Bitcoin (BTC) is experiencing notable short-term price fluctuations as of August 26th, 2025. Over the last few hours, the cryptocurrency has been swinging between $109K and $113K, with a 1.1% decrease over the past 24 hours.

Despite these fluctuations, the general trend over the past week shows a 4.1% decline, and over the past 14 days, a 7.3% drop. Amid these price movements, the key indicators and data are watched for market sentiment at large and possible future direction.

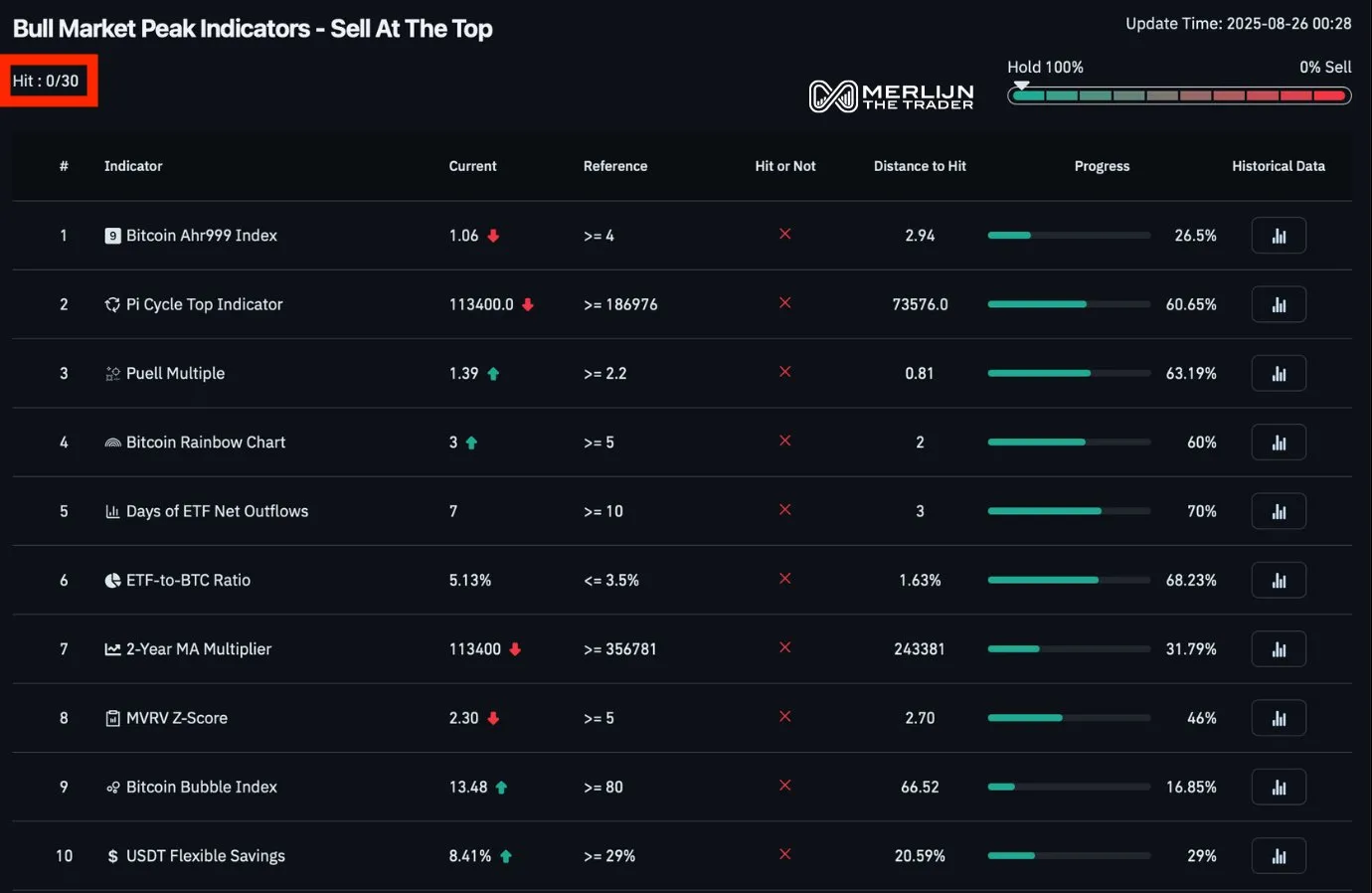

Merlijn The Trader points out that Bitcoin's current price is not near its cycle peak, sharing a technical chart with the Pi Cycle Top Indicator, Puell Multiple and MVRV Z-Score to demonstrate that none of the indicators indicate top levels.

Source: X

Source: X

For instance, while the Pi Cycle Top Indicator is one of the most widely used, it presently stands around $113,400 far below the $186,976 usually seen at the top of the Bitcoin cycles. Also, the Puell Multiple remains pegged at 1.39 below its key level of 2.2, thus giving yet another indication that the market has not yet realized its peak.

Other indicators such as the Bitcoin Rainbow Chart and the ETF-to-BTC ratio add to this perspective. The ETF-to-BTC ratio stands at 5.13%, above its 3.5% threshold to usually signal a peak. Meanwhile, both indicators suggest a scenario completely opposite to a peak, as the MVRV Z-Score is at 2.30 and well below its critical value of 5, which would ideally mark a cycle's top. These technical indicators, collectively, suggest that Bitcoin is still in a setup phase, with potential for a larger upward move rather than being at the peak of the current cycle.

