The Zama listing date has officially arrived, marking one of the most closely watched token launches of 2026. After weeks of auction activity and strong institutional interest, the asset will enter live trading today, February 2, at 12:00 UTC, with simultaneous listings across major global exchanges.

According to the official update, users who claim Prime Sale Keys can check balances and start trading immediately on Binance Alpha once the token goes live. The launch also aligns with the opening of the Zama protocol airdrop claim window today.

The Zama listing date is February 2, 2026, with trading opening in tightly coordinated phases across exchanges.

Source: Binance Wallet X

Binance will list $ZAMA token with a Seed Tag applied. Spot trading opens at 13:00 UTC. Deposits open one hour earlier, while withdrawals go live on February 3 at 13:00 UTC. The listing fee is confirmed at 0 BNB.

Beyond Binance, multiple exchanges are launching the token today:

Kraken and KuCoin: Trading starts at 13:00 UTC

OKX, Bybit, and Bitget: Trading begins at 13:00 UTC

Blynex, XT Exchange, LBank, Gate.io, BitMart, and MEXC are also listing the token, adding further liquidity and reach.

In addition, it launched on Solana today, with Humidifi supporting the asset from day one of TGE with deep liquidity provisioning.

The project’s Public Auction, held from January 21–24, 2026, closed with strong participation. Total Value Shielded (TVS) has crossed $121 million, highlighting early protocol adoption.

Key auction data that strengthens today’s launch are:

$118.5M total value committed (including $2.2M from KuCoin sale and $4.2M from CoinList sale)

Clearing price: $0.05

Tokens demanded: 2.8B

Tokens sold: 880M

Oversubscription: 218%

The Public Sale accounts for 12% of the initial supply, split into Community Sale (2%), Public Auction (8%), and Pre-TGE Sale (2%). The Pre-TGE sale opens today, allowing unsuccessful bidders to purchase the asset at the clearing price, capped at $10,000.

The fixed total supply is 11 billion tokens, with 20% circulating at TGE. The remaining supply unlocks gradually via vesting.

Source: Official Litepaper

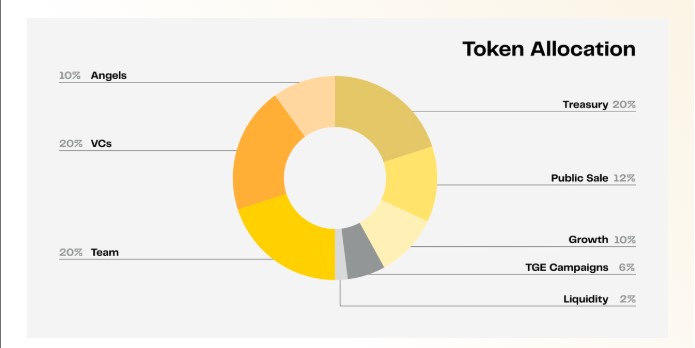

Allocation includes Treasury (20%), Team (20%), VCs (20%), Growth (10%), Angels (10%), TGE Campaigns (6%), Public Sale (12%), and Liquidity (2%). An additional 55 million coins is reserved for future marketing campaigns after the Zama listing date.

Based on auction data, exchange coverage, and current market conditions, the launch price is expected to open within a $0.045 to $0.065 range, with a base trading level near $0.055.

As per Coingabbar’s market analysts, this estimate closely aligns with the public auction clearing price of $0.05, while the 218% oversubscription signals strong demand going into launch.

In the first 7 to 30 days, the price prediction may experience volatility due to airdrop claims, refund capital rotation, and early profit-taking. A realistic trading range during this phase is $0.035 to $0.075.

From a longer-term perspective, its price outlook for 2026 remains constructive. Conservative estimates place the token between $0.25 and $0.40, driven by gradual vesting, protocol fee usage, and expanding TVS, which has already crossed $121 million. Extreme upside scenarios depend on broader Web3 privacy narratives and sustained real-world usage.

The Binance Zama listing stands out for its transparency, broad exchange support, and clear utility-driven design. Initial price volatility is expected due to overall crypto market breakdown, but the fundamentals place the project among the more structured protocol launches of early 2026.

YMYL Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets carry risk. Readers should do their own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.