The buzz over Pi Coin's mainnet release faded fast. From its $2 peak, its price dropped over 67.50% within 24 hours; today it trades at about $0.6500. With trade volumes above $67.86 million, this dramatic drop follows great selling pressure.

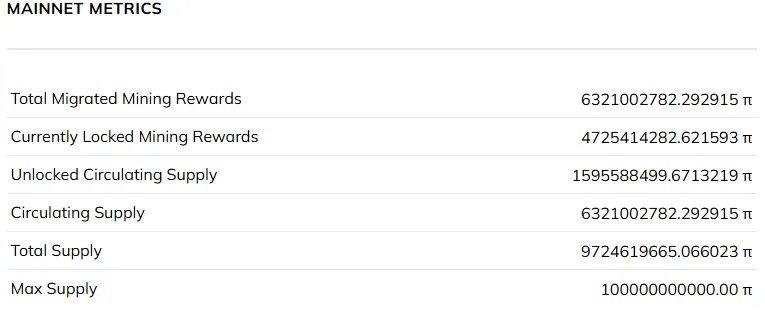

Pi Network's market capitalization, supported by over 10 million members, is $4.10 billion even with the slump. Currently in circulation among the 9.7 billion total PI tokens are one billion. The last tokens will unlock progressively over time.

Early investors grabbed advantage of the euphoria, cashed out at the high, and set off a dramatic downturn Pi Coin went through a classic pump-and-dump cycle. The fervor around the mainnet debut soon subsided as traders hurried to lock gains, causing a sharp price decrease.

Still, some analysts remain hopeful. They contend that the great trade volume shows considerable market interest, which would open the path for a possible return. Three main elements point to Pi Coin perhaps reversing direction and even exploding by 75,000%.

Source: TradingView

Pi Coin's announcement on big exchanges like Binance and Coinbase is much awaited by the crypto community. These sites have large user bases and great liquidity, therefore enhancing Pi Coin's demand and reputation.

This is important for why?

Lists on Binance and Coinbase would expose Pi Coin to millions of fresh investors all around.

Improved liquidity from these exchanges could inspire more active trading.

Improved confidence among retail and institutional investors would come from being on credible sites.

Such listings might be the spark Pi Coin needs to bounce back from its recent decline and start towards the $500 milestone.

Pi Coin's future is largely influenced by India's large crypto community. Currently registered on CoinDCX, an Indian exchange, Pi Coin is already becoming rather popular among millions of Indian users.

Drivers of potential expansion:

Expanding Listings: Demand might be much raised by more general listings on significant Indian platforms.

More Indian users actively trading Pi Coin would cause more market activity.

Establishing trust via a significant presence in the Indian market will inspire long-term holding.

Pi Coin might experience a major price increase as India's crypto acceptance rises and may approach the $500 mark.

Pi Coin is only accessible on centralized exchanges (CEXs) at the moment. Still, possible listings on distributed exchanges (DEXs) might create fresh prospects.

advantages of DEX Listings

DEXs appeal to those who give decentralization priority since they provide non-custodial trading.

Improved liquidity can result from more trading pairs and wider market involvement.

Attracting New Investors: The decentralized finance (DeFi) community loves openness and decentralization, therefore maybe driving more acceptance.

Pi Coin's demand and market value could be much raised with DEX listings.

Pi Coin has great potential for a comeback even with the current price drop following mainnet introduction. Key elements that could drive its price upward are major exchange listings like Binance and Coinbase, more Indian market participation, and maybe DEX availability.

Positive forecasts point to Pi Coin perhaps hitting the $500 mark by 2025. Still, this is only hypothetical, and much depends on acceptance and the state of the market.

Pi Coin's price has lately dropped sharply, which makes many investors wonder about their future actions. Although selling now locks in losses, if the suggested catalysts come to pass, the holding might provide significant future rewards.

As usual, make wise investments and take note of the natural hazards in the erratic crypto market. Though its future is yet unknown, Pi Coin is a coin worth examining given its potential for expansion.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.