Bitcoin experienced a significant sell-off on January 7, forming a bearish engulfing candle on its daily chart. This marked the second-steepest daily decline for BTC in the past 19 weeks, signaling heightened volatility in the market.

The sudden plunge from $102,760 to $92,500 was catalyzed by stronger-than-expected data from the U.S. Bureau of Labor Statistics. The report revealed 8.1 million job openings by the end of November, surpassing the anticipated 7.74 million. This robust economic data spurred a decline in equities and the crypto market as investors recalibrated their expectations.

The market now closely monitors Bitcoin’s ability to hold critical support levels. A daily close below $91,500 could confirm a bearish inverse head-and-shoulders pattern, potentially triggering a deeper crash.

Prominent crypto analyst Rekt Capital emphasized the importance of maintaining support above $91,000 to prevent further losses. In a January 8 post on X, Rekt Capital noted:

> “Bitcoin has clearly lost the $101,165 support level (marked in black) after failing its daily retest. This has pushed Bitcoin back into its previous range between $91,000 and $101,165.”

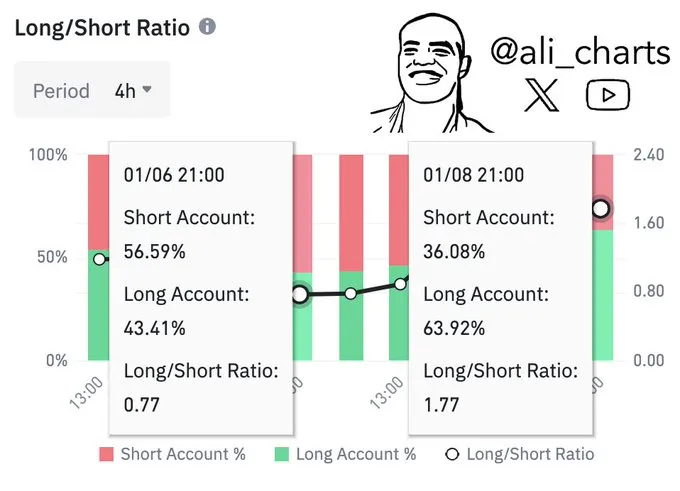

The market’s sentiment among Binance traders has undergone a dramatic shift. On January 6, when Bitcoin climbed to $102,000, 56.59% of traders were shorting the cryptocurrency. This bearish positioning coincided with a sharp 10% drop in BTC’s price, pulling it down to $93,000.

As of now, sentiment has flipped, with 63.92% of traders taking long positions on Bitcoin. This shift indicates renewed optimism, despite the recent downturn.

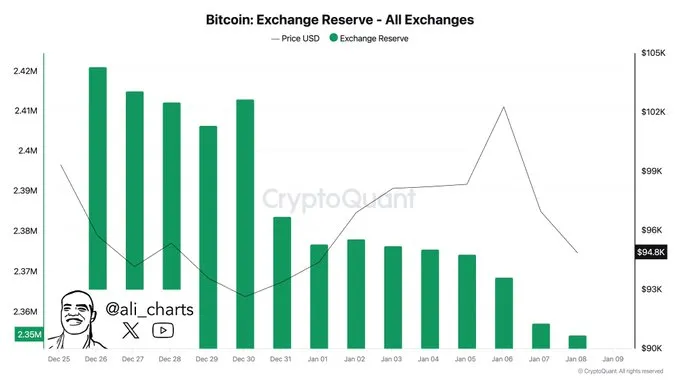

Adding to the market dynamics, over 22,000 BTC, valued at approximately $2.10 billion, have been withdrawn from exchanges in the past week.

According to an X post by analyst Ali, these outflows may suggest increasing confidence among investors in holding Bitcoin long-term, despite short-term volatility.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.