XRP has taken a major step into decentralized finance as XRP spot trading on Hyperliquid officially went live on January 7, 2026. For the first time, traders can buy and sell the coin exposure on Hyperliquid’s on chain orderbook, not just trade price bets.

Source: FlareNetworks Official

The launch was announced by Flare Networks, which enabled the first FXRP/USDC spot trading pair on the exchange. Until now, the decentralized exchange only supported XRP-perpetual futures, which allow traders to speculate on price without owning the asset.

This new listing changes that. Traders can now access actual XRPs exposure using FXRP, a 1:1 representation of XRPs. Hyperliquid runs on its own high-performance Layer-1 blockchain and has recorded over $185 million in trading volume in the past 24 hours, making it one of the most active onchain trading platforms.

FXRP is created using Flare’s FAssets system, which allows non-smart-contract assets to be used in DeFi. Real XRP is locked on its Ledger (XRPL), and FXRP is issued on FlareNetwork at a 1:1 ratio.

To move FXRP to Hyperliquid, Flare uses LayerZero’s omnichain token standard. This lets F-XRP move across blockchains without centralized custody. Traders can follow this flow:

Lock XRPs on ledger and receive FXRPs on Flare

Transfer FXRPs to Hyperliquid

Trade FXRP/USDC on the exchange’s onchain orderbook

Later move FXRPs back to Flare or convert it back to XRPs

A one-click bridge back to native XRPs is expected soon.

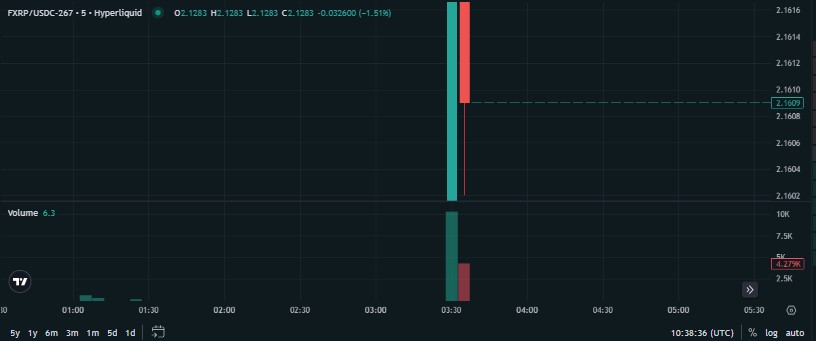

At the time of launch, the FXRP-USDC spot pair showed the following data:

Price: $2.1013

24-hour Change: -3.85%

24-hour Volume: $33,347.75 USDC

Market Cap: $38.77 trillion USDC (FXRP-representation)

Source:Hyperliquidxyz Trade

The platform has recorded over $185 million in trading volume in the past 24 hours across markets.

For this, market liquidity and pricing may vary as adoption of F-XRP spot trading develops.

According to Flare co-founder Hugo Philion, the goal is to expand XRP’s use across DeFi while keeping XRPL as the final settlement layer. Hyperliquid’s orderbook model offers tighter spreads and better execution than typical DeFi pools, which matters for larger investors.

This launch allows XRP-holders to hedge futures positions, access deeper liquidity, and use XRPs in lending, staking, and other DeFi tools, without giving up ownership.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.