Crypto derivatives trading is on the rise in India. More traders are moving beyond just buying and holding tokens - they’re now looking at futures and options in crypto to hedge and speculate on market movements. But that also means more people are dealing with volatility, liquidation risks, and the stress of timing.

That’s where Delta Exchange finds its edge. As one of the largest and top crypto trading platform in India, it has built its reputation around speed, INR settlements, and a range of instruments that are useful for traders. And with trackers now part of the product mix, this crypto derivative platform is offering a new way to trade BTC - without the FOMO.

If you’re just starting out to explore more active strategies, Delta makes the whole process simpler and accessible.

In this post, we’ll take you through what exactly Delta trackers are and how it simplifies your crypto moves in the market.

Trackers on Delta Exchange offer a simpler way to trade crypto. They’re contracts that follow the price of the underlying asset - similar to spot trading - but without the need to manage margin or worry about getting liquidated.

If you’ve ever wanted to trade BTC without using leverage or dealing with futures and options in crypto, this feature might fit your style.

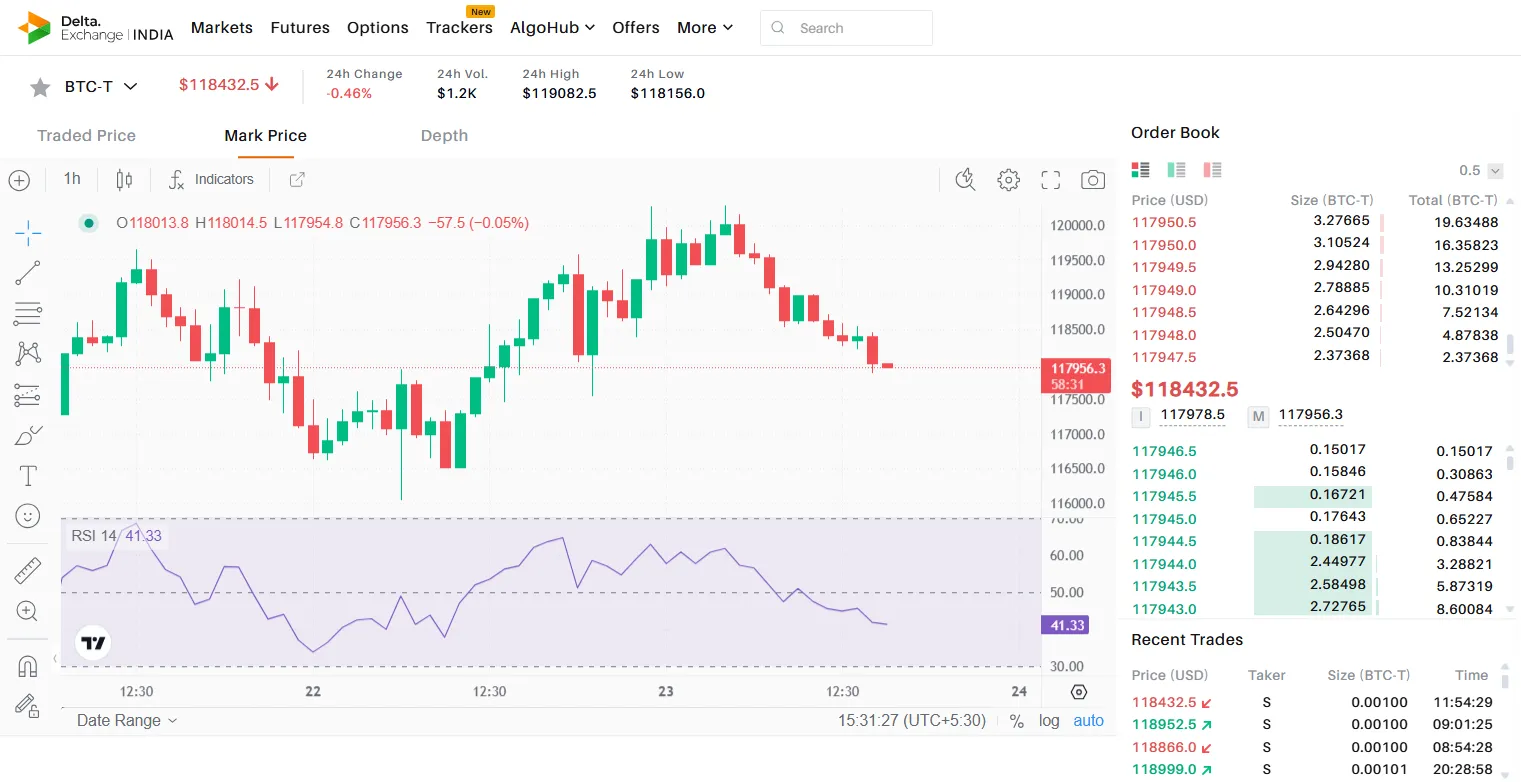

You can buy a Bitcoin Tracker (BTC-T), hold it in your account, and sell it whenever you feel the timing is right. You’re only trading what you own, so there’s no short-selling involved here, unlike perpetual futures or options in crypto. Trackers show up in your account just like any other position - ready to trade when you are.

Trackers on Delta Exchange offer a unique way to trade without actually holding or owning the underlying asset.

Compared to spot markets, they offer tighter spreads and deeper liquidity, which means lower slippage for traders.

If you frequently trade BTC, the trading fees for trackers are also quite affordable. However, there’s a daily holding cost involved.

The gains or losses in trackers are treated just like those for perpetual futures and options making tax filing simpler for you.

One thing to remember is that tracker positions can’t be withdrawn or moved to other platforms.

If your goal is exposure and flexibility without the spot trading expenses, trackers can be a suitable option.

Delta trackers are built for those who want simplicity without giving up on strategy. If you’ve been trading derivatives, trackers on Delta Exchange offer a low-barrier alternative.

Here’s who they work well for:

If you’re a short-term trader looking to capitalise on small price swings without the extra cost of high spreads.

New users who find futures and options in a bit too technical can try out Trackers or practice using the demo account.

Existing Delta Exchange traders who want to explore a new product to trade BTC, without leverage.

