Bitcoin ($BTC) is experiencing a decline as market volatility surges, leaving investors wondering, Why Bitcoin is falling today? The primary factors driving the recent price drop include escalating trade tensions triggered by Trump tariffs news, increased short positions in the crypto market, and large-scale liquidations.

The Bitcoin price recently declined by 1.88% in the last 24 hours, currently trading at $97,513.77 as per CoinMarketCap. Over the past week, BTC price have fallen by 4.97%.

Source: CoinMarketCap

A key catalyst behind this downward trend is the Trump tariffs news, which has heightened market uncertainty. The U.S. government, led by President Donald Trump, recently imposed new tariffs on imports from China, Canada, and Mexico. In retaliation, China's Ministry of Finance announced countermeasures, including an additional 15% tariff on coal and liquefied natural gas and a 10% tariff on agricultural equipment, crude oil, and certain vehicles starting February 10.

Additionally, China has accused the U.S. of violating World Trade Organization (WTO) regulations, further intensifying geopolitical tensions. These trade disputes have led to broader market instability, including in the cryptocurrency sector, causing investors to rethink their strategies.

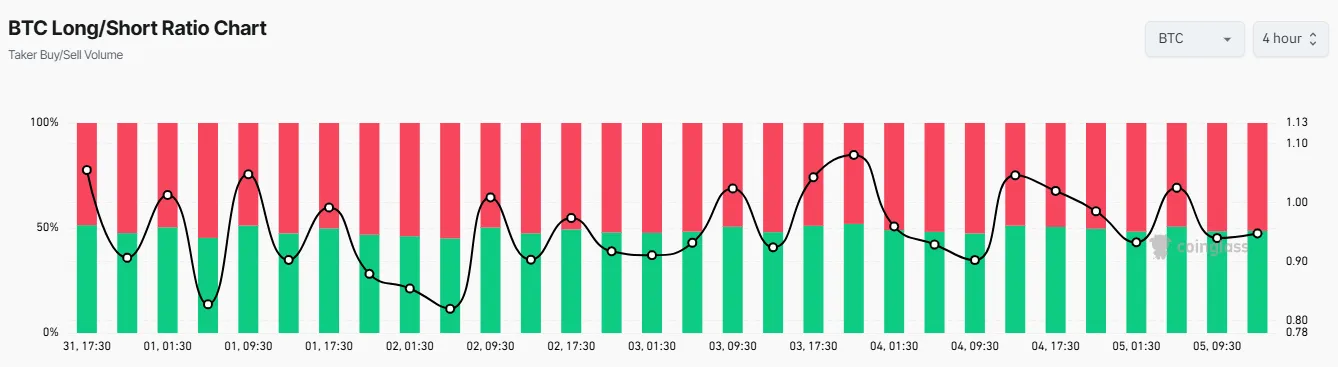

Another reason why Bitcoin is going down is the current BTC long and short positions imbalance. Data reveals that 51.34% of traders are in short positions, expecting Bitcoin to decline, compared to 48.66% in long positions. The total short positions amount to $3.18 billion, while long positions stand at $2.88 billion.

Source: CoinGlass

This skew towards shorting has triggered forced liquidations, adding selling pressure to the market. Over the past 24 hours, 121,373 traders were liquidated, leading to total liquidations worth $382.20 million. The largest single liquidation occurred on HTX, where a ETH-USDT trade worth $43.05M was wiped out.

David Sacks Crypto Regulation Push & BTC Price Decline

Venture capitalist David Sacks and Republican lawmakers are pushing for a U.S. crypto regulatory framework, aiming for legislation within six months. They emphasize U.S.-based stablecoin issuance to strengthen the dollar’s dominance and attract trillions in demand. However, investors were disappointed by the lack of immediate impact. This uncertainty, coupled with regulatory delays, is a key factor behind Bitcoin's price decline, as unclear policies drive capital away and slow institutional adoption, weakening market confidence.

Currently, Bitcoin is consolidating between $92,500 and $106,500. A clear breakout beyond this range is needed to determine the next trend direction. Analysts suggest that Bitcoin will likely end December 2025 trading between $130,000 and $150,000.

Looking further ahead, the Bitcoin price prediction for 2030 indicates a potential rally, with forecasts suggesting BTC could trade between $150,000 and $300,000. However, until market stability improves and regulatory concerns ease, Bitcoin crash risks remain, making short-term movements unpredictable.

As uncertainty looms, traders will be closely monitoring whether President Trump will reconsider or pause tariffs, potentially easing market fears and stabilizing BTC price.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.

3 months ago

Crypto market predictions