Bitcoin (BTC) price continued its downward slide, trading at $112,518 as of August 2, 2025. The recent move marks a steady decline from the $120,000 resistance level, with bears currently dominating the market.

BTC recently broke below the $116,000 support zone, signaling growing selling pressure. The next significant support lies near the $110,000 level, a crucial area for bulls to defend in the short term.

Technical indicators suggest continued bearish momentum. The MACD shows widening divergence, with the signal line trending well below the MACD line. This highlights growing downside strength and little sign of reversal.

Source: Tradingview

Meanwhile, the Relative Strength Index (RSI) stands at 25.96, placing BTC deep in oversold territory. An RSI below 30 typically indicates a potential bounce, but momentum remains weak. The RSI has remained below its moving average, further confirming the bearish outlook.

Cryptocurrency analyst Javon Marks has drawn attention to a key technical development in Bitcoin’s recent price action. Citing a successful retest of a previously broken resistance level, Marks shared a chart suggesting bullish momentum is gaining strength.

The chart indicates a pattern resembling an inverse head and shoulders formation, a signal often interpreted as a bullish reversal. A blue arrow marks the retest area, where price touched the breakout zone before bouncing upward, hinting at further gains.

In his brief commentary, Marks mentioned a potential target above $135,000, emphasizing that this projection is conservative. While Bitcoin's price continues to consolidate just above the neckline of this long-term pattern, this retest could solidify support before a significant upward move. If market sentiment remains positive and momentum builds, the technical setup may drive Bitcoin toward new highs

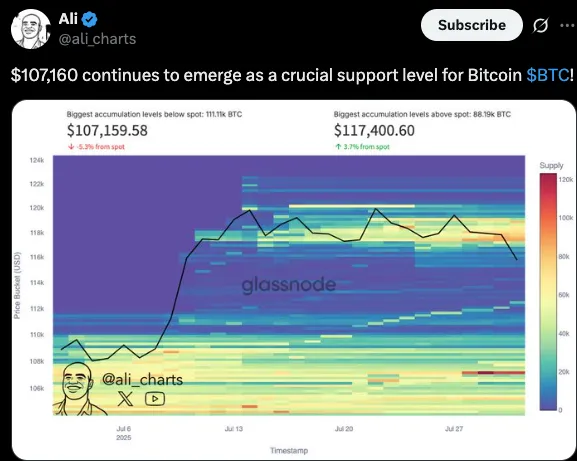

Bitcoin has revealed a significant support area at about $107,160 as per recent information posted by Ali Charts. This number is one of the largest accumulation areas, and this is below the present market price where there has been a claimed accumulation of more than 111,000 BTC.

According to the market watchers, this backward price range is crucial in sustaining bullrun. In case of a price plunge, this level can be seriously defended by investors who will make it even stronger as a base.

On the positive side, the zone of resistance of $117,400 has become important and about 88,000 BTC are in the accumulation process. There may be a headwind on the way up in the short term.

The data is taken by Glassnode through their on-chain analysis and represents the manner in which the behavior of investors is defining the current market structure. Until the time when Bitcoin breaks its current price of over $107,160, the bull will be in charge of price trends.

Annah Mugoiri is an emerging voice in the crypto content space With More than 5 years of experience, with a growing passion for blockchain technology and digital finance. She possesses a sharp grasp of market dynamics and the broader cryptocurrency landscape, skillfully simplifying complex topics like Bitcoin, altcoins, DeFi, and NFTs into reader-friendly, engaging articles. Annah combines in-depth research with a clear and concise writing style that appeals to both beginners and seasoned crypto investors. Dedicated to monitoring price trends, project launches, and regulatory changes, she keeps her audience updated on the rapidly evolving crypto scene. Annah is a firm believer in blockchain’s transformative power to foster innovation and expand financial access worldwide.