Getting started with trackers on Delta Exchange is quick and simple. If you’ve ever traded futures and options in crypto or even if you’re new, the process is beginner- and app-friendly.

Head to the official website: www.delta.exchange or download the mobile app.

Register with your email and phone number and sign up.

Add your bank details and complete your KYC to deposit and withdraw funds in INR.

Once your account is confirmed, explore the market section for futures, options, and trackers.

Go to the trackers page to check the price movement, place your order, and track BTC.

You don’t have to manage leverage or keep an eye on liquidation. Just pick your asset and track its price.

Trading trackers on Delta Exchange involve trading fees and a daily holding cost.

Trading fees

You’re charged a small fee when you buy BTC-T and again when you sell the asset. This applies to both maker and taker orders and is set at 0.05% of the trade value. It's lower than what many spot trading platforms charge, where fees can go higher.

Holding cost

Daily holding cost is a small fee applied to your position’s value at 5:30 PM IST each day, and is deducted from your available balance. The current holding rate is visible on the Delta Exchange platform at all times before you buy and while you're holding.

A key point to note here is that there is no holding charge on the first day you purchase a tracker.

The Bottom Line

Delta Exchange continues to stand out as one of the leading crypto derivatives exchanges in India for a lot of good reasons. Being FIU-registered adds a layer of credibility, while INR transactions, real-time updates, and smart analytical tools make the trading experience more practical for all levels of traders.

Trackers on Delta are the newest addition, giving you a low-fee, expiry-free way to trade BTC with minimal hassle. If you're looking to trade smart with shorter holding periods, trackers might be worth looking at.

For more information, visit delta exchange or join the community on X for all the latest news and updates.

Disclaimer: Cryptocurrencies are highly volatile and carry inherent risks. Kindly do your own research before investing in any digital currencies or crypto derivatives.

Sanket Sharma is an experienced crypto writer with five years of expertise in blockchain technology and digital assets. He specializes in translating complex concepts into clear, accessible insights, catering to both novice and seasoned investors.With a keen focus on Bitcoin, altcoins, NFTs, and DeFi, Sanket provides in-depth analysis of market trends, price movements, and emerging developments. His work is rooted in thorough research and a deep understanding of the evolving crypto landscape.Passionate about blockchain’s transformative potential, he is committed to delivering well-researched, informative content that empowers readers to navigate the fast-paced world of cryptocurrency with confidence. Through his writing, Sanket continues to educate and engage audiences, helping them stay ahead in the digital asset space.