The move today is not just about Bitcoin. Ethereum, Solana, and XRP are also pushing higher, which is why Altcoin Price Prediction is suddenly back in discussion. ETH is trading around $3,333, up close to 6.48% in the last 24 hours. Solana is sitting near $144.89 with a 3.90% move, while XRP is holding around $2.15, up roughly 4.55%. This kind of move across big altcoins usually does not come from one single headline. It feels more like broader positioning and sentiment slowly turning positive. When ETH, SOL, and XRP move together, it often says more about the altcoin market trend than about any one coin. The real test is whether this strength stays once the initial momentum cools off.

The image and the tweet together point toward one clear thing: larger players are still positioned on the long side. According to the shared data, the same OG whale who had shorted before the October 10 crash is now sitting on significant long positions, with nearly $647M in ETH, $93M in BTC, and over $73M in SOL.

Source: X@@TedPillows

The positions are not small or short-term bets. At current levels, the wallet is showing sizable unrealized gains, which suggests conviction rather than a quick trade. When such positioning lines up with rising prices in Ethereum and Solana, it adds weight to the broader Altcoin Price Prediction, even if short-term pullbacks still remain possible.

On the 4-hour chart, Ethereum shows a fairly clean structure. Earlier, price moved higher inside a rising channel and pushed into the $3,300 resistance zone, where some profit booking kicked in. That rejection did not break the trend. Instead, ETH pulled back in a controlled way and spent a good amount of time consolidating near the Fibonacci 0.5–0.618 retracement zone. This area acted as a base rather than a breakdown point

Source: TradingView

What helped the structure was the $3,050 level, which had earlier worked as resistance and later flipped into support. Along with that, the 100 EMA continued to act as strong dynamic support. Price accumulated in this zone and then pushed higher again ETH is sitting near the $3,350 area, and the price is clearly slowing there. RSI is already around 73, so some cooling off will not be surprising; that does not break the trend, it just means the price might breathe a bit.

If ETH keeps holding and buyers stay active, the next area to watch is $3,480. Above that, the move can stretch toward $3,640, which lines up with the Fib 1.618 zone. On the flip side, if pressure builds and price starts slipping, $3,182 is the first level that matters. Below that, the $3,050 area is a strong demand zone where the structure really needs to hold for the long-term Ethereum outlook.

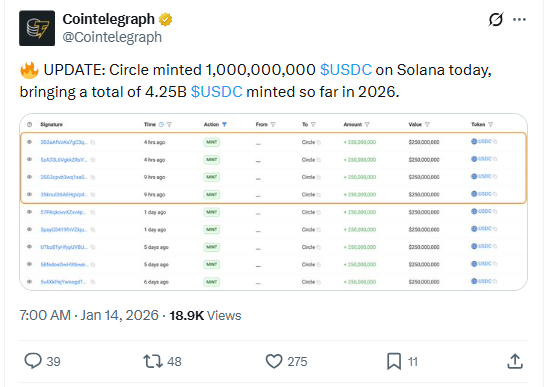

As per the tweet by Coin Telegraph, Circle has minted 1 billion USDC on Solana today, taking the total USDC minted on the network to 4.25 billion so far in 2026. This points to rising stablecoin activity on Solana, which often supports liquidity and short-term momentum in SOL.

Source: X@@Cointelegraph

When large amounts of USDC enter a network, it usually signals preparation for increased trading or on-chain activity rather than passive holding. This liquidity factor adds context to why Solana is showing relative strength today.

On the 4-hour chart, Solana is still holding its structure. Price is moving inside an ascending channel, and instead of breaking down, it spent time moving sideways. That sideways move looks more like accumulation than weakness. Buyers were active there. The 9 and 21 EMA crossover lines up with this, giving confirmation to the buyer and showing short-term momentum flipping back up.

Source: TradingView

Right now, SOL is sitting near the $144–$145 area, and this is where the price usually pauses. This area earlier acted as a resistance and is now acting as a support. Some back and forth here would not be a surprise here. If SOL manages to stay above this zone, the next areas to watch are $155 and then $164 above that.

On the downside, $134–$135 is the first level that needs to hold. If the price slips further, $123–$124 is still a level where the trend can stay intact.

The 4-hour chart of XRP is not looking weak at the moment. A sharp move first occurred, reaching $2.40–$2.50, but was rejected from there. This was expected, as the area was a strong supply zone. After that, the price did not dump; it simply stopped and traded in the $2.05–$2.15 range for a considerable time. This phase seems more like consolidation, not an exit.

SOurce: TradingView

The $2.05 level has been held repeatedly, and the 100 EMA is also coming up there and acting as the dynamic support, and the price made a breakout for the upside levels.

If momentum and border sentiment support it, $2.30–$2.40 will be the next tough area. Above that, $2.57 is visible. On the downside, a slip below $2.05 would make the $1.86–$1.81 zone important to see for the XRP Price Outlook.

As per the analysis and data overall, the current move in Ethereum, Solana, and XRP looks more like a continuation phase than a random spike. Price action across these altcoins shows structure holding, with buyers stepping in at key levels instead of chasing blindly. From an altcoin price prediction point of view, this kind of coordinated strength usually reflects improving short-term sentiment, not a final top. That said, most of these assets are now sitting close to important resistance zones, where reactions are expected. Some cooling off or sideways movement would be healthy and would not change the broader trend. The next direction will depend on whether these levels turn into acceptance or rejection. For now, the bias stays constructive, but confirmation will only come from how price behaves after this momentum settles.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.