Crypto trading platform hacked, leading to a $14M loss from user accounts. On Thursday, the platform detected unauthorized activity and suspended withdrawals. The company claims that no internal or corporate wallets were affected by the breach, only nine user-controlled accounts.

Source: @_woo_x

Multiple suspicious transactions of $BTC, $ETH, $BNB, $ARB networks including firm’s tokens have been identified by platform, with an estimated loss of over $12 million. Its hot wallet sent $1M $USDT to a suspicious address on $ETH along with extra $ETH. The entire $1 million in $USDT was converted to $ETH, and subsequently, $7.3 million was sent to a new address. Five $BTCB were received from the platform on $BNB Chain, converted to $BNB, and sent to a new address. This movement generated early red lights among monitoring companies.

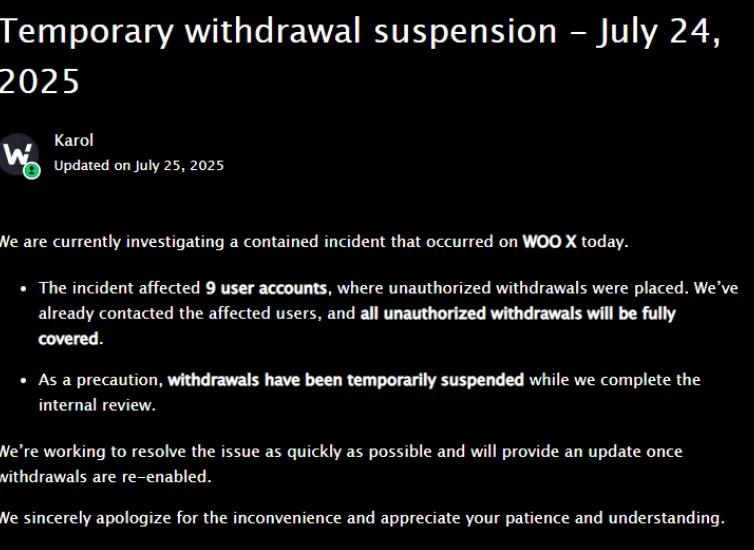

Source: Website

"We're currently investigating a contained incident that occurred earlier today," the team said in acknowledgment of the incident. Withdrawals have been temporarily suspended while the inquiry is continuing, but user funds and trading are unaffected.

The issue is isolated, according to the platform, but the exact cause is yet unknown. The investigation is receiving assistance from outside blockchain security organizations. Both off-chain and on-chain security protocols are being examined by exchange. The company promises full reimbursement to all affected users.

This is the latest in a series of crypto exchange breaches in July, and has sparked a growing demand for stronger onchain privacy and verification. In the past two weeks, Arcadia Finance experienced a $3.5 million breach on June 15, BigONE was hacked for $27 million on July 16, and Indian exchange CoinDCX lost $44 million on July 19. Two days after CoinDCX launched a white hat bounty program for fund recovery.

Source: CoinMarketCap

The company had a 65% surge in trading volume in the last 24 hours. This rise demonstrates that exchange utilization remains strong in the face of uncertainty. However, the price dropped 6.35% in 24 hours due to the Woo X hack of $14M loss and subsequent exchange bans.

The incident serves as yet another reminder of the constantly changing cyberthreats in the cryptocurrency industry. Although the public loss has been reported and companies call for a deep scrutiny, it still questions the necessity. In previous cases, enhanced infrastructures, fund segregation, and the risk of faults in third-party suppliers have been common trends.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.