The crypto market is watching closely as the Zama Protocol airdrop listing date and the $ZAMA Pre TGE sale officially go live on the Binance Web3 Wallet today.

The Binance Wallet X post confirmed that the Prime Sale campaign starts on January 29, 2026, from 08:00 to 10:00 UTC. This event connects the asset’s sealed-bid ICO, and its upcoming token generation event, making it a key milestone for privacy-focused blockchain infrastructure.

Key Details To Watch:

The token is issued on BNB Smart Chain (BSC), with a total supply of 11,000,000,000 tokens and an initial circulating supply of 2,200,000,000.

The sale price is fixed at $0.05 per coin, paid in BNB. Exchange has capped participation at 3 BNB per wallet, and allocation is done on a pro-rata basis.

The airdrop is structured through Binance $ZAMA Pre TGE Prime Sale Campaign. Users subscribe using BNB inside the wallet, following an oversubscription model.

After the subscription period ends, participants receive a Key on BSC that represents their token allocation. Alpha and DEX trading will open at 12:00 UTC. Any unused BNB is refunded automatically. Actual coins will be airdropped directly to users’ Alpha accounts on the Zama listing date February 2, 2026.

Key figures:

Total raise: $11 million

Tokens offered: 220,000,000 coins (2% of total supply)

Price: $0.05 per token

Accepted asset: BNB

Allocation: Proportional to total BNB deposited

Eligibility: Requires Binance Alpha Points

This structure makes the airdrop claim one of the most transparent campaigns seen recently.

Zama Protocol is a cross-chain confidentiality layer that enables private smart contracts on any L1 or L2 using Fully Homomorphic Encryption (FHE).

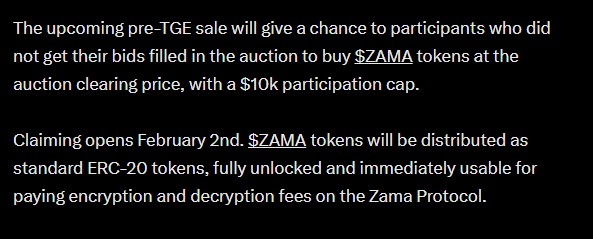

On December 30, the project launched its mainnet on Ethereum and completed the first confidential stablecoin transfer using cUSDT. The ICO used a confidential sealed-bid Dutch auction between January 21 and January 24, 2026. Claiming for unsatisfied auction participants opens on February 2 which is also expected to be the listing date, with a $10,000 participation cap.

Results:

Total Value Shielded (TVS): $121.3 million

Total committed value: $118.5 million

Tokens demanded: 2,805,849,657

Tokens sold: 880,000,000

Clearing price: $0.05

This means demand exceeded supply by more than three times, showing strong institutional and retail interest.

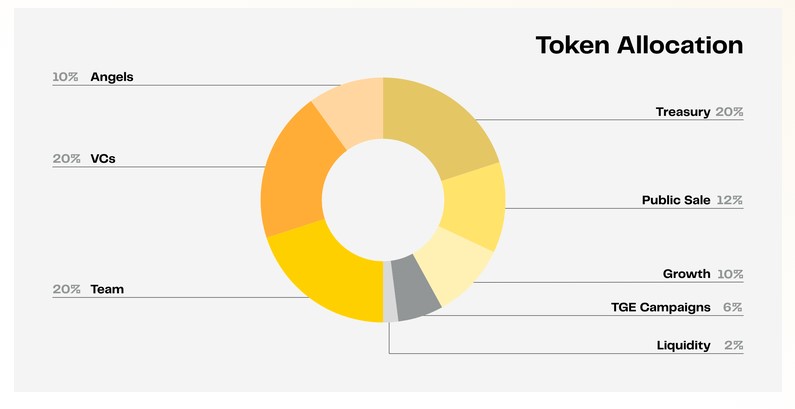

The public sale structure accounts for 12% of the initial supply:

Community Sale: 2%

Public Auction: 8%

Pre-TGE: 2%

Staking rewards are minted through an inflation model that starts at 5% and can be changed by governance.

The asset began premarket trading on January 9 at $0.1585. At present, it trades near $0.04201, reflecting an 11% decline in the last 24 hours according to CoinMarketCap premarket data. This price movement keeps bullish attention on the possible listing price.

Binance and MEXC Zama airdrop listing are one of the confirmed listing exchanges. The tokens are fully unlocked at distribution. Based on Prime Sale history, Coingabbar’s expert analysis says Binance launches often open with 2x or more initial movement. If market sentiment remains stable and FDV approaches $1B, a listing range near $0.08 is considered realistic, with volatility possible on both sides.

The $ZAMA Pre TGE and claim date combine strong technology, high ICO demand, and BNB access into a single market event. With a fixed $0.05 price, bonus allocations, and February 2 distribution, the project stands at a critical point between infrastructure value and open market pricing. Traders should watch the upcoming update closely.

YMYL Disclaimer: This article is strictly for informational purposes only and does not provide any financial advice. Cryptocurrency investments carry risk. Readers should do their own research before making any investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.