moves up from these levels, it leads to strong rallies.

Source: BlockchainCenternet

Past data confirms this. The last major allternatie cryptocurrency interval came after similar levels in late 2024, and if the pattern repeats, we could see a powerful altcoin season 2025 shaping up soon.

Altseason Index >75 = confirmed Altseason period

Bitcoin Period <25 = current phase

A breakout from here could be significant for the entire digital coin market

Crypto analyst Ash Crypto explains that we’re currently entering this 3.0, following the most extended accumulation period ever seen:

Source: Ash Crypto X

Altseason 1.0: 408 days accumulation → 15,000% gains

2.0: 1008 days accumulation → 600% gains

3.0: 1050 days accumulation — likely breakout started in Q4 2024

While geopolitical tensions like Trump tariffs and Elon and Donald fight, caused short-term delays, the structure of the cycle remains intact. As history shows, it typically leads for 3 to 3.5 years, and they explode for 4–6 months shortly after.

If the current setup holds, then it could mirror or even exceed the gains of earlier cycles.

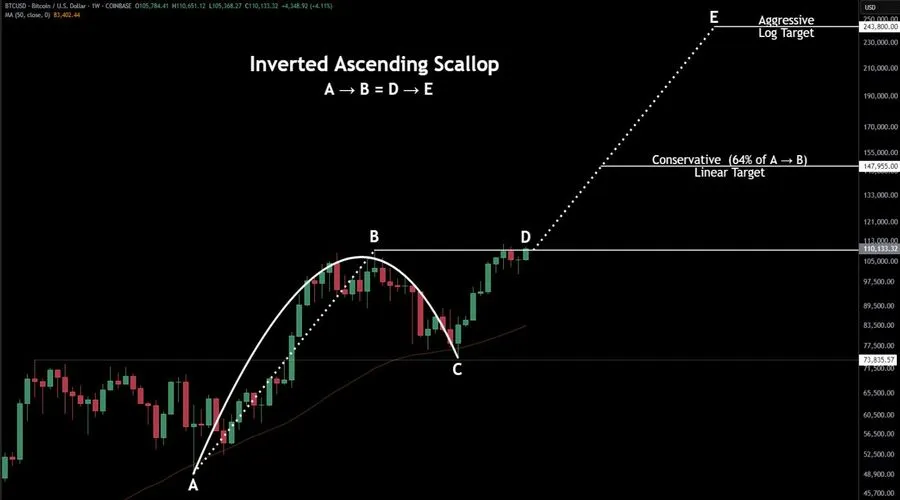

Being an crypto analyst, as per my expertise, the below chart appears to be its strongest bullish setup, known as the Inverted Ascending Scallop, which started at $49,500 in August 2024, peaked at $109K in January 2025, and then retraced down to $74,400 in April.

Source: X

Bitcoin now can retest the $109,358 breakout (was resistance), and if we see a valid breakout, targets could be set conservatively as $148,000, and aggressive targets as high as $244,000.

At the same time, the its Dominance chart (BTC.D), is signaling bearish reversals. We have clear RSI divergence (lower highs on RSI and Bitcoin price are creating higher highs), a rejection from a rising wedge, and dominance has failed to break the 64-67% strong resistance zone.

Analysts Agree: Bitcoin to Lead, Other Coins to Explode in 2025

The market is aligning behind a familiar playbook — Bitcoin leads the charge, then other cryptocurrnecies deliver exponential returns. Top analysts are watching for the following confirmations:

Bitcoin closes above $109,358 on the weekly chart

Altcoin Index rises above 50

BTC Dominance starts trending down with volume

All of this supports the thesis that altcoin 2025 is not only likely — it may be inevitable.

The stars appear to be aligning. From historical accumulation cycles to Bitcoin dominance reversal patterns and analyst price targets, the signs are all there. If you're still in the crypto space, this is not the time to exit. Instead, it might be the most strategic moment to position for the upcoming wave. Altcoin season 2025 may be the most explosive cycle yet — so keep an eye on its chart pattern and latest crypto news.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.