The global cryptocurrency market is on the rise today. As of now, the total market cap stands at $3.33 trillion, marking a 1.68% increase in the last 24 hours, according to CoinGecko. The total trading volume is at $129 billion. Bitcoin continues to lead with a dominance of 59.7%, while Ethereum holds 9.15% of the industry.

Major cryptocurrencies are also performing well. Bitcoin is trading around $103,804.46, gaining over 2% intraday, with a strong market cap of $2.06 trillion and $51.24 billion in trading volume. Ethereum jumped 3.35% to $2,623, and Solana rose 2.02% to hit $172. Cardano is also seeing positive movement.

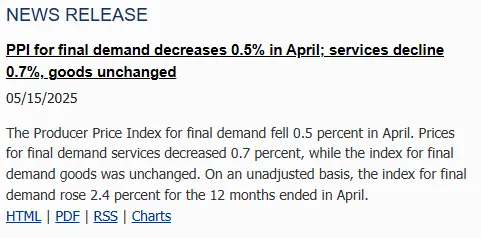

US CPI and PPI Data Look Positive: One of the main reasons for today’s crypto price rise is the newly released US economic data. On May 15, the Producer Price Index (PPI) showed a 0.5% drop in April, mainly because prices for services went down by 0.7%, while goods prices remained unchanged. Over the past 12 months, PPI rose 2.4%.

Source: US Bureau of Labor Statistics

The Consumer Price Index (CPI), which tracks prices that consumers pay, went up by 0.2% in April, after dropping 0.1% in March. Year-over-year, the CPI increased 2.3%, which is slightly lower than many had expected. These numbers suggest that inflation is under control, which brings hope that interest rates might stay low or even drop in the future.

US Federal Reserve Holds Interest Rates: This idea was supported by the Federal Reserve’s recent decision during the May 6–7 FOMC meeting, where they kept interest rates steady at 4.25%–4.50%. It’s the third time in a row they made no changes, which is being seen as a positive sign for the crypto sector.

Spot Bitcoin ETFs Attract Big Inflows: Another reason for the price rise is the performance of Spot Bitcoin ETFs. These ETFs are showing strong investor interest, with daily net inflows of $114.96 million as of May 15.

Source: SoSoValue

The net assets in Spot ETFs add up to $121.47 billion, which is 5.91% of the entire market cap of Bitcoin. The entire cumulative inflow is $41.51 billion. This is an indication of increasing confidence by large investors.

Lastly, the Fear and Greed Index, which is a sentiment gauge for the industry, is within the "Greed" category at 71. It stood at 70 yesterday and 73 a week ago, indicating that the investors are optimistic. Just a month ago, it was in the "Fear" zone at 29, but sentiment has improved a lot.

Even though the crypto industry is up right now, there are still some risks that could push prices down.

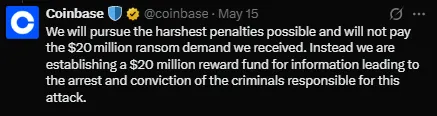

One major concern is the Coinbase hack. On May 16, Coinbase, one of the biggest crypto exchanges in the world, was hacked. According to their official tweet, less than 1% of users were affected, and no funds or passwords were stolen. However, the hackers demanded a $20 million ransom, which the company refused to pay. Instead, Coinbase announced a $20 million reward fund to find and punish the attackers.

Source: X

This concerns the investors, and if something goes wrong and becomes worse or additional attacks are launched, this can cause a new crypto market crash. Panic is so easy to revive again, given that everybody still remembers previous hacks and scandals on the crypto sector.

Cryptocurrency is rallying today on a combination of good economic news, sound Federal Reserve policy, strong ETF action, and upbeat investor sentiment. But the recent hack of Coinbase reminds us that the industry remains vulnerable.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.