Is the listing of Spur Protocol in January going to trigger a price breakout for SON, or will the market conditions that are careful and hesitant keep the prices within a certain range during the initial days?

As the event becomes closer, the attention of investors is on the new timeline, tokenomics, and price potential of Spur Protocol to find out the next steps for this new crypto project.

The Spur Protocol price prediction that we present here does not only reveal the listing update, SON token economics, and price scenarios but also helps traders and long-term holders to decide wisely.

On the spur protocol team’s latest update, the decision to delay the listing to January is a reflection of a strategic shift towards sustainability rather than a slowdown in progress. The team intends to have a technically sound product, get the advisors aligned, and have legal clarity before they enter the trading in the open market.

Looking at the market, such delays usually result in short-term uncertainty, which can reduce speculative momentum in advance of listing. Then, it might be trading at a price close to its fundraising or implied valuation until the confirmed listing date and liquidity details are disclosed.

But on the other hand, projects that have their foundations laid stronger at the time of launch usually enjoy a higher post-listing confidence, especially when execution milestones take the place of speculation.

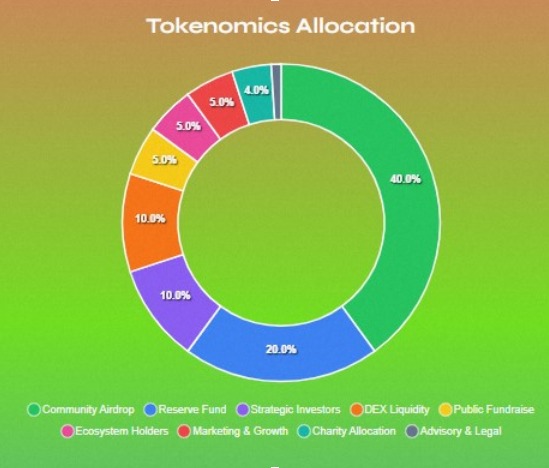

Understanding SON tokenomics plays a critical role in any accurate Spur Protocol price prediction. The token's total supply is fixed at 1 billion tokens, with such distributions aiming at integrating growth, liquidity, and long-term stability.

Token Distribution Breakdown

Source: Website

Community Allocation (40%) – It will be used mainly for ecosystem incentives, SON airdrops, and future rewards

Project Future Reserves (20%) – It will be kept for 24 months with a 6-month cliff to minimize the sell pressure

DEX Liquidity (10%) – It enables stability in trading on-chain

Investors (10%) – It is provided to early backers

Marketing (5%) – To pursue and promote brand expansion and growth

Fundraising (5%) – For the purpose of raising investment capital in a strategic manner

PoG Holders (5%) – For the issuance of rewards to Proof of Growth participants

Charity Initiatives (4%) – For the implementation of social impact programs

Advisory Roles (1%) – For the payment of advisors and consultants

This mapping out of distributions not only limits the early dumping which is an influence on the SON price but also strengthens the price outlook by keeping the market liquidity and ecosystem growth.

The initial price prediction models for the Spur Protocol, based on the current market demand indicators, the funding structure, and the historical performance of similar cryptocurrencies, position the SON listing price on the conservative side between $0.52 and $0.85. The range, while very cautiously, also fairly and tentatively represents the market expectation for the token's first day.

This initial price is determined by a variety of factors. It is expected that the deployment of liquidity will be done cautiously and this will help to stabilize the market and prevent volatility.

On the other hand, the gradual increase of investors will also lead to a more controlled price discovery. Moreover, the crypto market's general tendency to be sensitive to new issuances could keep the SON price movement in a narrow band during the initial phase.

In case Spur Protocol manages a hassle-free January listing along with sufficient DEX or CEX liquidity, SON could very quickly garner support above the lower side of this range, which would be a sign of early market confidence.

In a favorable market situation, it might show a strong upside after the listing. Positive overall crypto sentiment recovery coupled with the transparent delivery of the roadmap milestones could bring back investor interest. The demand for staking and community participation might endorse the price by limiting the circulating supply.

In case of the most positive scenarios, SON could be in the range of $1.20–$1.50 immediately after the listing, especially if the early trading volume is still good.

If the Spur Protocol is listed on major centralized exchanges like Binance or Bybit, then according to community-driven predictions, the price can be $3 in the short term.

Looking ahead, the adoption of the ecosystem, the utility, and the long-term incentives might gradate SON to $5 in the medium term. However, these estimates are still speculative and depend a lot on the quality of execution, liquidity depth, and overall market trending.

Though the price action in the short term might remain safe, the launch plan has positioned token for a gradual increase rather than extreme volatility. The main issue for the investors remains: Will the Spur Protocol be able to convert the preparation and planning into a continuous performance of the market once the SON is trading?

If the execution is as good as expected, the long-term price of the token could go way beyond the initial listing range.

Disclaimer

Crypto price predictions are for informational purposes only and not financial advice. The crypto market is highly volatile, and prices can change at any time. Do your own research before investing. We are not responsible for any financial losses.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.