The former Zcash Developer Team has officially launched the Zcash Open Development Lab, marking a major shift in the project’s direction. The creation comes after the team left Electric Coin Company earlier this year due to governance disagreements.

Founder Josh Swihart confirmed that the Zashi wallet will soon be renamed to Zodl in the next update. He clearly stated that users do not need to take any action. Funds, seed phrases, and wallet functionality will remain completely safe. It will continue maintaining the wallet and rolling out future updates.

Source: X (formerly Twitter)

The formation follows a governance split that surprised the community. In January, the entire ZEC core team stepped away from Electric Coin Company, citing disagreements over decision-making structure and operational freedom.

This move did not affect the Zcash network itself. Blocks continued processing as usual. However, leadership uncertainty raised concerns among users and investors. The launch now provides clarity. The original builders are still committed to network progress, but under a new structure.

Swihart emphasized that the new setup allows faster execution and more focused innovation. According to him, startups can move quicker than nonprofit models, especially in competitive crypto markets.

One of the first visible changes under the new Lab is the rebranding of the Zashi wallet to Zodl. This is only a name change. Users will not lose funds or need to migrate manually.

The ZODL development team assured the community that everything will function normally. The rename reflects the new identity under Zcash Open Development Lab but does not change core wallet features.

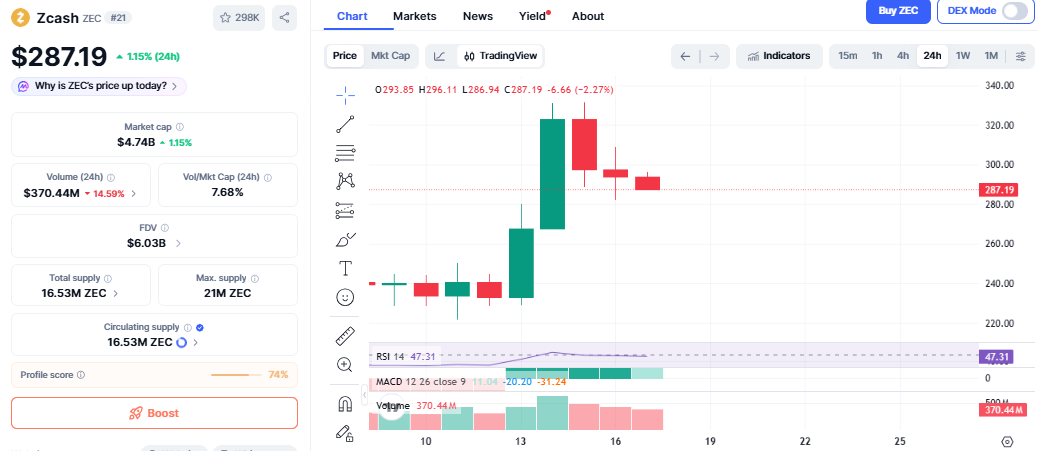

In conjunction with this governance news, the Zcash price today is also showing strength. ZEC is currently trading around $288.43, a significant increase of over 1% within the last 24 hours as per the coinmarketcap. Moreover, within the last week, the token has registered an increase of over 22%, which is quite robust compared to the flat performance of Bitcoin.

Source: CoinMarketCap Chart

According to analysts, this is a result of selective altcoin rotation. Market participants are searching for attractive narratives, and privacy coins are once again in focus.

Even the on-chain metrics are consistent with this trend. The percentage of the ZEC supply that is shielded has risen to 30%, which is a significant increase from the levels seen in late 2024.

Technically, $280 remains key support. If ZEC holds above this level, a move toward $300 is possible. A daily close above $300 could open the door toward $360.

If price falls below $280, the next support sits near $260. For now, momentum remains cautiously bullish. Broader market direction, especially after upcoming U.S. PCE data, could influence the next move.

The launch marks more than a branding change. It represents a new governance phase led by the original developers. While governance disagreements created short-term uncertainty, the new structure may bring faster innovation.

For users, nothing changes in terms of wallet security. For investors, the story now centers on leadership stability and continued privacy development.

Disclaimer: Cryptocurrency markets are volatile. This article is for informational purposes only and not financial advice. Conduct your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.