The global cryptocurrency market has witnessed an impressive performance, with the total market cap reaching $3 trillion, marking a 5.97% increase over the last day. Trading volumes have skyrocketed to $200.18 billion, reflecting a 187.71% surge. Bitcoin dominance has also increased to 60.33%, reinforcing its position as the market leader.

One of the biggest drivers behind why crypto is up today is Trump’s Strategic Crypto Reserve announcement. Former President Donald Trump has proposed the creation of a U.S. Crypto Reserve, which will include leading digital assets such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP (Ripple), and Cardano (ADA). This move signals potential regulatory clarity, boosting investor confidence.

During the Bitcoin 2024 conference in Nashville, Trump had hinted at a Bitcoin reserve, but an executive order issued on January 23 has expanded this vision to include a broader range of cryptocurrencies. This shift in approach has fueled speculation about future regulatory advancements, contributing to the crypto on the rise today.

Another key reason why the crypto market is going up today is the upcoming White House Crypto Summit on March 7. Hosted by Trump, this event will bring together crypto leaders, institutional investors, and government officials to discuss regulatory policies, blockchain innovation, and institutional adoption. Representatives from Coinbase, Binance.US, and Andreessen Horowitz are expected to attend.

If the summit results in clearer regulations, it could reduce market uncertainty, leading to further price surges. This anticipation has played a major role in why altcoins are going up alongside Bitcoin.

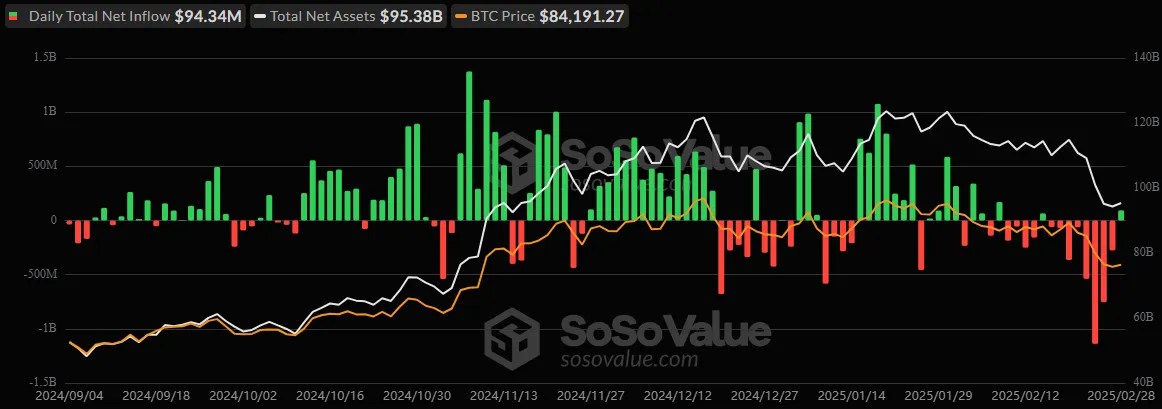

A surge in Spot Bitcoin ETF inflows has significantly contributed to why crypto went up today. As of February 28, daily total net inflows reached $94.34 million, with cumulative total inflows standing at $36.94 billion.

Source: SoSoValue

The total value traded hit $3.91 billion, while total net assets under management now amount to $95.38 billion (5.71% of Bitcoin’s market cap). These figures indicate strong institutional demand, driving the current market rally.

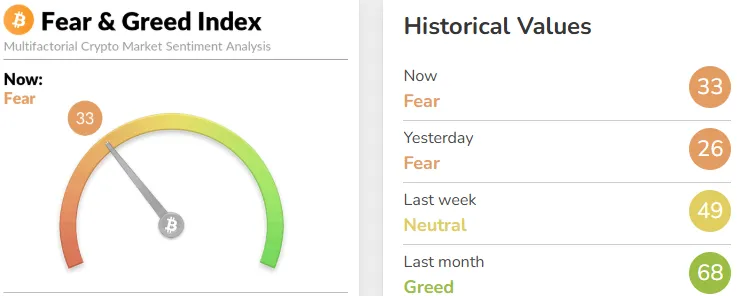

The Fear and Greed Index currently stands at 33 (Fear), compared to 26 (Fear) yesterday. Last week, the index was at 49 (Neutral), while last month, it showed 68 (Greed). This shift suggests that investors are still cautious but are gaining confidence in the market’s potential.

Historically, extreme fear presents buying opportunities, while excessive greed signals potential corrections. The current gradual shift from fear to neutrality indicates rising investor interest, reinforcing the bullish sentiment.

Bitcoin price is trading at $91,427.84, up 6.62% intraday, with a market cap of $1.81 trillion and $69.81 billion in 24-hour trading volume. Ethereum is priced at $2,348.57, increasing 6.01%, with a $283.22 billion market cap. Moreover, SOL price saw an impressive jump, trading at $159.16, up 11.52%, with an $80.8 billion market cap.

ADA price recorded a massive 42.76% surge, trading at $0.9441, with a $33.34 billion market cap, reinforcing the bullish sentiment in ADA price and market momentum for ADA crypto. Additionally, XRP is trading at $2.58, gaining 14.16%, driven by speculation around an XRP Crypto Reserve and upcoming ETF approvals.

The bullish rally may continue if institutional demand, regulatory advancements, and positive news around strategic crypto reserves persist. According to Crypto Rover, Oklahoma’s proposal to buy $1.5 billion in Bitcoin and Russia’s evaluation of a Bitcoin reserve could further fuel demand. If the ETF approvals for XRP, Dogecoin, and Litecoin materialize, the market could see an extended altcoin bull run.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.

3 months ago

Cryptocurrency scams and hacks

3 months ago

Cryptocurrency market updates

3 months ago

Blockchain integration in business

3 months ago

News on crypto regulations

3 months ago

How to follow crypto news

3 months ago

Crypto news and analysis

3 months ago

Bitcoin news updates

3 months ago

Crypto news today

3 months ago

Crypto market trends

3 months ago

News on crypto exchanges