The crypto market faced a significant liquidation event, with CoinGlass data showing that over 158,249 traders were liquidated, amounting to $883.39 million. Of these, long positions contributed over $130 million, while short traders accounted for the rest. Bitcoin’s open interest dropped by 4.8%, falling from $61.20 billion to $61.18 billion.

The sell-off came during a period of low trading volumes despite increased social media hype. Even with Tether minting $1 billion on Ethereum, market uncertainty led to sharp price declines. Bitcoin's price fell by nearly 5% in a single day, while Ethereum slipped to $3,890, showcasing heightened volatility.

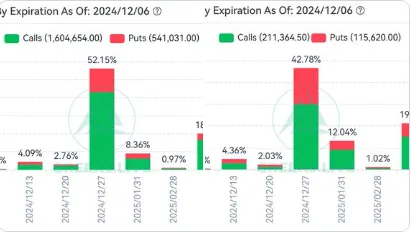

The crypto market is gearing up for a pivotal day as $3 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are set to expire. Historically, such expirations lead to sudden price swings, and traders are already bracing for potential turbulence.

Bitcoin’s recent price drop, from its peak of $98K, highlights the market’s sensitivity to these developments, further amplifying concerns about volatility.

In the broader financial landscape, traders are closely watching upcoming U.S. economic indicators such as Average Hourly Earnings, Non-Farm Employment Change, and the Unemployment Rate. These reports are expected to influence market sentiment and Bitcoin’s near-term price movements.

Amid significant crypto developments, Solana (SOL) has been in the spotlight due to its potential ETF launch. Key announcements, such as the introduction of a $60 million Solana startup fund and VanEck’s filing for a Solana ETF, created considerable buzz.

However, sources indicate the SEC is likely to reject ETF applications from at least two of the five issuers. Regulatory challenges under the current U.S. administration appear to stall any new crypto ETF approvals, dampening investor enthusiasm for Solana's ETF prospects.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

3 months ago

Top cryptocurrency news sites

3 months ago

Web3 news