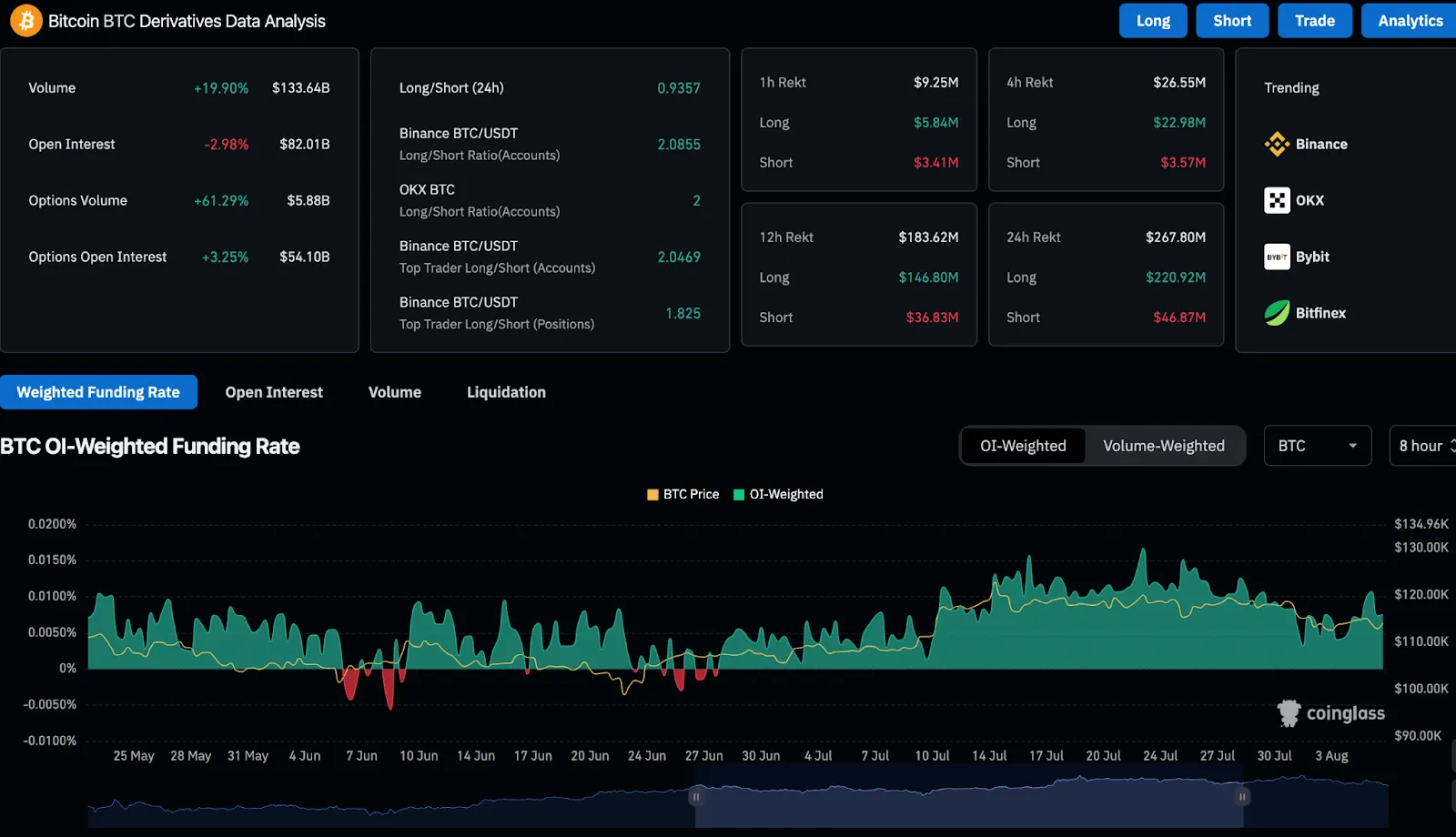

CoinGlass offers an overview of the derivatives, covering main market dynamics such as volume, open interest, and funding rates. Over the past day, Bitcoin derivatives volume increased by 19.90% to $133.64 billion. Volume rises signal increased trading activity and often coincide with an upsurge in volatility, especially as traders brace for big price movements.

Source: CoinGlass

Open interest, on the other hand, witnessing a 2.98% drop to $82.01 billion at present, signals a slight ramp-down in long-term speculative interest. However, interestingly enough, options volume has shot up by 61.29% to $5.88 billion. This surge in options trading is a reflection of mounting interest in speculating for Bitcoin's future price movements with market participants actively hedging.

The long/short ratio in Bitcoin's derivatives further seals the sentiment lying within traders. It reads 2.0855 on Binance, which means more traders are betting on Bitcoin's price moving higher. It tells that after recent price dips, most traders remain optimistic about the price movement of Bitcoin in the future.

An insight into liquidation data, on the other hand, would give a glimpse of a potential accumulation of stress. In the last 24 hours, positions worth $267.80 million were liquidated, with most coming from long positions. It thus points toward the increased volatility, hence forced closures of positions. One hour in the short-term recorded liquidations of $9.25 million, ranked into $5.84 million long positions and $3.41 million short positions. This means the short-term price swings are highly disruptive to the market.

Similarly, funding rates as depicted by OI-weighted funding rate can narrate a similar story about market sentiment. The funding rate has been fluctuating between periods where longs are paying shorts and vice versa. Positive funding rates, as seen during recent price movements, indicate that long positions are dominant, further emphasizing the bullish outlook.

Kelvin Munene is an experienced crypto and finance journalist with over five years in the industry, known for delivering detailed market insights and expert analysis. Holding a Bachelor’s degree in Journalism and Actuarial Science from Mount Kenya University, he is recognized for his thorough research and strong writing abilities, especially in cryptocurrency, blockchain, and financial markets. Kelvin consistently offers timely, accurate updates and data-driven perspectives, helping readers navigate the complex world of digital assets. His work focuses on identifying emerging trends, analyzing market cycles, exploring technological advancements, and monitoring regulatory changes that influence the crypto sector. Outside of journalism, Kelvin enjoys chess, traveling, and embracing new adventures.