Could the Work Dogs token listing date arrive sooner than expected as partnership signals grow stronger? A February 8 update has pushed the project into the spotlight after the team revealed collaborations with major global platforms. The announcement suggests a shift from a simple project toward a full ecosystem built on traffic, integration, and worldwide reach.

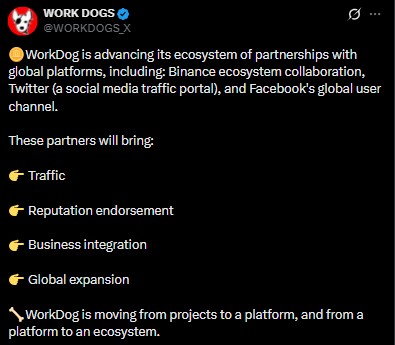

According to the official X update, the platform is advancing partnerships that include a Binance ecosystem collaboration, Twitter as a social traffic portal, and Facebook’s global user channel. These relationships are expected to drive traffic, strengthen reputation, support business integration, and accelerate global expansion.

Source: Official X

With more than 16 million users across Telegram and external platforms, the network is positioning itself as a ready-made ecosystem rather than a cold-start initiative. Analysts believe such scale could directly influence transaction demand, ecosystem activity, and long-term commercial revenue tied to token use cases.

The latest developments have intensified speculation around a potential Work Dogs Binance listing. While no exchange confirmation has been issued, ecosystem-level collaboration often signals preparation for broader market exposure.

The team stated it is evolving “from projects to a platform, and from a platform to an ecosystem.” This transition indicates strategic groundwork ahead of a public trading phase. Based on current announcements, the Work Dogs token listing date is widely expected between Q2 and Q3 of 2026.

Market observers note that large user bases typically help new assets gain early liquidity. If adoption converts into on-chain activity, the listing could attract immediate attention from traders seeking emerging ecosystem-driven assets.

Another major trigger behind listing conversations is the planned move into the Solana and Ethereum ecosystems. This upgrade will transform the asset into a cross-chain application layer rather than a single-network platform token.

Key expected outcomes include:

Higher-performance on-chain transactions

Wider user accessibility

Integration with DeFi and NFT environments

Faster expansion of ecosystem applications

Such infrastructure upgrades often improve developer participation and liquidity depth—two factors closely tracked before exchange debuts.

Presale data shows the project has already raised up to $16, while the team has announced an approximate listing price near $25. The fixed supply of 1 billion tokens is designed to support long-term system stability.

However, analysts caution that $25 represents a significant milestone. CoinGabbar analysts estimate that exchange exposure could push prices toward $20 in the short term, with $25 viewed as a longer-term target if ecosystem growth continues.

Expert Insight: Strong user metrics combined with cross-chain readiness typically indicate strategic timing before market entry. If partnerships convert into measurable activity, the asset may enter trading with structural demand rather than speculative hype—often a healthier setup for price discovery.

The Work Dogs token listing date remains unofficial, yet partnership signals, cross-chain expansion, and a large user base suggest clear forward momentum. If execution matches announcements, the expected Q2–Q3 2026 window could mark a notable entry. Investors should watch adoption metrics closely, as real usage will likely determine early valuation strength.

YMYL Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency markets are volatile and involve risk. Readers should conduct independent research and consult a qualified financial advisor before making investment decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.