In a big move for the crypto industry, the first XRP futures ETF on Nasdaq launched by Volatility Shares. This new fund, called $XRPI, lets people invest in XRP without needing to buy or hold the actual crypto. It officially launched on May 22, can be found on the SEC announcement, and it’s designed for regular investors who want to access the currency using their normal stock trading accounts.

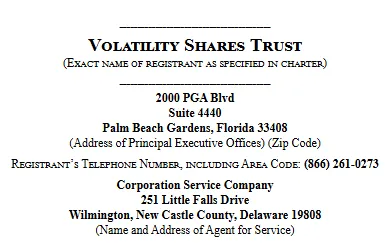

Source: U.S. Securities and Exchange Commission

Instead of holding actual digital currency, XRPI tracks the price of the coin using future contracts. This suggests that investors do not need to deal with complexities of digital wallets, cryptocurrency exchanges, and private keys. It’s made for people who are curious about cryptocurrency but don’t want the hassle of managing digital assets.

Volatility Shares is a U.S. company known for launching unique ETFs, especially ones focused on crypto and futures. This new fund is part of their Volatility Shares Trust, and at least 80% of the fund’s money will go into futures related to the Ripple's coin traded on the Chicago Mercantile Exchange (CME). These contracts are handled through a separate company based in the Cayman Islands.

Along with XRP futures, they also launched another ETF called $XRPT, which is a 2x leveraged fund. This one tries to double the daily returns of XRP futures. It’s riskier and is meant for experienced traders who want to go big.

With this launch of XRP futures, stock market users will find it easier to invest in the coin. It overcomes many of the concerns people have, for example not having to worry about their wallets or about the safety of their funds.

Eric Balchunas, a well-known ETF analyst at Bloomberg, termed this a “first for the market” for offering exposure to the token. The token is currently trading at $2.41 with an increase of 0.80% as per the CoinMarketCap. The new ETF is following in the footsteps of the ETF from Teucrium which launched in April. With over $120 million in assets and around $35 million in trade each day, demand for this fund is clearly high.

Source: Eric Balchunas

More big investors want safe, regulated ways to invest in digital currency. This is the reason why the CME Group started offering XRP futures on May 19. Providing different sizes of contract to align with different classes of investors. These moves depict that crypto is steadily becoming part of the conventional financial industry.

Other reasons are there that, this event is bringing optimistic sentiment from the industry. Ripple, organisation behind the currency, has been offered a settlement by the SEC. Even though the structure is still in progress, this update has made it simpler for Volatility Shares to introduce its products. Such a move also signals that XRP spot ETF might also get the approval sooner, says Nate Geraci, ETF store president.

The release of these ETFs could encourage regular investors and make crypto appear more trustworthy. Anyone can buy the currency with a basic brokerage account these days, so we could see even more money enter the market.

What’s even more exciting is that, if these funds succeed, there could be similar products for other cryptocurrencies. As a result, the crypto market would experience growth, trading activity would increase and investor rules would improve. Basically, crypto could become easier for regular people to adopt after this change.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.