The world crypto market is performing perfectly today with total market cap surging to $3.36 trillion, rising 0.91% within 24 hours. The volume traded over 24 hours amounted to $143.49 billion, pointing to increasing investors' demand. Top coins such as Bitcoin and Ethereum are showing excellent performance with Bitcoin standing at $104,542.64 and Ethereum standing at $2,565.37.

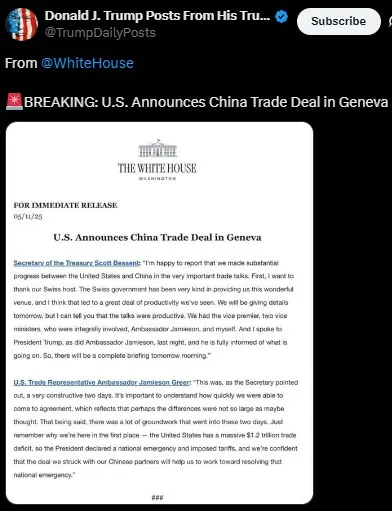

US-China Trade Deal in Geneva: A new trade deal was inked in negotiations between Chinese and U.S. officials in Geneva. U.S. Trade Representative Jamieson Greer and U.S. Treasury Secretary Scott Bessent signed on the U.S. side in negotiations.

Source: X

The deal plans to reduce tariffs and fix trade imbalances. Formerly, steep tariffs up to 145% on Chinese goods were in place. Now, with President Trump’s approval, the agreement is expected to lower those rates and improve relations.

This news gave a big push to Bitcoin, which jumped above $104,000, and the broader market followed.

Federal Reserve Keeps Rates Steady: During its May 6–7 meeting, the Fed decided not to raise interest rates, keeping them at 4.25%–4.50%. Although inflation is still high, the Fed wants to wait for better signs before making changes. Meanwhile, the U.S. added 177,000 new jobs in April, showing the labor sector is still strong. The decision gave a positive signal to the crypto world, as investors felt safer putting their money in digital coins.

Spot ETF Inflows Continue: Both Bitcoin and Ethereum ETFs saw positive net inflows on May 9, with $17.61 million flowing into each.

Source: SoSoValue

Total Bitcoin ETF inflow till date: $2.47 billion

Total traded: $620.39 million

Total ETF assets: $8.02 billion, equal to 2.84% of Ethereum’s market cap

These inflows show that traditional investors are becoming more confident in the crypto industry.

Current investor sentiment, according to Crypto Fear and Greed Index, is "Greed" with a reading of 70, a big jump from last month's Fear reading of 43.

That is what makes folks more inclined to buy, but excessive greed will also indicate a correction is warranted. If too many individuals are running to buy, prices fall in an instant if something breaks.

The current rally in the crypto market is founded on fundamentals — a U.S.-China trade breakthrough to the good, the Federal Reserve rate stand, and robust ETF inflows. These positives have saturated the marketplace with confidence again.

Bitcoin and Ethereum are still in control, but experts recommend that while sentiment is currently positive, staying updated and being cautious is always the best choice.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.