The crypto market is going through a very tough phase. Prices are falling, investors are scared, and most altcoins are under strong selling pressure. In the middle of this situation, the ZkPass Price Crash has caught everyone’s attention.

In the last 24 hours, $ZKP price has fallen by around 25%. Since its listing on December 19, the token is down nearly 35%. At first, people thought something was wrong with the project. But when we look at the data, we see a much bigger story.

Many people are now asking: Why is ZkPass price falling today? Let’s understand the current altcoin market crash where almost every small coin is losing value at the same time.

A popular market analyst Ash Crypto, shared an important chart on X. This chart tracks altcoin dominance and its monthly RSI (Relative Strength Index).

Now, according to the chart, the altcoin dominance RSI has dropped to an all-time low. This has never happened before. It clearly shows that altcoins are extremely weak right now.

Most money is moving into Bitcoin and large coins, while small assets are being sold heavily. This marketplace condition is one of the biggest reasons behind today’s ZkPass Price drop.

The official Zkpass airdrop listing made its multi-exchange debut on December 19. But soon after the launch, selling pressure increased.

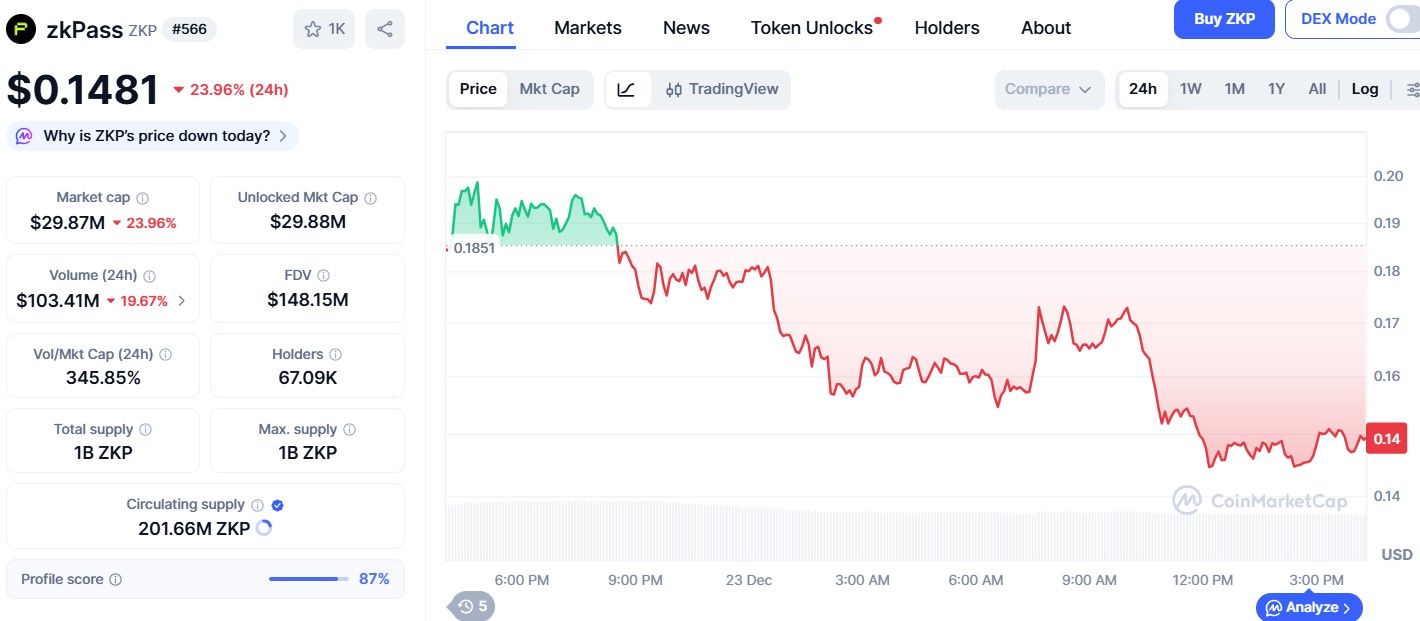

According to CoinMarketCap chart , the asset is trading near $0.1490, down around 25% in just one day. The price fell from the $0.18 - $0.19 range to around $0.14, showing strong selling.

Important market data to watch:

Market Cap: $29.87M (down 23.96%)

24h Trading Volume: $103.41M

Crypto fear index sitting at extreme 24 fear zone

When the crypto fear index is this low, people panic and sell their coins even if the project is good.

There are four main reasons why the ZKP crypto news is trending today after the major price fallout:

Airdrop Selling: Many people got free tokens through an airdrop on Dec 19. Most of them sold their tokens immediately to make a quick profit.

Weak Crypto Market : Total crypto market cap is down 2.12%, with $BTC and ETH both crashing down.

Crypto Fear Index is at 24, which means Extreme Fear

Weak Altcoin RSI: Bitcoin is taking all the attention, while Altcoin's RSI hit an all-time low today.

Based on the ZKP/USDC 4 hour Tradingview chart, the situation is risky but not broken. The RSI is near 53, which indicates the token is not in the overbought zone yet.

Strong support nears $0.135, if it breaks then the $ZKP price target 2026 will turn bearish.

Resistance $0.18, if the asset breaks this level, a trend reversal will begin.

Experts believe that as long as it holds above $0.135, the ZkPass Price Crash is just a healthy correction and not the end of the project.

Zkpass token price prediction 2025 : If the market and altcoin dominance improves, it could return to the $0.20 – $0.25 range.

Long Term Target: With more people using privacy tech, some analysts at Coingabbar see the price reaching $0.50 or higher if the ecosystem grows.

Another well-known analyst Satori , shared his view on X. He said that ZKP’s trend since listing has been clean and steady. The current dip into support is often where smart investors slowly build positions. This clearly shows that not all experts are worried about the ZkPass Price Crash.

When fear is high, new tokens usually fall faster, and this asset is facing the same pressure.

The ZkPass Price Crash is a result of a very weak altcoin market and extreme fear among investors. There is no sign of project failure or serious problems with its ecosystem.

Traders should note that as long as the $0.135 support stays strong, $ZKP token still has a chance to recover when the altcoin RSI improves.

Disclaimer: This article is for educational purposes only. Crypto prices are very risky and change quickly. Always do your own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.