The White House Digital Asset Report released today and it has also delivered the biggest regulatory shift in crypto history: BTC will now be officially held in the U.S. Treasury’s balance sheet. Yet in a twist few saw coming, its price is dropping—currently down from its daily highs, hovering near $116,000.

Why is Bitcoin Falling Today, after receiving the treasury shift? Here’s the full breakdown.

In a dramatic twist from earlier speculation, the final White House Digital Assets Report confirms that the world's largest cryptocurrency will be included in the United States’ sovereign strategy starting immediately.

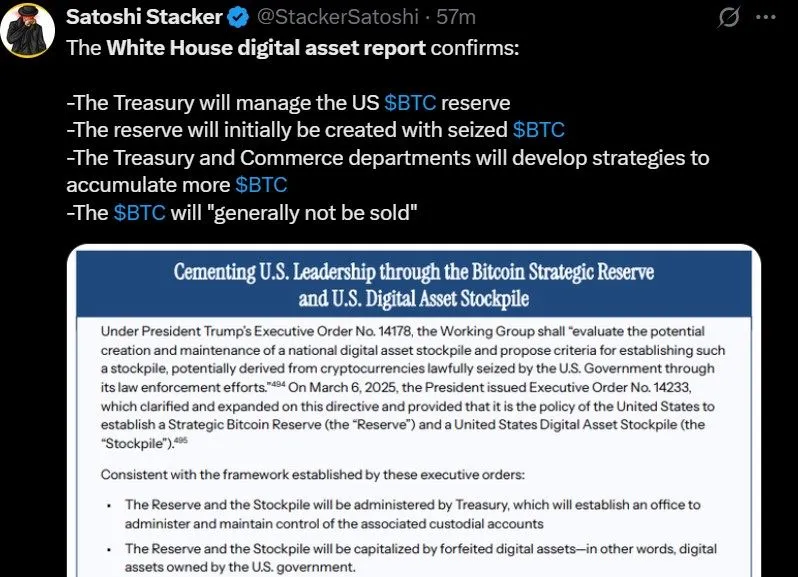

Crypto analyst Satoshi Stacker first broke the summary:

The White House U.S. Treasury will manage the official Bitcoin reserve

The initial reserve will use seized coin, with plans to accumulate more

The BTC held will "generally not be sold"

The Federal Reserve is banned from launching a CBDC (digital dollar)

Banks must serve crypto clients without regulatory discrimination

This shift confirms the token’s bull hope for the next major breakout soon.

In the latest Bitcoin news today, it dropped from intra-day highs. The short answer: "Buy the rumor, sell the news." But here are deeper reasons behind the pullback:

Whale Profit-Taking After Weeks of Rally: Smart money may have been priced in this policy shift news long ago. As soon as it went public, whales exited with profit, triggering short term pullback.

Retail FOMO Arrived Too Late: Retail rushed in after the policy news, while whales used the opportunity to offload—a classic distribution top.

MACD and RSI Levels: MACD is showing Bearish crossover in progress, while RSI is neutral at 59.44, but fading from earlier highs, as seen in the TradingView chart.

All of these reasons are behind the rumoured question, why btc is crashing today amid a positive US BTC reserve policy news. However, as per my experience being a crypto analyst, this pullback won’t last as seen with this cryptocurrency's earlier price charts.

Short-Term: $115K–$112K (Sell-the-news dip and consolidation)

Mid-Term: $121K–$130K (Recovery as Treasury reserve impact grows, and investor confidence stands back in line)

Long-Term: $180K–$220K (Final bullish rally before possible major correction)

Pro Traders Still Cautious: “Exit Zone” Warning Remains

Despite the bullish policy development, Merlijn The Trader maintains his warning:

“This is the final rally phase. BTC will spike, but the correction will be brutal.”

In a rational market, the coin should be pumping. But crypto is rarely rational. This cryptocurrency just became part of U.S. financial infrastructure, yet price is dipping, and everyone is asking Why is Bitcoin falling today?

Well, now it's clear, it's not because the White House crypto policy is bad, but because big players profit from volatility.But remember, in the long run $BTC’s legitimacy will just hit an all-time high.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.