The cryptocurrency marketplace today is flouring, raising some eyebrows among traders and investors: why is the cryptocurrency marketplace up now? Is this genuine recovery or merely a dead-cat bounce? Let us analyze the causes of the rally and find if the marketplace is actually on a path towards recovery, given that Bitcoin, Ethereum, and other altcoins have registered significant gains.

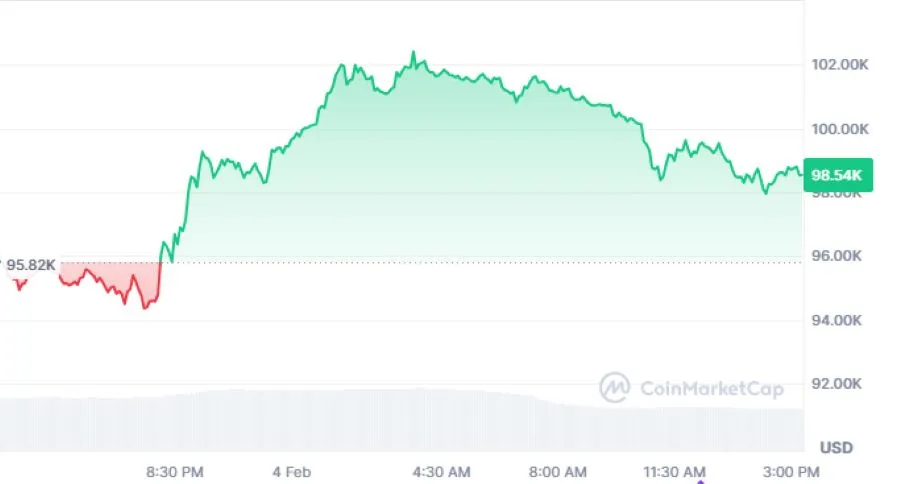

This cryptocurrency marketplace is up today, a breather for investors was a much-awaited one after weeks of excessive turbulence. Bitcoin has surged up beyond $98,549.41, while Ethereum shot back toward $2,719.26. The total digital currency marketplace cap stands an insane $3.22 trillion, reflecting a gain of 2.83% in just one day. The real question now is: has the cryptocurrency marketplace truly bounced back, or is this just a temporary tailwind?

One of the biggest reasons why the cryptocurrency marketplace is up now is the relaxation of tensions between the U.S. and China. President Donald Trump is said to have agreed to pause the implementation of 25% tariffs on Canada and Mexico for 30 days.

This has allowed new life into the global economy, allowing many investors to posit bets on risk assets, including cryptocurrency. This has caused many traders to march back into Bitcoin and its altcoins and pump up the prices.

Renowned financial educator and investor Robert Kiyosaki has recently warned of a massive economic crash while also proclaiming it to be the "best time to get rich." His belief that assets like Bitcoin, gold, and silver are "on sale" has rekindled interest in BTC, with investors examining the dip as a prime opportunity to buy.

The latest Bitcoin price at the time of writing is about $98,549.41, which marks a 2.96% increase over the 24 hours. The trading volume hovers just below $81.45B, albeit with a 19.86% decline over the last 24 hours. Bitcoin, with an increase of 2.96% today, provides evidence that indeed whales are buying up the discounted assets hoping for long-term gains.

Ethereum has also gained traction, rallying back up to 5.84% within 24 hours. One of the leading reasons behind ETH's recovery is a key upgrade to the network gas limit.

The subsequent increase denominating the gas limit has uplifted from the old 30 million to 31 million. The development process seeks to increase scalability and make the network more viable for developers and investors alike.

While few traders remained in today's bullish movement, a cautious mood engulfed the trading marketplace today. A 26.71% drop in trading volume from yesterday implies that while prices are indeed increasing, marketplace participation has gone down. The big question is, will the whole cryptocurrency marketplace launch itself back up, or are we looking at another pump before another leg down?

Indicators to Watch:

Bitcoin's resistance at $100K: "If BTC manages to break this psychological barrier, we could possibly see another sustained rally."

Trends in Ethereum gas fees: Lower fees and upgrades in networks could further add to the ETH price rise.

Macroeconomic Policies: "One sudden change in policy from a big economy could result in a deviation from market trends in crypto

The cryptocurrency market today has gone into exuberance with the jump of Fear & Greed Index into Greed (72), conveying strong positive vibrations. The index yesterday was in Fear (44), indicating an important turnaround in confidence in the markets. The previous week and last month also saw Greed (72), consolidating the bullish momentum.

The cryptocurrency market is up today, but it is uncertain whether this is a full recovery or a short-lived spike. The bulls may cheer the remarkable climb of Bitcoin, the scalability upgrades of Ethereum, and the macroeconomic relief that suggests that the good days are just around the corner; however, traders are advised to remain vigilant, as volatility continues to be a cornerstone in the whole cryptosphere.

Stay tuned for more cryptocurrency market updates!

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

3 months ago

Crypto news and analysis

3 months ago

Ethereum news

3 months ago

News on crypto lending

3 months ago

News on crypto lending

3 months ago

How to follow crypto news

3 months ago

Metaverse and crypto

3 months ago

New cryptocurrency releases

3 months ago

Ethereum news

3 months ago

Latest cryptocurrency news

3 months ago

Bitcoin market trends