During the high-profile visit to the Federal Reserve Building, US President reignited the monetary policy debate by asking Fed Chair Jerome Powell to Cut Rates. The tour, which also included Senator Tim Scott, is taking place during renovations to the famous building that Trump said, "would have been better if it were never started," referring to the massive cost overruns.

Trump said it as he saw it about the costs of the Fed renovation. Still, he went on to say that it really needed to be done but that the project had been mishandled and that costs kept getting larger and larger. He pointed out that the overspending notwithstanding, the U.S. economy is doing fine enough to “afford just about anything—even the cost of this building.”

Standing true to his style of doing things, he compared the renovation to his own real estate deals: “I renovated the Old Post Office on Pennsylvania Avenue, and it was a roaring success.... The costs were a fraction of what the Fed's budget was and a smaller building.”

Beyond infrastructure complaints, Trump used this moment to champion his usual cause of monetary easing. His message was nothing if not direct. "Let's just get it finished and, even more importantly, LOWER INTEREST RATES!” He call was yet another public push for Jerome Powell to Cut Rates, aligning with his long-standing criticism of the Fed’s cautious monetary policy.

While He said that there currently is no plan to fire Powell — a stop that he admits would jeopardize the Federal Reserve's independence — he believes that Fed Chair has been “too late” in cutting points. Trump added that “everyone knows what the right thing is,” suggesting rate reductions are even approved by those who favored tighter policy before. Analysts also note that the sustained push by Trump for Jerome Powell to Cut Rates could influence the political narrative heading into 2025.

In private discussions, His advisors have reportedly echoed similar sentiments, repeatedly bringing up the need for Jerome Powell to Cut Rates as a tool to energize the economy ahead of the next election cycle.

Even conservative economists who once supported tighter monetary policies are now coming around to the idea that it’s time for Jerome Powell to Cut Rates to sustain the U.S. growth story.

Source:X

Despite the billions of words of rhetoric on the matter, Trump reassured that he was not messing with the Fed's independence. His saying he was confident Powell will “do the right thing” reinforces that there was pressure but it was not coercion. That said, many in the financial sector believe Trump's consistent statements urging Jerome Powell to Cut Rates are starting to weigh on investor sentiment and Fed communication strategy.

The Trump comments come as Federal Reserve President Mary Daly noted that the tariffs he imposed had less impact on inflation than expected. Daly also implied that two rate cuts this year could be about the right call, in line with Trump’s urging. If momentum builds in the markets for further easing, the case for Jerome Powell to Cut Rates could become even stronger heading into Q4 2025.

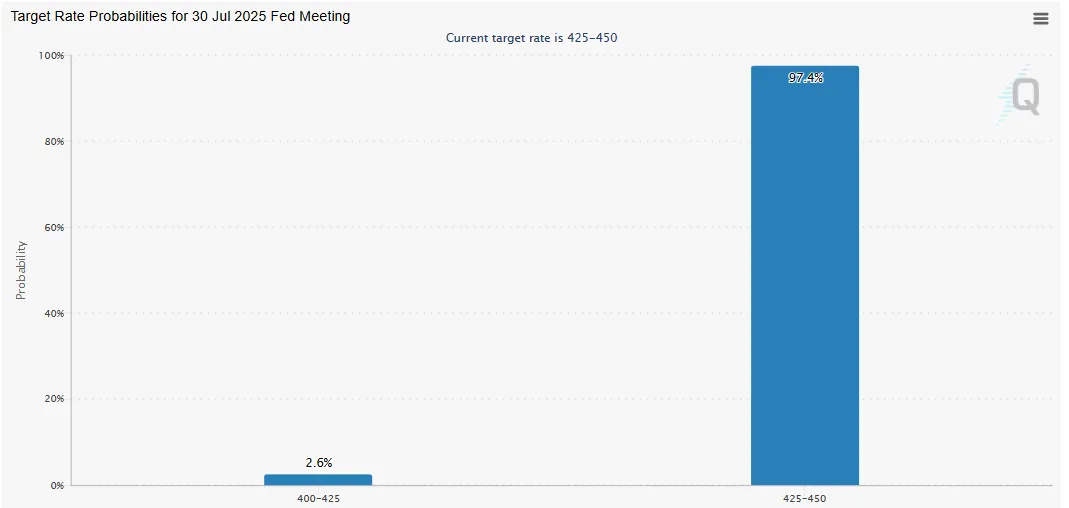

With the July FOMC meeting just around the corner, the Federal Reserve must just hold steady. The CME FedWatch Tool puts the odds at 97.4% that the interest rate will stay at the 4.25%-4.5% band throughout this month.

On the other side, the markets are pricing potential cuts coming in the second half of 2025, once the inflation eases and economic signals on a pathway to Trump's optimistic beacon.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.