The global cryptocurrency market has seen a significant surge, with the total market cap reaching $3.01 trillion, marking a 5.15% increase in just one day. Despite this, the total market volume has decreased by 16.76%, standing at $121.58 billion in the last 24 hours. Bitcoin's dominance has also increased slightly to 60.70%, indicating strong investor interest.

Several factors have contributed to the crypto market rally. Here are the key reasons why the crypto market is going up today:

A major development driving the current crypto boom is former U.S. President Donald Trump's crypto reserve announcement. Trump declared that the U.S. government would establish a strategic reserve of digital assets, including Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA). This statement caused an immediate surge in the market value of these cryptocurrencies.

Trump emphasized that Bitcoin and Ethereum would be at the core of the reserve, boosting investor confidence.

The announcement aligns with increasing institutional interest and regulatory discussions on digital assets.

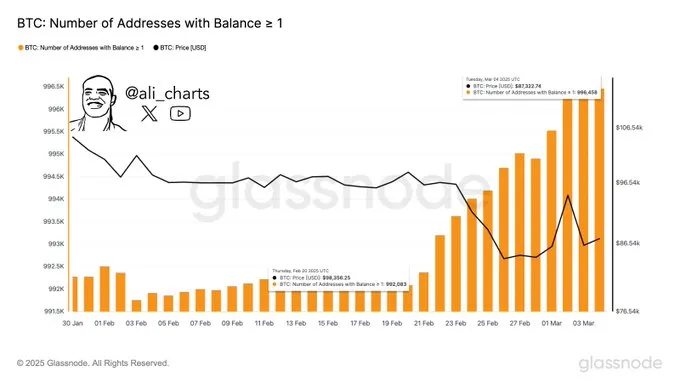

On-chain data shows a steady rise in Bitcoin accumulation, supporting the crypto market’s upward trend:

Source: X

4,375 new wallets have been added in two weeks, each holding at least 1 BTC.

The total number of these wallets grew from 992,083 on February 15, 2025, to 996,458 on March 2, 2025.

Bitcoin prices have fluctuated between $58.5K and $106.5K, showing increasing demand and accumulation.

Another factor influencing why all altcoins are going up is Trump’s decision on U.S. trade tariffs. He announced a temporary exemption for Canada and Mexico from a 25% import tax on carmakers, bringing relief to global markets.

This decision helped stabilize the stock market, indirectly boosting confidence in digital assets.

Investors often turn to cryptocurrencies during economic uncertainty, pushing Bitcoin and crypto on the rise.

The fear and greed index crypto provides insight into market sentiment:

Although the index remains in the fear zone, it has improved from 10 to 25 in a week, indicating growing investor confidence. Extreme fear often suggests a buying opportunity, while high greed signals a potential market correction.

The recent surge in Bitcoin and altcoins has sparked discussions on whether the crypto market will crash again. While volatility remains a key factor, current trends suggest a positive outlook. Bitcoin (BTC) is trading at $91,281.04, up 1.52%, while Ethereum (ETH) has risen 2.35% to $2,289.00. Meanwhile, XRP has seen a notable increase of 4.69%, reaching $2.62.

With a White House Crypto Summit on the horizon, further announcements on regulatory policies and institutional investments will significantly impact market movements. The ETF approvals and increasing adoption of Trump’s crypto reserve strategy will likely keep the market bullish in the short term.

The crypto market is on the rise, fueled by Trump’s strategic reserve announcement, trade policies, and Bitcoin accumulation trends. While uncertainties remain, the shift in investor sentiment and growing institutional interest suggest that the market may continue its bullish momentum. However, investors should remain cautious and monitor upcoming regulatory decisions to gauge what is going on with crypto today and in the near future.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.

3 months ago

I want to express my gratitude to Barry White for his incredible assistance in helping me recover my lost funds. His professionalism, persistence, and expertise made what felt like an impossible situation manageable. Barry kept me informed throughout the entire process and was always available to address my concerns. Thanks to him efforts, I was able to regain what I thought was lost forever. Highly recommend his services! Email : barrywhite4390 @-gmail.com