The crypto market pulled back on Tuesday after a few days of steady gains. Total market cap slipped below 3.20 trillion dollars as BTC saw a small dip, down around 1.10% and trading near the 92,825 area. It was not just BTC feeling the pressure. Major memecoins and several altcoins also moved lower, showing that the market was taking a pause. After a strong run, this slowdown has made traders a bit uneasy. Is this just a normal cooldown, or is the market trying to trap late buyers again?

On the 1-hour chart, BTC is clearly not in a comfortable spot right now. Price is sitting below the 21 EMA, and that level, which earlier was giving support, is now acting like a wall. Every time the price moves up, it gets pushed back down. Buyers are trying, but sellers are looking stronger. Source: TradingView

Source: TradingView

The price is trading inside the rising channel, but it is approaching the lower side now. That usually is not a good sign. It tells that the move is getting weak. If this channel breaks, BTC can easily slide toward $90,500, and if selling continues, $89,800 is also possible. Those levels look like the next areas where buyers might try to defend.

On the flip side, if BTC somehow manages to get back above the 21 EMA and hold there for some time, then a move toward $93,500 could happen. A stronger push could even test $94,800, but at the moment, that looks difficult.

Looking at the bigger picture on the 4-hour chart, one important thing stands out. According to analysts, not all BTC futures gaps get filled, and past price action supports this view. In the current cycle alone, several CME gaps are still open below the current price. The chart highlights unfilled gaps around $88K, $52K, and deeper zones between $20K and $30K.

Source: X@@seth_fin

Analysts point out that this does not mean Bitcoin is guaranteed to move to all these levels. Gap fills are not rules, but they often act as reference areas when market momentum weakens. The $88K zone is seen as more relevant in the short to medium term if selling pressure increases and key supports fail. Lower gaps, such as $52K and below, would likely come into focus only if the broader market structure breaks down.

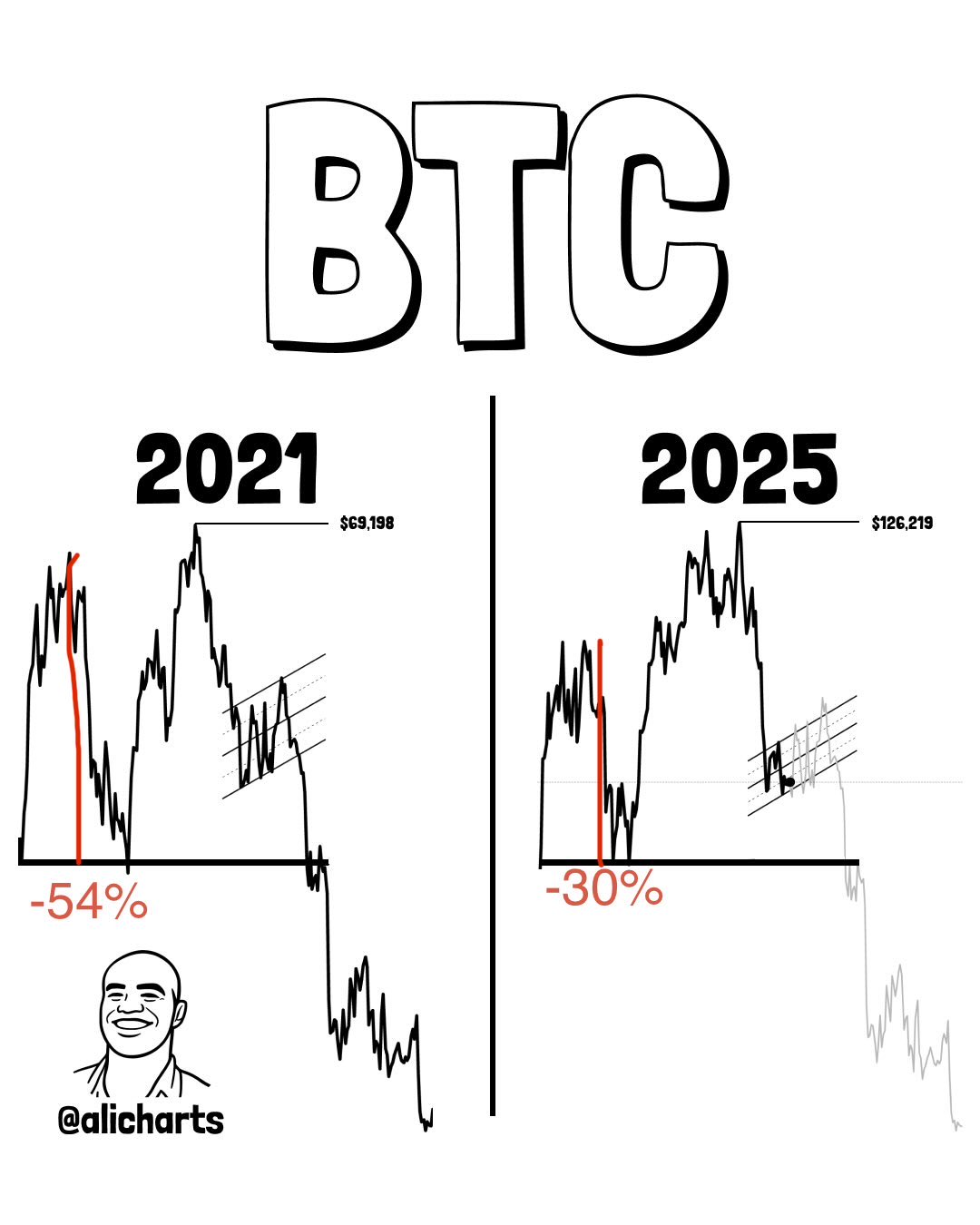

The analyst is named Ali Martinez; in his analysis, the difference between the two cycles stands out. In 2021, after Bitcoin topped out, the drop was deep, around -54%. It did not collapse instantly. Price moved sideways first, some stability showed up, and then the bigger downside followed. That pause fooled a lot of people back then.

Source: X@alicharts

Now compare that with the current cycle. So far, the pullback is closer to -30%. That is still a correction, but clearly smaller than what happened in 2021. Price is not trending cleanly here either. It is moving sideways, stuck in a tight range, and the structure looks like a bearish flag. This is the kind of phase where the market usually slows down and waits.

If this bearish flag breaks lower, then the correction can easily extend further, just like it did in the last cycle after a similar pause. It does not have to repeat -54%, but the risk is there because the current pullback has not been that deep yet. On the other hand, if the flag does not break and the price keeps holding this range, Bitcoin can simply stay choppy and move sideways for longer.

Right now, the Bitcoin price prediction feels messy, not clear. Price is still struggling, short-term charts look weak, and buyers are not showing real strength yet. On higher timeframes, Bitcoin has been in similar phases before where the market moved sideways. trapped traders, and took time before choosing a direction. Until price shows real strength again, this looks more like a risky zone than the start of a clean upside move

This content is for informational purposes only and does not constitute financial advice. Cryptocurrency investments involve risk, and readers should conduct their own research before making any investment decisions.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.