Over the past three weeks, BNB has demonstrated a sharp V-shaped recovery, rising from $471.3 to $596.30, marking a 26.40% increase.

On the daily chart, this recovery contributed to the formation of an inverted head and shoulders pattern, a classic bullish reversal signal.

On September 23rd, Binance Coin broke through a key neckline resistance at around $600, confirming the bullish reversal pattern.

A bullish crossover between the 50-day and 100-day EMAs further strengthens the bullish outlook, indicating continued upward momentum.

The anticipated release of former Binance CEO Changpeng Zhao adds to the positive sentiment, enhancing the bullish narrative for BNB.

Despite the breakout, if BNB retests and falls below the trendline, bearish momentum could return. This could potentially drive the price back down to $525, reversing the current bullish setup.

Despite the recent 25% rally, Binance Coin now shows signs of weakness. A concerning development is the formation of a bearish triple-top pattern, typically seen as a negative indicator by investors.

Compounding this bearish sentiment is the appearance of a bearish evening star candlestick pattern near the $605 resistance level, signaling a potential trend reversal from bullish to bearish.

Given historical price trends, BNB may decline by up to 18%, possibly reaching $480 in the near future.

This bearish outlook is contingent on BNB staying below the $620 resistance level. Should the price surpass $620, the downtrend scenario may not unfold, and BNB could maintain its bullish trend.

This analysis indicates that BNB is at a critical juncture, with both bullish and bearish factors influencing its next moves. Traders should closely monitor the $620 level and the evening star pattern for confirmation of the upcoming trend.

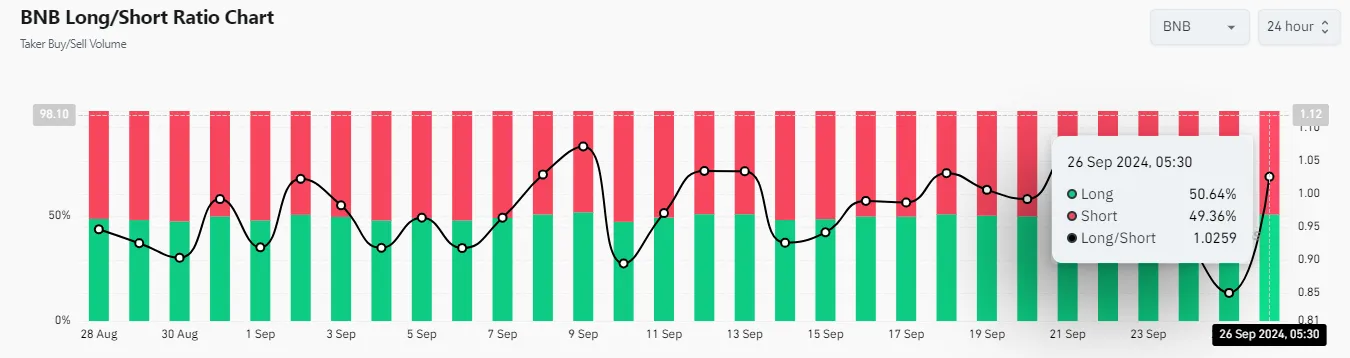

Besides this technical analysis, the current negative outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, BNB’s Long/Short ratio currently stands at 0.9153, the lowest since August 27, 2024. This indicates a strong bearish sentiment among traders.

Source: Coinglass

Source: Coinglass

Additionally, The Volume declined by 17.08% and its interest declined by 7% in the last 24 hours, indicating growing fear among traders, likely due to the bearish price action pattern. Currently, 49.36% of top traders hold short positions, while 50.64% hold long positions.

While combining all of BNB’s on-chain metrics with its price action, it appears that bears are dominating the assets and may cause a significant price decline in the coming days.

Also Read: Hamster Kombat Price Prediction: How Much Is 1 HMSTR in USD?

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.