The global crypto market is falling, with total market capitalization now at $3.28 trillion, down 1.48% in the past 24 hours. As prices slip, the big question on everyone’s mind is — why did crypto drop today?

While short-term volatility plays a role, today’s correction comes alongside several important developments. Here are 5 major crypto news updates shaping the market narrative right now.

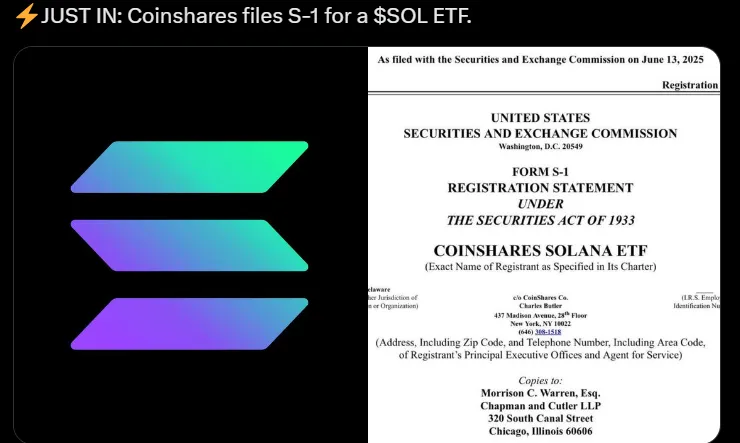

In a major move, CoinShares has officially filed an S-1 form with the SEC to launch a Spot Solana ETF, making it the eighth issuer to join this race after Fidelity, Grayscale, and Bitwise.

Source: BelynCrypto X

The filing mentions Coinbase Custody and BitGo as custodians and includes plans to stake SOL holdings if approved. This adds to the growing buzz around CoinShare Solana ETF plans — a factor now watched closely during this market pullback.

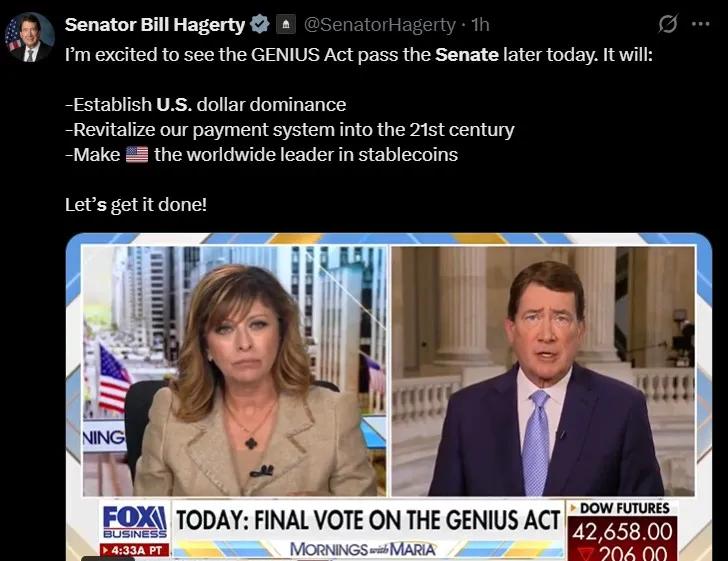

A major reason why the crypto market is down today could be uncertainty around new U.S. regulations. At 4:30 PM ET, the U.S. Senate will vote on the Genius Act, a new bill that sets legal rules for stablecoins like USDT and USDC.

Source: Senator Bill Hagerty, Former U.S. Ambassador to Japan

The bill, if passed, could bring clarity to real-world currencies, something investors have long demanded. Today’s vote is critical and adds regulatory pressure during an already fragile industry.

Thailand’s Cabinet has approved a tax exemption on capital gains from the sale of digital assets through licensed cryptocurrency exchanges. The rule will apply from January 1, 2025, to December 31, 2029, making Thailand one of the most crypto-friendly nations in Asia.

According to Wu Blockchain, this move is designed to stimulate the local sector and attract global investors. Today’s Thailand cryptocurrency news provides long-term optimism, even as short-term sentiment remains cautious.

While Bitcoin dropped slightly to around $105,883, spot Bitcoin ETFs recorded $412 million in net inflows on June 16. This marks the sixth straight day of institutional buying, with 24-hour volume rising 25.70% to $52.26 billion.

These inflows suggest that while the crypto market is crashing today, big players are still accumulating. So, for those asking why market is down, the answer may be more technical than fundamental.

While the U.S. delays, Canada is moving forward. On June 18, Purpose Investments will launch the first-ever Spot XRP ETF, beating the U.S. to the punch.

Known for pioneering the first Bitcoin and Ethereum Exchange traded funds, Purpose is now setting the tone with XRP. As per Coin Bureau’s post on X, this signals rising demand for regulated altcoin ETFs. According to the Coin Bureau post on X, this indicates increased demand for regulated altcoin ETFs.

So, why crypto market is down today? A mix of regulatory uncertainty, profit-taking, and industry reactions to upcoming decisions may be driving the pullback.

But underneath the red candles, we’re seeing serious developments: Solana ETF filings, stablecoin bill votes, Bitcoin ETF inflows, and global tax incentives. If history repeats, today’s fall could be tomorrow’s entry point.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.