Bitcoin's price has regained strong upward momentum, achieving seven consecutive days of inflows for the first time since November 2024. Over the past 24 hours, BTC has seen a 2.27% increase in value, with an impressive ~9% gain during the first week of January 2025.

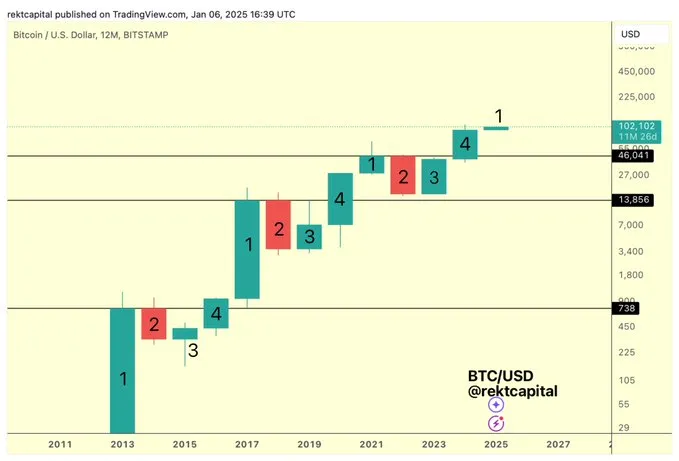

The Bitcoin Four-Year Cycle theory suggests a recurring pattern of market behavior that unfolds over four years. According to this framework:

2024 represents the recovery and breakout year, often termed Candle 4.

2025 is predicted to be the year of the Bitcoin Bull Market peak.

2026 is expected to transition into a Bear Market.

2027 is likely to mark the Bottoming Out phase, setting the stage for the next Bull Market cycle.

Source: Rektcapital

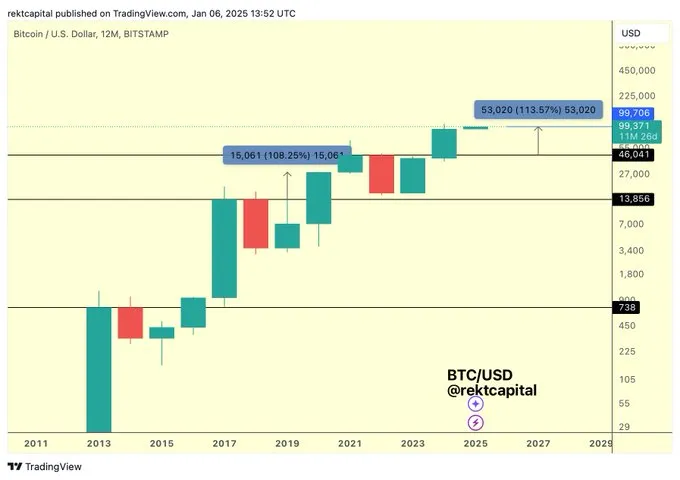

In the current 2024 "Candle 4," Bitcoin has already rallied by +113% after breaching its Four-Year Cycle resistance, outperforming the +108% rally observed in the 2020 "Candle 4." This suggests growing momentum and potential for greater upside compared to previous cycles.

Source: Rektcapital

Recent on-chain data indicates continued accumulation by whales, a critical signal of long-term confidence. Notably, within the last six hours, three newly created wallets withdrew 2,173 BTC (valued at $221.6M) from Binance. This aligns with a broader trend of large entities accumulating Bitcoin, reducing exchange liquidity—a historically bullish indicator.

2025 Peak Prediction: Bitcoin's previous Four-Year Cycle bull peaks (2017 and 2021) demonstrated exponential growth, with gains exceeding 1,200% from their respective bottoms. Assuming Bitcoin follows a similar trajectory, it could reach $120,000–$150,000 at its 2025 peak, driven by halving dynamics, institutional adoption, and macroeconomic shifts favoring hard assets.

2026 Bear Market: As seen in past cycles, Bitcoin's Bear Market typically results in a 50–85% correction from its peak. A potential retracement to the $30,000–$50,000 range could occur during this phase.

2027 Bottoming Year: Consistent with historical behavior, Bitcoin may form its bottom in late 2027, likely coinciding with renewed accumulation by long-term holders.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.